Demo Account Futures Trading: Learn the Ins and Outs of Trading with Virtual Currency

Are you interested in futures trading but unsure where to start? Look no further than demo account futures trading. A demo account allows you to practice trading futures without risking any real money. It's the perfect way to gain experience and confidence before diving into the real market. In this comprehensive guide, we will walk you through everything you need to know about demo account futures trading, from its benefits to how to get started.

What is a Demo Account?

A demo account is a virtual trading platform that simulates real market conditions, allowing you to practice trading without using real money. It provides an opportunity to familiarize yourself with the trading platform, test different strategies, and gain hands-on experience in a risk-free environment. Unlike a live trading account, where you trade with real money, a demo account uses virtual currency, allowing you to make trades and track your performance without any financial consequences.

Advantages of Using a Demo Account for Futures Trading

There are several advantages to using a demo account for futures trading:

- Risk-Free Practice: One of the biggest benefits of a demo account is that it allows you to practice trading without risking any real money. This gives you the freedom to experiment with different strategies, learn from your mistakes, and refine your trading skills.

- Platform Familiarization: Demo accounts provide an excellent opportunity to familiarize yourself with the trading platform. You can explore the various features and tools available, such as charting options, order types, and market analysis tools.

- Strategy Testing: With a demo account, you can test different trading strategies in real market conditions. This allows you to evaluate the effectiveness of your strategies and make adjustments as necessary.

- No Financial Consequences: Since demo accounts use virtual currency, any losses or gains you experience are not real. This eliminates the financial risk associated with live trading and allows you to focus on learning and improving your trading skills.

How to Open a Demo Account

Opening a demo account is a straightforward process. Follow these steps to get started:

Step 1: Research and Choose a Reputable Futures Trading Platform

The first step in opening a demo account is to research and select a reputable futures trading platform. Look for platforms that offer demo accounts with realistic trading conditions, user-friendly interfaces, and a wide range of trading instruments.

Step 2: Sign Up and Register for a Demo Account

Once you have chosen a platform, visit their website and sign up for a demo account. You will typically need to provide basic personal information, such as your name and email address. Some platforms may also require additional information for verification purposes.

Step 3: Download and Install the Trading Platform

After registering for a demo account, you will usually need to download and install the trading platform on your computer or mobile device. Follow the platform's instructions for downloading and installing the software.

Step 4: Set Up Your Virtual Trading Environment

Once the trading platform is installed, you will need to set up your virtual trading environment. This includes customizing your chart settings, selecting your preferred trading instruments, and familiarizing yourself with the platform's features and tools.

