Order Management System Trading: Streamline Your Trading Operations

Are you looking to enhance the efficiency and effectiveness of your trading operations? If so, implementing an order management system (OMS) could be the solution you need. In this comprehensive blog article, we will delve into the world of OMS trading, exploring its benefits, features, and how it can revolutionize your trading strategies.

Paragraph 2: In the fast-paced world of trading, managing orders manually can be a daunting and time-consuming task. This is where an order management system comes into play. An OMS is a software solution designed to streamline and automate the entire order lifecycle, from the initial order placement to its execution and allocation. By centralizing and automating these processes, traders can save valuable time, reduce errors, and gain a competitive edge in the market.

Paragraph 3: Now, let's dive deeper into the key aspects of order management system trading. In this article, we will cover everything from the basics of OMS trading to its advanced functionalities, ensuring you have a comprehensive understanding of this powerful tool. So, let's get started!

What is an Order Management System?

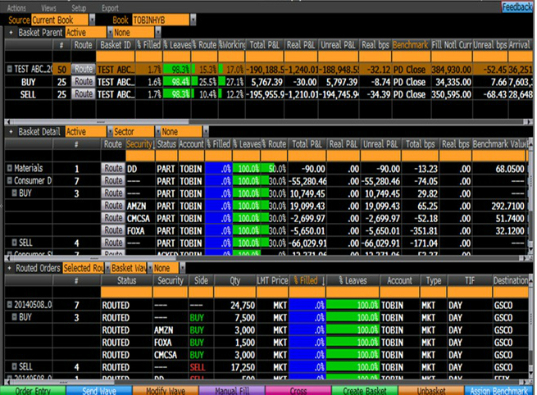

In the world of trading, an order management system (OMS) is a powerful tool that helps traders streamline their order processing and execution. An OMS serves as a central hub for managing orders, allowing traders to place, track, and execute orders efficiently. It acts as a bridge between the trader and the market, ensuring seamless order flow and timely execution.

Within an OMS, traders can input various order types, including market orders, limit orders, stop orders, and more. These orders are then transmitted to the relevant exchanges or marketplaces for execution. The OMS also handles order routing, ensuring that each order is sent to the most suitable venue based on factors such as liquidity, pricing, and trading rules.

Additionally, an OMS provides traders with real-time order status updates, allowing them to monitor the progress of their orders and make informed decisions. It also facilitates order allocation, enabling traders to allocate trades across multiple accounts or portfolios accurately.

Key Features of an OMS

Order management systems come equipped with a range of features that enhance traders' ability to manage and execute orders effectively. Some key features of an OMS include:

1. Order Entry: Traders can easily input and modify orders within the OMS, specifying details such as quantity, price, order type, and time in force.

2. Order Routing: The OMS intelligently routes orders to the most appropriate venue or exchange based on predefined rules, optimizing execution quality.

3. Execution Management: Traders can monitor and manage the execution of their orders in real-time, ensuring timely and accurate execution.

4. Trade Allocation: The OMS allows traders to allocate trades across multiple accounts, portfolios, or funds, ensuring accurate and efficient distribution.

5. Risk Management: OMS solutions provide risk management tools and alerts to help traders monitor and mitigate risks associated with their orders and portfolios.

6. Compliance Monitoring: An OMS assists traders in adhering to regulatory requirements by providing compliance monitoring features and generating necessary reports.

7. Reporting and Analytics: OMS platforms offer comprehensive reporting and analytics capabilities, allowing traders to gain insights into their trading activities and performance.

By leveraging these features, traders can streamline their order management process, minimize errors, and optimize their trading strategies to achieve better outcomes.

Benefits of Implementing an OMS

Implementing an order management system offers a multitude of benefits for traders, enabling them to enhance their trading operations and achieve improved outcomes. Let's explore some of the key advantages of using an OMS:

1. Enhanced Efficiency and Accuracy

By automating the order management process, an OMS reduces manual errors and eliminates time-consuming tasks. Traders can efficiently handle a higher volume of orders while ensuring accuracy in execution and allocation. This increased efficiency allows traders to focus on analyzing market trends and making informed trading decisions.

