The Ultimate Guide to Futures Online Trading Platforms

Are you interested in trading futures online? If so, you've come to the right place. In this comprehensive guide, we will explore everything you need to know about futures online trading platforms. Whether you're a beginner or an experienced trader, this article will provide you with valuable insights and tips to enhance your trading experience.

Before we dive into the specifics, let's first understand what futures trading is. Futures are financial contracts that allow traders to speculate on the price movement of an underlying asset, such as commodities, currencies, or stock indexes. Online trading platforms provide traders with the necessary tools and resources to execute trades, monitor market trends, and manage their portfolios effectively.

Understanding Futures Online Trading Platforms

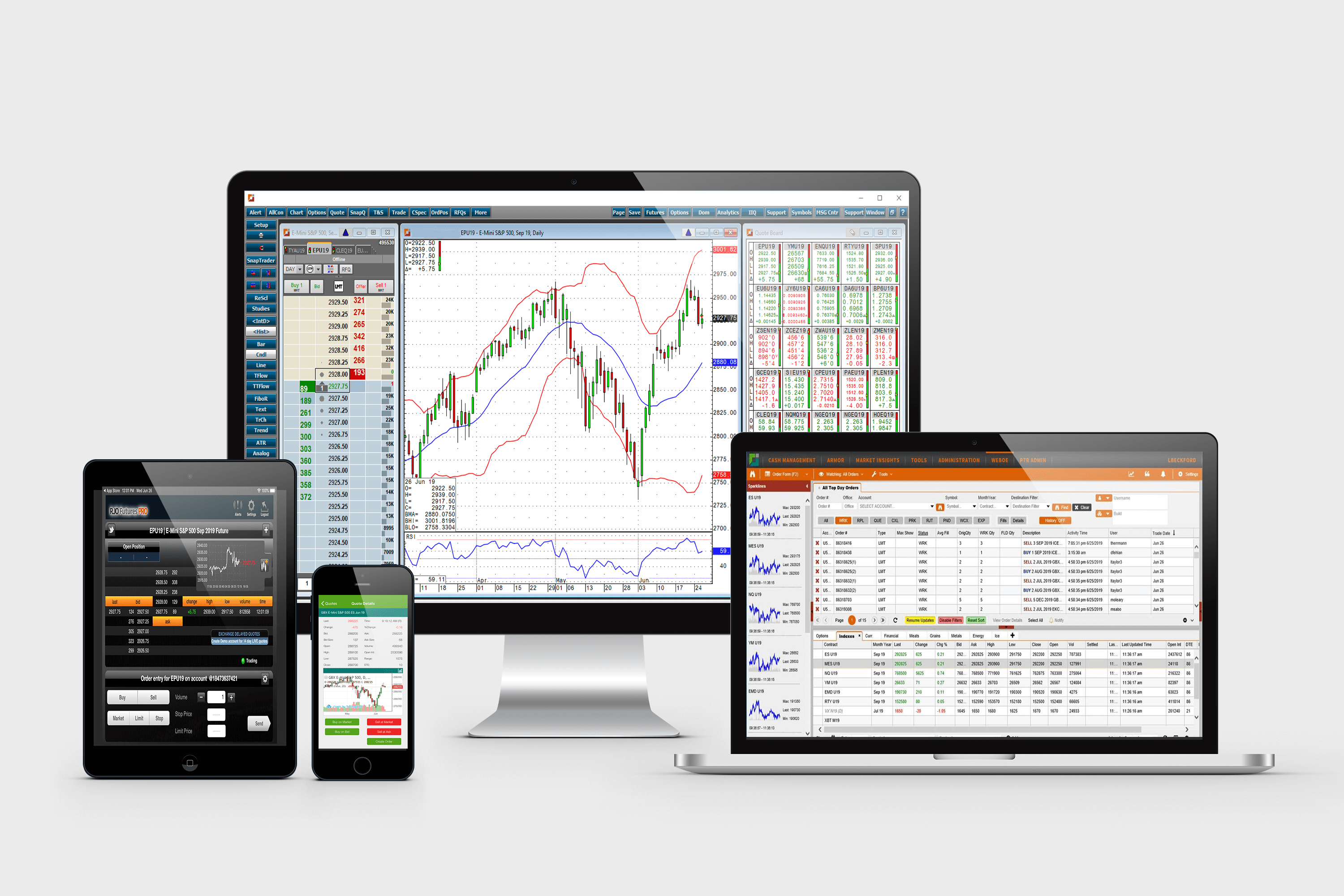

When it comes to futures online trading platforms, understanding the key features and benefits is essential. These platforms serve as a gateway to the futures market, enabling traders to access a wide range of contracts and trade them electronically. One of the primary advantages of using online platforms is the ability to trade from anywhere, at any time, as long as you have an internet connection.