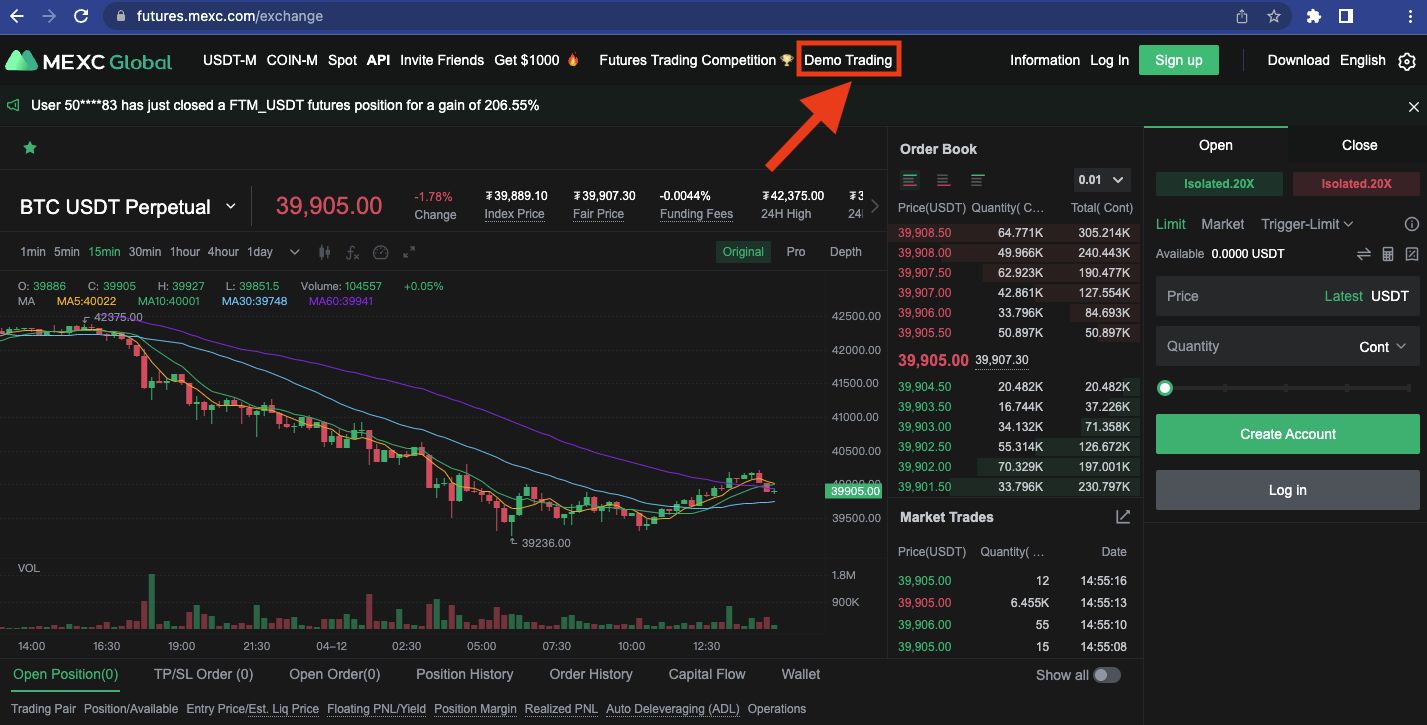

Navigating the Demo Trading Platform

Once you have your demo account set up, it's essential to understand how to navigate the trading platform. Here are some key features and tools you should be familiar with:

Charting Options

The charting options available on the trading platform allow you to analyze price movements and identify potential trading opportunities. You should be familiar with different chart types, such as line charts, bar charts, and candlestick charts, as well as the various technical indicators and drawing tools available.

Order Types

Understanding different order types is crucial for executing trades effectively. Common order types include market orders, limit orders, stop orders, and stop-limit orders. Each order type has its own purpose and execution rules, so it's essential to familiarize yourself with them to make informed trading decisions.

Market Analysis Tools

Most trading platforms offer a range of market analysis tools to help you make informed trading decisions. These tools may include real-time market news, economic calendars, and technical analysis indicators. Explore these tools and understand how they can assist you in analyzing market trends and identifying potential trade setups.

Understanding Futures Contracts

Before you start trading futures, it's crucial to have a solid understanding of what futures contracts are and how they work. Here are the key concepts you should know:

Contract Specifications

Each futures contract has specific contract specifications, including the underlying asset, contract size, tick size, and contract months. Understanding these specifications is essential for selecting the right contracts to trade and managing your positions effectively.

Margin Requirements

Margin requirements refer to the amount of money you need to deposit as collateral to open and maintain a futures position. Different futures contracts have different margin requirements, which may vary based on factors such as contract volatility and exchange regulations. It's important to understand margin requirements to manage your trading capital properly.

Expiration Dates

Futures contracts have expiration dates, after which they cease to exist. It's crucial to be aware of the expiration dates of the contracts you are trading to avoid any unintended delivery obligations. Most traders close out their positions before the expiration date to avoid physical delivery.

Analyzing Market Trends

Successful futures trading requires the ability to analyze market trends and make informed decisions. Here are some common methods of market analysis:

Technical Analysis

Technical analysis involves analyzing historical price data and using chart patterns, indicators, and trend lines to predict future price movements. Traders who use technical analysis often rely on indicators such as moving averages, MACD, and RSI to identify potential entry and exit points.

Fundamental Analysis

Fundamental analysis involves analyzing economic, financial, and geopolitical factors that may impact the price of the underlying asset. This analysis includes studying supply and demand dynamics, economic indicators, company earnings reports, and news events that may affect the market.

Sentiment Analysis

Sentiment analysis involves gauging market sentiment and investor psychology to anticipate market movements. Traders using sentiment analysis often monitor indicators such as market breadth, investor surveys, and social media sentiment to assess whether the market is bullish or bearish.

Developing a Trading Strategy

A successful futures trader needs a well-defined trading strategy. Here are the key steps to developing a trading strategy:

Risk Management Techniques

Effective risk management is crucial for preserving capital and managing losses. Determine your risk tolerance and develop risk management techniques such as setting stop-loss orders, diversifying your portfolio, and managing position sizes appropriately.