2. Improved Order Execution

An OMS provides real-time access to market data and liquidity, enabling traders to execute orders at optimal prices and volumes. By leveraging advanced order routing algorithms, traders can intelligently route orders to venues with the best execution quality, resulting in improved trade execution and reduced slippage.

3. Streamlined Workflow

An OMS centralizes all order-related activities, ensuring a streamlined workflow for traders. From order placement to execution, allocation, and reporting, the OMS provides a unified platform that eliminates the need for multiple systems and manual data entry. Traders can seamlessly manage their entire order lifecycle within a single interface.

4. Risk Management and Compliance

An OMS includes risk management tools and compliance monitoring features to help traders manage and mitigate risks associated with their orders and portfolios. It provides real-time alerts and reports on risk exposures, enabling traders to make timely decisions and ensure compliance with regulatory requirements.

5. Reporting and Analytics

OMS platforms offer robust reporting and analytics capabilities, providing traders with valuable insights into their trading activities and performance. Traders can generate various reports, such as trade activity reports, order status reports, and performance analytics, allowing them to evaluate their strategies and make data-driven decisions.

Key Components of an OMS

An order management system comprises several key components that work together to deliver a comprehensive solution for traders. Let's explore the essential components of an OMS:

1. Order Entry

The order entry component allows traders to input and modify orders within the OMS. Traders can specify various parameters, including order type, quantity, price, time in force, and other relevant details. The order entry component ensures accurate and efficient order placement.

2. Order Routing

The order routing component intelligently routes orders to the most suitable venues or exchanges based on predefined rules. It considers factors such as liquidity, pricing, and trading rules to optimize order execution quality. The order routing component helps traders achieve the best possible execution outcomes.

3. Execution Management

The execution management component provides real-time monitoring and management of order execution. Traders can track the status of their orders, receive execution updates, and make necessary adjustments. The execution management component ensures timely and accurate order execution.

4. Trade Allocation

The trade allocation component allows traders to allocate trades across multiple accounts, portfolios, or funds. Traders can define allocation rules and percentages, ensuring accurate distribution of trades. The trade allocation component helps traders efficiently manage their trade allocations.

5. Risk Management

The risk management component provides tools for monitoring and managing risks associated with orders and portfolios. Traders can set risk thresholds, receive real-time risk alerts, and take appropriate actions. The risk management component helps traders mitigate potential risks and protect their portfolios.

6. Compliance Monitoring

The compliance monitoring component ensures traders adhere to regulatory requirements. It provides features for monitoring compliance with trading rules, reporting obligations, and other regulatory constraints. The compliance monitoring component helps traders maintain regulatory compliance and avoid potential penalties.

7. Reporting and Analytics

The reporting and analytics component enables traders to generate various reports and gain insights into their trading activities and performance. Traders can analyze trade data, track performance metrics, and identify areas for improvement. The reporting and analytics component empowers traders to make data-driven decisions and optimize their trading strategies.

By leveraging these key components, an OMS provides traders with a comprehensive solution for managing their orders, mitigating risks, and maximizing trading performance.

Integration with Trading Platforms

Integrating an order management system (OMS) with various trading platforms and tools is crucial for seamless order flow and efficient trading operations. Let's explore the importance of integration and some popular trading platforms that can be integrated with an OMS:

Importance of Integration

Integration between an OMS and trading platforms allows for smooth data flow and automated order execution. It eliminates the need for manual data entry and ensures accurate and timely order placement and execution. Integration also enables traders to access real-time market data, monitor their portfolios, and make informed trading decisions within a single interface.

By integrating an OMS with trading platforms, traders can leverage the features and capabilities of both systems, enhancing their overall trading experience and efficiency.