Furthermore, futures online trading platforms offer real-time market data, advanced charting capabilities, and various order types to suit different trading strategies. They also provide access to historical data, helping traders analyze market trends and make informed decisions. To ensure a seamless trading experience, it's crucial to choose a platform that offers a user-friendly interface and reliable data feeds.

The Key Features of Futures Online Trading Platforms

Online trading platforms come equipped with a range of features designed to enhance your trading experience. These features may include:

- Real-time market quotes: Access up-to-date price information for the futures contracts you are interested in.

- Advanced charting tools: Analyze historical price data, apply technical indicators, and draw trend lines to identify potential trading opportunities.

- Order types: Place market orders, limit orders, stop orders, or even advanced order types like trailing stops to manage your positions effectively.

- Portfolio management: Monitor and manage your open positions, track your profit and loss, and assess the overall performance of your portfolio.

- Risk management tools: Set stop-loss and take-profit levels to protect your capital and manage risk.

- News and research: Stay informed about market developments and access research reports to make informed trading decisions.

- Mobile trading: Trade on the go with mobile apps that offer the same functionality as desktop platforms.

Choosing the Right Futures Online Trading Platform

With numerous futures online trading platforms available in the market, finding the right one can be overwhelming. To make an informed decision, consider the following factors:

Platform Security

Ensure that the platform you choose has robust security measures in place to protect your personal and financial information. Look for platforms that offer encryption, two-factor authentication, and secure data storage.

Trading Fees

Compare the fees charged by different platforms. Some platforms may charge a flat fee per trade, while others may have a tiered fee structure based on the volume of trades. Consider your trading frequency and the impact of fees on your overall profitability.

Charting Capabilities

If you rely heavily on technical analysis, choose a platform that offers advanced charting tools. Look for features like customizable indicators, drawing tools, and the ability to save and analyze multiple chart layouts.

Customer Support

Having access to reliable customer support is crucial, especially if you encounter technical issues or have questions about the platform's features. Look for platforms that offer 24/7 customer support via live chat, phone, or email.

Getting Started with Futures Online Trading

If you're new to futures trading, getting started can seem daunting. However, with the right knowledge and guidance, you can ease into the world of futures online trading. Here are the essential steps to help you get started:

1. Educate Yourself

Before diving into futures trading, it's important to educate yourself about the basics of the market. Familiarize yourself with key concepts like contract specifications, margin requirements, and trading hours. There are numerous online resources, books, and courses available to help you gain the necessary knowledge.

2. Choose a Reputable Broker

To trade futures online, you'll need to open an account with a reputable futures broker. Research different brokers and compare their offerings, such as commission rates, trading platforms, and customer service. Choose a broker that aligns with your trading goals and offers a user-friendly platform.

3. Complete the Account Opening Process

Once you've chosen a broker, you'll need to complete the account opening process. This typically involves providing personal information, verifying your identity, and funding your account. Follow the broker's instructions and provide the necessary documents to get your account up and running.

4. Understand Margin Requirements

Margin requirements vary for different futures contracts and brokers. It's important to understand how margin works and the initial and maintenance margin levels required by your broker. Margin allows you to control a larger position with a smaller amount of capital, but it also amplifies both profits and losses.

5. Develop a Trading Plan

Before placing any trades, it's crucial to develop a trading plan. A trading plan outlines your trading goals, risk tolerance, and strategies. It helps you stay disciplined and make consistent trading decisions. Define your entry and exit criteria, risk management rules, and the markets you want to trade.

6. Practice with a Demo Account

Most futures online trading platforms offer demo accounts where you can practice trading with virtual money. Utilize this feature to familiarize yourself with the platform's functionality, test your trading strategies, and gain confidence before risking real capital.

7. Start with Small Positions

When you're ready to start trading with real money, it's advisable to begin with small positions. This allows you to manage risk effectively and gain experience without exposing yourself to significant losses. Gradually increase your position sizes as you become more comfortable and confident in your trading abilities.

Analyzing Market Trends and Indicators

Successful futures trading requires a thorough understanding of market trends and indicators. By analyzing these factors, you can identify potential trading opportunities and make informed decisions. Here are some essential tools and techniques for analyzing market trends:

Technical Analysis

Technical analysis involves studying historical price data and using various indicators and chart patterns to predict future price movements. Some commonly used technical indicators include moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and Bollinger Bands. These indicators help identify trends, overbought or oversold conditions, and potential reversals.

