The Best Futures Paper Trading Platforms

Are you looking to venture into futures trading? Before diving into the real market, it is crucial to practice and refine your skills using paper trading platforms. These virtual platforms allow you to simulate real-time trading without risking any actual money. However, with a plethora of options available, finding the best futures paper trading platform can be a daunting task. In this comprehensive guide, we will explore the top platforms that offer an excellent learning experience for aspiring futures traders.

What is Paper Trading?

Before we delve into the various platforms, let's first understand what paper trading entails. Paper trading refers to the act of practicing trading strategies and executing trades in a simulated environment. The trades are executed using virtual money, allowing traders to gain experience without any financial risk. It is an invaluable tool for beginners to learn about the futures market, test trading strategies, and improve decision-making skills.

When engaging in paper trading, traders are provided with a virtual account that mirrors the functionalities of a real trading account. They can access real-time market data, execute trades, and monitor their positions. The primary difference is that the funds used for trading are not real, eliminating the risk of financial loss. This allows traders to experiment with different strategies, learn from their mistakes, and refine their trading techniques.

The Benefits of Paper Trading

Paper trading offers numerous benefits to both novice and experienced traders. Firstly, it provides an opportunity to learn about the mechanics of futures trading, including order types, chart analysis, and risk management techniques. By executing trades in a simulated environment, traders can familiarize themselves with the various features and functionalities of the trading platform they intend to use.

Furthermore, paper trading allows traders to gain confidence in their strategies and make necessary adjustments without incurring any actual losses. It offers a risk-free environment to test different trading strategies, analyze their performance, and identify areas for improvement. By evaluating the outcomes of their trades, traders can refine their approaches and develop a solid foundation for future trading success.

In addition to strategy development, paper trading helps traders understand market dynamics, such as price movements, volatility, and liquidity, which are crucial for successful trading. By observing market trends and analyzing historical data, traders can identify patterns and develop a deeper understanding of the market's behavior. This knowledge can be invaluable when transitioning to live trading, as it enables traders to make informed decisions based on market conditions.

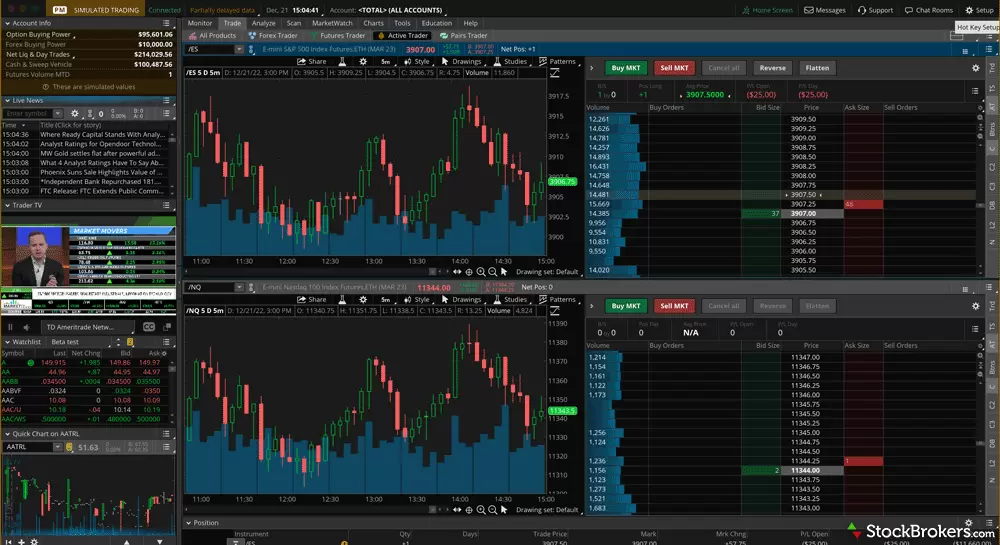

TD Ameritrade's Thinkorswim

Thinkorswim by TD Ameritrade is one of the most popular and comprehensive paper trading platforms available. It offers a wide range of features, making it an ideal choice for both beginners and experienced traders. With Thinkorswim, traders can access real-time market data, practice trading futures, options, stocks, and even participate in paper trading competitions.