Entry and Exit Strategies

Define clear entry and exit strategies for your trades. This includes identifying specific criteria for entering a trade, such as technical indicators or fundamental factors, and determining when to exit based on predetermined profit targets or stop-loss levels.

Position Sizing

Position sizing refers to determining the appropriate quantity of contracts to trade based on your account size and risk tolerance. It's important to calculate position sizes in a way that allows you to manage risk effectively and avoid excessive exposure to any single trade.

Practicing Different Trading Techniques

There are various trading techniques commonly used in futures trading. Here are a few examples:

Scalping

Scalping involves making multiple quick trades to take advantage of small price movements. Scalpers aim to profit from short-term fluctuations in the market and usually hold positions for only a few minutes or seconds. This technique requires fast execution and a keen understanding of market dynamics.

Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders aim to profit from intraday price movements and typically do not hold positions overnight. This technique requires active monitoring of the market and quick decision-making.

Swing Trading

Swing trading involves holding positions for a few days to several weeks, aiming to capture medium-term price swings. Swing traders focus on identifying trends and market reversals using technical analysis tools. This technique requires patience and the ability to ride out short-term market fluctuations.

Evaluating Performance and Making Adjustments

Regularly evaluating your trading performance is crucial for continuous improvement. Here are some steps to evaluate your performance and make necessary adjustments:

Trade Analysis

Analyze your trades to identify patterns and assess the effectiveness of your trading strategy. Review your winning and losing trades, identify any recurring mistakes, and consider adjusting your strategy accordingly.

Keeping a Trading Journal

Maintain a trading journal where you record your trades, including entry and exit points, reasons for taking the trade, and any emotions or thoughts you experienced during the trade. Regularlyreviewing your trading journal can provide valuable insights into your trading behavior and help identify areas for improvement.

Identifying Areas for Improvement

Based on your trade analysis and journal review, identify specific areas for improvement in your trading strategy. This may include refining your entry and exit criteria, adjusting risk management techniques, or enhancing your market analysis skills. Focus on one area at a time to avoid overwhelming yourself with too many changes.

Making Necessary Adjustments

Once you have identified areas for improvement, make the necessary adjustments to your trading strategy. Implement the changes gradually and monitor their impact on your overall performance. Keep track of any positive or negative outcomes and be willing to adapt and refine your strategy as needed.

Transitioning to Live Trading

Once you feel confident in your trading skills and have consistently achieved positive results in your demo account, you may consider transitioning to live trading. Here are some steps to make a smooth transition:

Selecting a Suitable Broker

Research and choose a reputable broker that offers futures trading services. Consider factors such as commission fees, customer support, trading platforms, and regulatory compliance. Ensure that the broker you choose aligns with your trading goals and provides a seamless transition from demo to live trading.

Managing Emotions

Live trading involves real money, which can evoke strong emotions such as fear, greed, and anxiety. It's essential to manage your emotions and maintain discipline in your trading decisions. Stick to your trading plan and avoid making impulsive decisions based on emotions.

Setting Realistic Expectations

Set realistic expectations for your live trading. Understand that trading involves both profits and losses, and it takes time to become consistently profitable. Avoid the temptation of expecting overnight success and focus on continuous learning and improvement.

Additional Resources and Support

As you continue your journey in futures trading, there are various additional resources and support available to enhance your knowledge and connect with like-minded traders:

Books and Online Courses

Explore books and online courses on futures trading to deepen your understanding of trading concepts, strategies, and market dynamics. Look for reputable authors and educators who have a track record of success in the industry.

Forums and Communities

Participate in online forums and communities dedicated to futures trading. Engage in discussions, share experiences, and learn from other traders. These platforms offer a valuable opportunity to network and gain insights from traders with different perspectives and levels of experience.

Mentorship and Coaching

Consider seeking mentorship or coaching from experienced traders or trading professionals. A mentor can provide guidance, share their experiences, and help you navigate the challenges of futures trading. They can offer personalized feedback and support to accelerate your learning curve.

In conclusion, demo account futures trading is an invaluable tool for anyone interested in futures trading. It allows you to gain hands-on experience without risking real money, helping you develop essential trading skills and strategies. By following the steps outlined in this comprehensive guide and putting in the necessary practice, you can set yourself up for success in the exciting world of futures trading. Remember, continuous learning, self-reflection, and adaptability are key to becoming a successful futures trader. Start your journey with a demo account today and unlock the potential of futures trading.