Support and Resistance Levels

Support and resistance levels are price levels where the market tends to pause or reverse. Support levels are areas where buying pressure is expected to emerge, preventing prices from falling further. Resistance levels, on the other hand, are areas where selling pressure is expected to increase, preventing prices from rising further. Identifying these levels can help traders determine entry and exit points.

Trend Lines

Trend lines are diagonal lines drawn on a price chart to connect higher lows in an uptrend or lower highs in a downtrend. They provide a visual representation of the market's direction and can help traders identify potential trend reversals. Additionally, trend lines can be used to spot breakout opportunities when price breaches the line.

Candlestick Patterns

Candlestick patterns provide valuable insights into market sentiment. These patterns, formed by the open, high, low, and close prices, can indicate potential reversals or continuation of trends. Examples of popular candlestick patterns include doji, hammer, engulfing patterns, and morning/evening stars.

Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that drive the price of a futures contract. This can include analyzing economic data, supply and demand factors, geopolitical events, and weather patterns. Fundamental analysis can help traders identify long-term trends and make informed trading decisions based on the fundamental value of an asset.

Executing Trades on Futures Online Trading Platforms

Executing trades efficiently and effectively is crucial for successful futures trading. Here are some important considerations when placing trades on futures online trading platforms:

Market Orders

Market orders are executed at the prevailing market price. They provide quick execution but do not guarantee a specific price. Market orders are suitable when you want to enter or exit a position promptly, regardless of the price.

Limit Orders

Limit orders allow you to specify the maximum price at which you are willing to buy or the minimum price at which you are willing to sell. These orders provide more control over the price but may not be executed if the market does not reach your specified price.

Stop Orders

Stop orders are used to protect profits or limit losses. A stop-loss order is placed below the current market price to automatically sell if the price falls to a specified level. A stop-limit order is alimit order that is triggered when the price reaches a specific level, and it becomes a limit order to buy or sell at a specified price or better. Stop orders are useful for managing risk and ensuring disciplined trading.

Trailing Stops

A trailing stop is a dynamic stop order that follows the price as it moves in your favor. It allows you to lock in profits while giving the trade room to potentially continue in your desired direction. Trailing stops are particularly effective in trending markets where prices can move significantly in one direction.

Order Types for Advanced Strategies

Advanced futures traders may utilize additional order types to implement complex trading strategies. These could include bracket orders, OCO (one cancels the other) orders, and iceberg orders. Each order type serves a specific purpose and can help you execute trades more efficiently and manage multiple positions simultaneously.

Trade Execution Speed

Trade execution speed is crucial in futures trading, as even a slight delay can result in missed opportunities or unfavorable prices. When choosing a futures online trading platform, consider the platform's reputation for fast and reliable order execution. Low-latency connections and direct market access (DMA) can help ensure that your trades are executed swiftly.

Leveraging Advanced Trading Strategies

For experienced traders looking to take their futures trading to the next level, advanced trading strategies can offer a competitive edge. Here are a few strategies worth exploring:

Spread Trading

Spread trading involves simultaneously buying and selling related futures contracts to profit from price differentials or relative value. This strategy aims to reduce risk by taking advantage of price relationships between different contracts or different months of the same contract. Examples of spread trading strategies include calendar spreads, intercommodity spreads, and intramarket spreads.

Options Strategies

Options can be used to enhance futures trading strategies. Options provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Traders can utilize options strategies such as straddles, strangles, and spreads to hedge against price fluctuations or take advantage of anticipated market movements.

Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on predefined rules and algorithms. These algorithms can analyze market data, identify patterns, and execute trades automatically. Algorithmic trading can help traders capitalize on opportunities in rapidly changing markets and make split-second decisions.

Risk Management for Advanced Strategies

When implementing advanced trading strategies, risk management becomes even more critical. These strategies often involve higher complexity and potential risks. It's essential to employ proper position sizing, set stop-loss orders, and regularly review and adjust your risk management plan to protect your capital and maintain consistent profitability.

Monitoring and Managing Your Portfolio

Effectively monitoring and managing your portfolio is crucial for long-term success in futures trading. Here are some key considerations:

Portfolio Diversification

Diversifying your futures portfolio involves spreading your investments across different contracts, asset classes, or sectors. By diversifying, you reduce the concentration risk associated with a single position or market. This can help mitigate losses and smooth out overall portfolio performance.