Popular Trading Platform Integrations

Several popular trading platforms can be seamlessly integrated with an OMS, providing traders with a comprehensive trading solution. Let's explore some of these platforms:

1. MetaTrader

MetaTrader is a widely used trading platform in the forex and CFD markets. By integrating an OMS with MetaTrader, traders can automate order placement and execution, access real-time market data, and manage their portfolios efficiently. The integration enables seamless trade execution and accurate order allocation across multiple accounts or portfolios.

2. Bloomberg Terminal

Bloomberg Terminal is a leading platform for financial market data, news, and analytics. Integrating an OMS withBloomberg Terminal allows traders to combine the powerful analytics and data provided by Bloomberg with the order management capabilities of an OMS. Traders can access real-time market data, news, and research, and seamlessly place and execute orders directly from the Bloomberg Terminal. The integration enhances the speed and accuracy of order execution, while also providing traders with valuable market insights.

3. Interactive Brokers

Interactive Brokers is a popular brokerage platform that offers access to multiple financial markets and a wide range of trading instruments. By integrating an OMS with Interactive Brokers, traders can automate order routing and execution, access real-time market data, and manage their portfolios efficiently. The integration ensures seamless connectivity between the OMS and Interactive Brokers, allowing for streamlined order flow and optimal trade execution.

4. E*TRADE

E*TRADE is a well-known online brokerage platform that provides trading services across various asset classes. By integrating an OMS with E*TRADE, traders can automate order placement and execution, access real-time market data, and manage their portfolios effectively. The integration allows for seamless order routing and execution, ensuring that trades are executed at optimal prices and volumes.

5. TD Ameritrade

TD Ameritrade is a popular brokerage platform that offers a wide range of trading tools and resources. By integrating an OMS with TD Ameritrade, traders can automate order execution, access real-time market data, and manage their portfolios efficiently. The integration allows for seamless trade execution and accurate order allocation across multiple accounts or portfolios.

These are just a few examples of the trading platforms that can be integrated with an order management system. The specific platforms available for integration may vary depending on the OMS provider. By integrating an OMS with trading platforms, traders can streamline their order flow, access real-time market data, and optimize their trading strategies.

Customization and Scalability

One of the key advantages of an order management system (OMS) is its ability to be customized and scaled to meet the specific needs of individual traders. Let's explore the customization and scalability options offered by OMS solutions:

Customization Options

An OMS can be customized to align with traders' unique trading strategies and requirements. Some common customization options include:

1. Order Types and Parameters

Traders can customize the available order types within the OMS to match their preferred trading strategies. They can define parameters such as order quantity, price, time in force, and order validity. This customization allows traders to execute orders based on their specific trading preferences.

2. Trading Rules and Algorithms

OMS solutions often provide traders with the flexibility to define their own trading rules and algorithms. Traders can create custom algorithms to automate order execution based on their unique trading strategies. This customization empowers traders to execute trades in line with their specific criteria and market conditions.

3. Reporting and Analytics

OMS platforms typically offer customizable reporting and analytics capabilities. Traders can define the specific metrics and parameters they want to track in their reports, enabling them to focus on the key performance indicators that matter most to their trading strategies. Customizable reporting and analytics allow traders to gain deeper insights into their trading activities.

Scalability

OMS solutions are designed to accommodate the growing needs of traders as their trading activities expand. OMS platforms offer scalability options to handle increased order volumes, support additional trading accounts, and integrate with new trading platforms. Traders can scale their OMS to match the growth of their trading operations without compromising performance or efficiency.

With the customization and scalability options offered by OMS solutions, traders can tailor the system to their specific requirements and adapt it as their trading activities evolve over time.