Advanced Charting Tools and Technical Indicators

One of the standout features of Thinkorswim is its advanced charting tools and extensive library of technical indicators. Traders can analyze market trends and patterns using a variety of chart types and drawing tools. Additionally, they can incorporate technical indicators such as moving averages, MACD, and Bollinger Bands to enhance their analysis. These tools provide valuable insights into market conditions and assist traders in making informed trading decisions.

Customizable Watchlists and Alerts

Thinkorswim allows traders to create customizable watchlists to monitor their favorite futures contracts. By adding specific instruments to their watchlist, traders can track their performance and identify potential trading opportunities. Moreover, the platform offers customizable alerts that notify traders of significant price movements or other market events. These alerts ensure that traders stay updated and can react promptly to market changes.

Practice Trading Competitions

Thinkorswim hosts paper trading competitions, providing traders with a competitive and engaging learning experience. These competitions allow traders to test their skills against other participants and potentially win prizes. Participating in such competitions can further enhance traders' abilities, as they learn to adapt to various market conditions and develop effective trading strategies.

NinjaTrader

NinjaTrader is another powerful platform that offers an extensive range of features for paper trading futures. It provides a realistic trading environment and a wealth of tools to support traders in their learning journey.

Realistic Trading Environment

NinjaTrader's paper trading platform replicates the experience of live trading, providing traders with a realistic environment to practice and refine their strategies. Traders can execute trades, set stop-loss orders, and monitor their positions just as they would in a live trading scenario. This realistic simulation helps traders become familiar with the platform's functionalities and gain confidence in their trading abilities.

Advanced Charting and Backtesting

NinjaTrader offers advanced charting capabilities, enabling traders to analyze market trends and patterns effectively. The platform provides a wide range of technical indicators and drawing tools, empowering traders to conduct in-depth technical analysis. Additionally, NinjaTrader's backtesting feature allows traders to test their strategies using historical data. By analyzing the performance of their strategies over different market conditions, traders can identify strengths and weaknesses and make necessary adjustments.

Market Replay Functionality

The market replay functionality is a unique feature of NinjaTrader that allows traders to practice trading in real-time using historical market data. Traders can choose specific trading sessions or days and replay them as if they were trading live. This feature enables traders to experience different market scenarios, test their strategies, and improve their decision-making abilities.

TradeStation

TradeStation is a renowned platform that provides a comprehensive suite of tools for paper trading futures. It offers a user-friendly interface, advanced charting capabilities, and a range of features to support traders' learning and development.

Customizable Workspaces and Layouts

TradeStation allows traders to customize their workspaces and layouts to suit their preferences and trading style. Traders can arrange various windows, charts, and tools to create a personalized trading environment. This level of customization enhances traders' efficiency and allows them to focus on the information and tools that are most relevant to their trading strategies.

Real-Time Market Data and Charting Tools

TradeStation provides access to real-time market data, ensuring that traders have up-to-date information to make informed trading decisions. The platform offers advanced charting tools, including a wide range of technical indicators and drawing tools. Traders can analyze market trends, identify entry and exit points, and develop effective trading strategies based on these tools and indicators.

Community and Educational Resources

TradeStation has a large community of traders, where users can share ideas, strategies, and insights. Traders can join forums, participate in discussions, and learn from experienced traders. Additionally, TradeStation offers a wealth of educational resources, including webinars, tutorials, and research reports. These resources enable traders to expand their knowledge, stay updated with market trends, and enhance their trading skills.

Interactive Brokers

Interactive Brokers' paper trading platform is widely recognized for its realistic trading simulation. Traders can practice trading futures, options, stocks, and more using virtual funds. The platform offers advanced features and a range of tools to support traders' learning and development.

Realistic Trading Simulation

Interactive Brokers' paper trading platform aims to replicate the experience of live trading as closely as possible. Traders can execute trades, monitor their positions, and access real-time market data. This realistic simulation allows traders to become familiar with the trading platform's interface and functionalities before transitioning to live trading.

Advanced Order Types and Risk Management Tools

Interactive Brokers' paper trading platform offers a wide range of advanced order types, allowing traders to execute complex trading strategies. Traders can also utilize risk management tools such as stop-loss orders and trailing stops to manage their positions effectively. These tools enable traders to mitigate risk and protect their capital while practicing and refining their trading strategies.