Tracking Performance

Regularly tracking the performance of your futures trades is essential to evaluate your trading strategies and make informed decisions. Monitor your profit and loss, analyze your winning and losing trades, and identify patterns or areas for improvement. This information can guide your future trading decisions and help refine your approach.

Position Adjustments

As market conditions change, it may be necessary to adjust your positions. This could involve scaling into or out of existing positions, adding or reducing exposure based on market signals, or rolling contracts to extend or modify your trade duration. Regularly assess your positions and make adjustments as needed to align with your trading plan and market conditions.

Risk Management

Risk management is an ongoing process in futures trading. Regularly review and update your risk management plan, including setting appropriate stop-loss orders, defining maximum risk levels for each trade, and applying proper position sizing. Be disciplined in adhering to your risk management rules to protect your capital and maintain long-term profitability.

Learning from Successful Traders

Learning from the experiences and strategies of successful traders can provide valuable insights and inspiration. Here are a few ways to learn from their expertise:

Read Books and Biographies

There are numerous books and biographies available that share the stories and strategies of successful futures traders. Delve into these resources to gain insights into their trading approaches, mindset, and risk management techniques. Learn from their successes and failures, and apply those lessons to your own trading journey.

Attend Trading Webinars and Seminars

Many online trading platforms and educational institutions offer webinars and seminars conducted by experienced traders. These events provide an opportunity to learn from their expertise, ask questions, and gain practical insights into specific trading strategies or market analysis techniques. Take advantage of these educational resources to expand your knowledge and refine your trading skills.

Follow Trading Blogs and Social Media Accounts

Follow trading blogs, social media accounts, and forums where successful traders share their insights and market analysis. Engage with the trading community, ask questions, and participate in discussions to learn from others and stay updated on the latest trends and strategies.

Utilize Trading Simulators

Trading simulators allow you to practice trading strategies and test your skills without risking real money. Many online platforms offer simulated trading environments that replicate real market conditions. Use these simulators to experiment with different strategies and gain hands-on experience in a risk-free environment.

Staying Informed with Market News and Updates

Staying informed about market news and updates is crucial for making timely and informed trading decisions. Here are some strategies to stay updated:

News Sources

Identify reliable news sources that cover financial markets and provide real-time updates. Subscribe to reputable financial news websites, follow financial news channels, and set up news alerts to stay informed about important events and announcements that may impact the futures market.

Economic Calendar

Consult an economic calendar to keep track of important economic indicators and events that can influence the futures market. Economic calendars provide information on key releases such as GDP data, employment reports, central bank decisions, and more. Understanding the potential impact of these events can help you adjust your trading strategy accordingly.

Research Reports

Access research reports from reputable financial institutions and analysts. These reports often provide in-depth analysis of market trends, forecasts, and expert insights. Reading research reports can give you a broader perspective on the market and help you identify potential trading opportunities.

Market Analysis Tools

Utilize market analysis tools offered by your trading platform or external sources. These tools can include technical analysis indicators, charting capabilities, and market sentiment tools. By analyzing market data and trends, you can gain a better understanding of market dynamics and make more informed trading decisions.

Overcoming Challenges in Futures Online Trading

Futures trading can come with its own set of challenges. Here are some common challenges faced by traders and strategies to overcome them:

Managing Emotions

Emotions like fear and greed can cloud judgment and lead to irrational trading decisions. Develop a disciplined mindset and stick to your trading plan. Implement risk management strategies, set realistic expectations, and avoid impulsive trading based on emotions.

Adapting to Market Volatility

Futures markets can experience high volatility, which can lead to rapid price movements. Be prepared for market fluctuations and adjust your risk management strategies accordingly. Implement stop-loss orders and consider position sizing to manage your exposure to market volatility.

Continuous Learning and Adaptation

The financial markets are dynamic and constantly evolving. To stay ahead, continuously educate yourself, adapt to changing market conditions, and refine your trading strategies. Be open to learning from your experiences and the experiences of others in the trading community.

Controlling Overtrading

Overtrading can lead to excessive risk-taking and poor decision-making. Stick to your trading plan and avoid taking trades that do not meet your predefined criteria. Be patient and wait for high-probability setups that align with your strategy.

In conclusion, futures online trading platforms offer traders a world of opportunities to profit from price movements in various asset classes. By understanding the fundamentals, choosing the right platform, implementing effective strategies, and continuously learning, you can enhance your trading experience and increase your chances of success in this dynamic market.

Start your futures trading journey today and unlock the potential of online trading platforms.