Risk Management and Compliance

Risk management and compliance are critical aspects of trading, and an order management system (OMS) plays a vital role in helping traders effectively manage risks and ensure regulatory compliance. Let's explore how an OMS supports risk management and compliance:

Risk Assessment Tools

An OMS provides traders with risk assessment tools to identify and evaluate potential risks associated with their orders and portfolios. These tools analyze factors such as market volatility, position concentrations, and exposure to specific securities or asset classes. Traders can set risk thresholds and receive real-time alerts to manage and mitigate potential risks proactively.

Real-time Risk Monitoring

An OMS enables real-time risk monitoring, allowing traders to continuously track their risk exposures and portfolio performance. Traders can access comprehensive risk reports and visualizations that highlight key risk metrics, such as value at risk (VaR), profit and loss (P&L), and risk-adjusted returns. Real-time risk monitoring helps traders make informed decisions and take necessary actions to mitigate risks.

Compliance Monitoring and Reporting

An OMS includes compliance monitoring features to ensure traders adhere to regulatory requirements. The system can automatically monitor and enforce trading rules, such as restrictions on short-selling or trading in specific securities. Traders can generate compliance reports and audit trails, demonstrating their adherence to regulatory obligations. Compliance monitoring and reporting help traders maintain regulatory compliance and avoid potential penalties.

Pre-trade and Post-trade Compliance Checks

An OMS performs pre-trade and post-trade compliance checks to ensure that trades meet regulatory guidelines before they are executed and after they are completed. The system verifies factors such as trade size, trading limits, and suitability requirements. By conducting these checks, an OMS helps traders comply with applicable regulations and reduces the risk of non-compliant trades.

Integration with Compliance Systems

An OMS can integrate with external compliance systems or data providers, ensuring access to up-to-date regulatory information and rules. This integration allows traders to align their trading activities with the latest compliance standards and automatically incorporate regulatory changes into their trading strategies. Integration with compliance systems enhances accuracy and efficiency in compliance management.

By leveraging the risk management and compliance features of an OMS, traders can effectively identify, monitor, and mitigate risks associated with their trading activities while ensuring regulatory compliance.

Reporting and Analytics

An order management system (OMS) provides traders with robust reporting and analytics capabilities, enabling them to gain valuable insights into their trading activities and performance. Let's explore how reporting and analytics enhance trading operations:

Types of Reports

An OMS offers various types of reports that provide traders with valuable information and analysis. Some common types of reports include:

1. Trade Activity Reports

Trade activity reports provide a comprehensive overview of trades executed within a specific timeframe. These reports include details such as trade timestamps, executed prices, order sizes, and trade volumes. Traders can analyze their trade activity to identify patterns, assess trading performance, and make informed decisions based on historical trade data.

2. Order Status Reports

Order status reports provide real-time updates on the status of orders within the OMS. Traders can track the progress of their orders, monitor order executions, and identify any potential issues or delays. Order status reports help traders ensure timely and accurate execution of their orders.

3. Performance Analytics

OMS platforms offer performance analytics tools that enable traders to assess the performance of their trading strategies and portfolios. These tools provide metrics such as realized and unrealized profits and losses, returns on investment, and risk-adjusted performance measures. Performance analytics help traders evaluate the effectiveness of their strategies and make data-driven decisions.

4. Compliance Reports

OMS solutions generate compliance reports that summarize traders' compliance with regulatory guidelines and trading rules. These reports document adherence to restrictions on short-selling, trading in specific securities, or other regulatory requirements. Compliance reports provide traders with a clear overview of their compliance status.

Insights and Data Analysis

Reporting and analytics capabilities allow traders to gain valuable insights from their trading data. They can identify trends, patterns, and correlations to refine their trading strategies. By analyzing historical trade data, traders can identify areas for improvement, optimize their trading decisions, and ultimately enhance their trading performance.

Data Visualization

OMS platforms often provide data visualization tools that present trading data in a visual and easily understandable format. Traders can create charts, graphs, and dashboards to visualize their trade activity, portfolio performance, and risk exposures. Data visualization allows traders to quickly grasp and interpret complex trading data, facilitating better decision-making.