Educational Resources

Interactive Brokers provides access to a vast range of educational resources that can help traders enhance their trading skills. The platform offers webinars, tutorials, and research reports, covering various topics related to futures trading. Traders can utilize these resources to deepen their understanding of market dynamics, technical analysis, and trading strategies.

E*TRADE

E*TRADE's paper trading platform is an excellent option for beginners looking to gain experience in futures trading. It offers a user-friendly interface, advanced charting tools, and a range of features to support traders' learning and development.

User-Friendly Interface

E*TRADE's paper trading platform features a user-friendly interface that is intuitive and easy to navigate. Traders can quickly familiarize themselves with the platform's functionalities, making it an ideal option for beginners. The platform provides a seamless trading experience, allowing traders to focus on analyzing market trends and executing trades.

Advanced Charting Tools and Technical Indicators

E*TRADE offers advanced charting tools and a wide range of technical indicators to assist traders in their analysis. Traders can customize their charts, add technical indicators, and analyze market trends effectively. These tools enable traders to identify potential trading opportunities and develop effective trading strategies.

Real-Time Market Data and News

E*TRADE's paper trading platform provides access to real-time marketdata and news, ensuring that traders have the most up-to-date information at their fingertips. Traders can stay informed about market developments, economic news, and company announcements that may impact the futures market. This real-time data and news can help traders make informed trading decisions and stay ahead of market trends.

Educational Resources and Support

E*TRADE offers a range of educational resources and support to help traders enhance their futures trading knowledge and skills. The platform provides access to educational articles, videos, webinars, and tutorials that cover various topics related to futures trading. Traders can learn about technical analysis, risk management, and trading strategies to improve their trading performance. Additionally, E*TRADE offers customer support services to assist traders with any platform-related queries or technical issues they may encounter.

Summary of Platforms

Each platform mentioned above offers unique features and advantages for paper trading futures. TD Ameritrade's Thinkorswim is a comprehensive platform with advanced charting tools, customizable watchlists, and paper trading competitions. NinjaTrader provides a realistic trading environment, advanced charting, backtesting capabilities, and market replay functionality. TradeStation offers customizable workspaces, real-time market data, and access to a large community of traders. Interactive Brokers provides a realistic trading simulation, advanced order types, and access to educational resources. E*TRADE is a user-friendly platform with advanced charting tools, real-time market data, and educational resources.

Choosing the Right Platform

When selecting the best futures paper trading platform, it is important to consider your specific trading needs and preferences. Some factors to consider include the type of instruments you want to trade, the level of customization required, the availability of educational resources, and the platform's user interface. It is recommended to try out different platforms using their free trial versions to determine which one suits your trading style and preferences. Consider the features and tools offered by each platform and assess how well they align with your trading goals and strategies.

Demo Accounts and Free Trials

Many futures paper trading platforms offer demo accounts or free trial versions that allow traders to test the platform's features and functionality. Take advantage of these opportunities to explore the platforms and assess their suitability for your trading needs. During the trial period, familiarize yourself with the platform's user interface, test the available features, and evaluate the quality of the market data provided. This hands-on experience will help you make an informed decision when choosing the right platform for your paper trading journey.

Start Practicing Today

Now that you are familiar with some of the top futures paper trading platforms, it's time to start your journey towards becoming a successful futures trader. Choose your preferred platform based on your trading needs and preferences, set up a paper trading account, and begin practicing your strategies in a risk-free environment. Remember, consistency and continuous learning are key to mastering the art of futures trading. Monitor your trades, analyze your performance, and make necessary adjustments to improve your trading skills. With dedication and perseverance, you can develop the expertise needed to navigate the real futures market with confidence and success.

In conclusion, paper trading is an essential step for aspiring futures traders to gain experience and refine their strategies. The platforms discussed in this guide, including TD Ameritrade's Thinkorswim, NinjaTrader, TradeStation, Interactive Brokers, and E*TRADE, offer excellent features and tools to enhance the learning process. By utilizing these platforms, traders can gain confidence, test various strategies, and ultimately transition to real trading with a higher probability of success. Start your paper trading journey today and unlock the potential to become a profitable futures trader.