By leveraging reporting and analytics capabilities, traders can gain valuable insights into their trading activities, assess performance, identify areas for improvement, and make informed decisions based on data-driven analysis.

OMS Trading Strategies

An order management system (OMS) supports various trading strategies, empowering traders to execute their preferred approaches effectively. Let's explore some popular trading strategies that can be implemented using an OMS:

1. Algorithmic Trading

Algorithmic trading involves executing trades based on predefined algorithms and rules. With an OMS, traders can build and deploy their own algorithmic trading strategies. They can define specific trading rules, such as price thresholds, volume limits, and timing parameters, and automate the execution of trades. The OMS facilitates real-time data access, order routing, and trade execution, enabling efficient implementation of algorithmic trading strategies.

High-frequency trading (HFT) involves executing a large number of trades within very short timeframes to capitalize on small price discrepancies. An OMS is essential for HFT strategies as it allows for ultra-fast order routing and execution. The OMS can integrate with market data feeds and execute trades within milliseconds, enabling traders to take advantage of fleeting market opportunities.

3. Pair Trading

Pair trading involves simultaneously buying and selling two correlated securities to exploit relative price movements. An OMS can facilitate pair trading strategies by automatically executing the buy and sell orders for the selected securities. Traders can set up rules within the OMS to trigger trades based on predefined pricing relationships or statistical indicators.

4. Portfolio Rebalancing

Portfolio rebalancing involves adjusting the weights of assets within a portfolio to maintain desired allocation targets. An OMS can automate the rebalancing process by executing the necessary buy and sell orders based on predefined portfolio allocation rules. Traders can set up rebalancing triggers and frequency within the OMS, ensuring that the portfolio remains aligned with the desired asset allocation.

5. Event-Driven Trading

Event-driven trading involves taking advantage of market opportunities arising from specific events, such as earnings announcements, economic releases, or corporate news. An OMS can facilitate event-driven trading strategies by allowing traders to set up automated rules that trigger trades based on specific event criteria. The OMS can integrate with news feeds or event calendars to monitor and respond to relevant market events.

6. Statistical Arbitrage

Statistical arbitrage involves exploiting pricing discrepancies between related securities based on statistical models. An OMS can support statistical arbitrage strategies by automating the identification of trading opportunities and executing trades based on predefined statistical indicators. Traders can set up rules within the OMS to monitor price differentials and trigger trades when specific thresholds are met.

7. Market Making

Market making involves providing liquidity to the market by continuously quoting bid and ask prices for a specific instrument. An OMS can support market making strategies by facilitating the automatic placement and management of orders based on predefined pricing spreads. Traders can set up rules within the OMS to adjust quotes based on market conditions and order book dynamics.

These are just a few examples of trading strategies that can be implemented using an OMS. The flexibility and automation provided by an OMS empower traders to execute their preferred strategies more efficiently and effectively.

Implementation and Integration Process

Implementing and integrating an order management system (OMS) requires careful planning and execution. Let's explore the key steps involved in the implementation and integration process:

1. Assessing Requirements

The first step is to assess your trading requirements and identify the specific functionalities and features you need from an OMS. Consider factors such as order volume, asset classes, trading platforms, risk management, and compliance requirements. Understanding your needs will help you choose the most suitable OMS provider.

2. Selecting an OMS Provider

Research and evaluate different OMS providers based on your requirements. Consider factors such as system reliability, scalability, customization options, integration capabilities, customer support, and pricing. Select an OMS provider that best aligns with your trading needs and offers the features and support you require.

3. Defining Implementation Plan

Work with your chosen OMS provider to define an implementation plan. This plan should outline the steps, timeline, and resources required for the successful deployment of the OMS. It should consider factors such as data migration, platform configuration, testing, and training.

4. Data Migration

If you are transitioning from an existing system, data migration is an important step. Ensure that your historical trade data, order records, and other relevant information are accurately transferred to the new OMS. This may involve working with your OMS provider to develop a data migration strategy and perform testing to verify the integrity of the migrated data.

5. Platform Configuration

Configure the OMS platform according to your specific trading requirements. This includes setting up order types, order routing rules, risk parameters, compliance rules, and other customization options. Work closely with your OMS provider to ensure that the platform is tailored to your trading strategies and preferences.

6. Testing and Quality Assurance

Thoroughly test the OMS platform to ensure its reliability, accuracy, and performance. Conduct functional testing to validate that all the desired features and functionalities are working as intended. Perform integration testing to verify the seamless connectivity between the OMS and any integrated trading platforms or systems. Address any issues or bugs identified during the testing phase.

7. User Training and Support

Provide comprehensive training to your trading team on how to effectively use the OMS platform. Ensure that traders are familiar with the order entry, execution, allocation, and reporting functionalities. Work closely with your OMS provider to offer ongoing support, address user queries, and provide assistance during the initial transition period.

8. Go-Live and Monitoring

Once all testing and training are completed, it's time to go live with the OMS. Monitor the system closely during the initial period to ensure that it is functioning as expected. Address any issues or concerns promptly and make necessary adjustments to optimize the system's performance.

By following these implementation and integration steps, you can successfully deploy an OMS and seamlessly integrate it into your trading operations.

Choosing the Right OMS Provider

Choosing the right order management system (OMS) provider is crucial for the success of your trading operations. Let's explore the factors to consider when selecting an OMS provider:

1. Functionality and Customization

Evaluate the functionality and customization options offered by the OMS provider. Ensure that the OMS can support your specific trading requirements, including order types, risk management tools, compliance monitoring, reporting capabilities, and integration with trading platforms. Look for an OMS that offers the flexibility to customize the system to align with your trading strategies.

2. Scalability

Consider the scalability of the OMS platform. Ensure that it can handle increasing order volumes, support additional trading accounts or portfolios, and integrate with new trading platforms or systems as your trading operations grow. A scalable OMS will accommodate your future needs and facilitate seamless growth.

3. Reliability and Support

Assess the reliability and stability of the OMS platform. Look for an OMS provider with a proven track record of system uptime and performance. Additionally, consider the level of customer support provided by the OMS provider. Ensure that they offer timely and responsive support to address any issues or concerns that may arise during your trading activities.

4. Integration Capabilities

Consider the integration capabilities of the OMS. Ensure that it can seamlessly integrate with your preferred trading platforms, data providers, and other systems. The OMS should facilitate efficient data flow and connectivity between different systems, enabling real-time information exchange and streamlined order execution.

5. Security and Compliance

Pay attention to the security measures and compliance features offered by the OMS provider. Ensure that the OMS platform adheres to industry-standard security protocols to protect your trading data and sensitive information. Additionally, verify that the OMS supports compliance monitoring and reporting to help you meet regulatory requirements.

6. Cost and Pricing

Consider the cost and pricing structure of the OMS. Evaluate the pricing models, such as subscription-based or transaction-based, and assess whether they align with your trading volumes and budget. Consider the value provided by the OMS compared to its cost and ensure that the pricing is transparent and competitive.

7. User Experience

Evaluate the user experience of the OMS platform. Look for an intuitive and user-friendly interface that enables efficient order entry, execution, and monitoring. The OMS should offer a seamless and intuitive workflow to enhance the productivity of your trading team.

By carefully considering these factors and conducting thorough research and evaluation, you can choose an OMS provider that best meets your trading needs and empowers you to streamline your trading operations.

In conclusion, an order management system (OMS) is a powerful tool that can revolutionize the way traders manage their orders and streamline their trading operations. By automating and centralizing the order lifecycle, traders can enhance efficiency, reduce errors, and gain a competitive edge in the market. Whether you are a professional trader or an individual investor, implementing an OMS can significantly improve your trading performance. So, why wait? Embrace the power of order management system trading and take your trading activities to new heights!