Free Futures Trading Demo

Are you interested in futures trading but unsure where to start? Look no further! In this blog article, we will explore the concept of a free futures trading demo and how it can be an invaluable tool for both beginners and experienced traders alike. Whether you are looking to practice your trading strategies, learn about the futures market, or simply get a feel for the trading platform, a free futures trading demo can provide you with the hands-on experience you need to succeed in this dynamic and fast-paced industry.

Before we delve into the details, let's first understand what futures trading entails. Futures trading refers to the buying and selling of contracts that oblige the parties involved to trade a specific asset, such as commodities, currencies, or stock indexes, at a predetermined price and date in the future. This financial instrument allows traders to speculate on the price movement of the underlying asset without actually owning it. It offers opportunities for profit through both long and short positions, making it a popular choice among traders seeking to diversify their investment portfolios and hedge against market fluctuations.

What is a Free Futures Trading Demo?

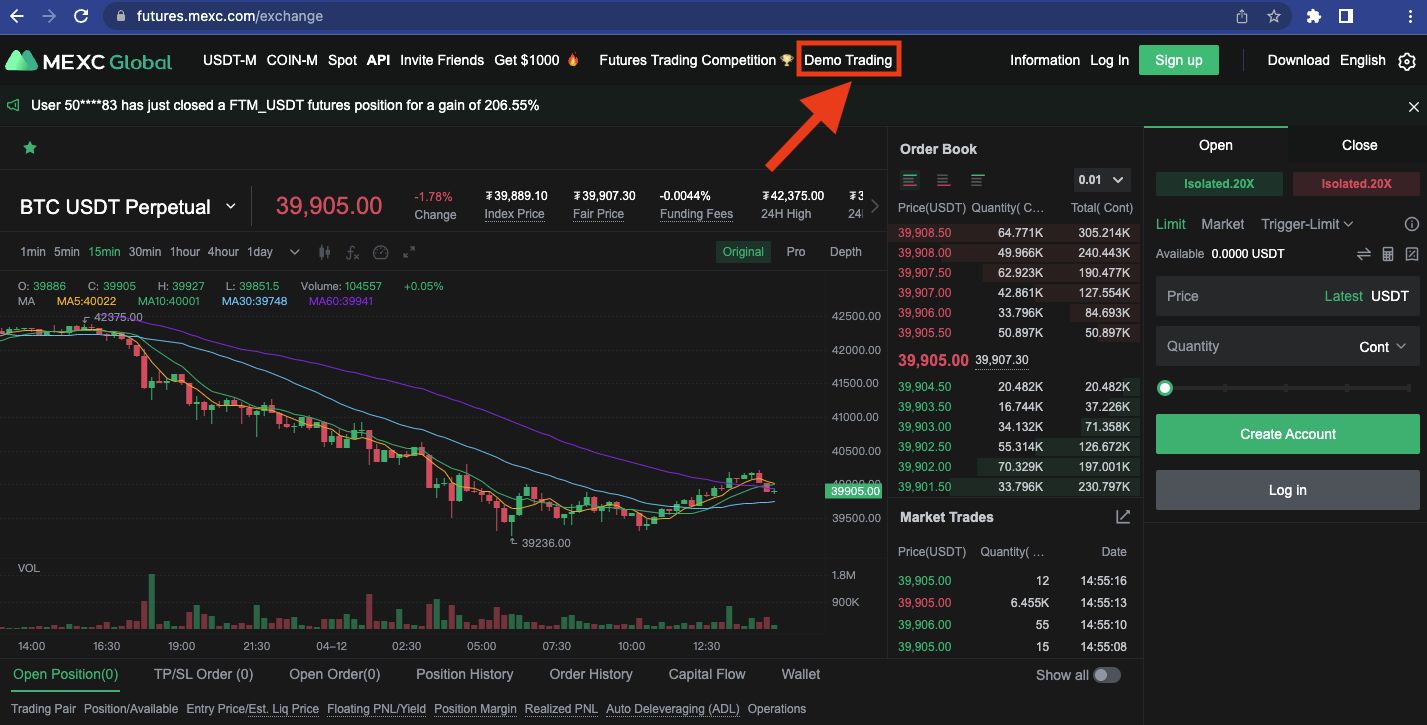

In this section, we will define a free futures trading demo and explain its significance for traders. A free futures trading demo is a simulated trading platform offered by various brokerage firms and trading software providers. It allows traders to practice trading in a risk-free environment using virtual funds, mimicking real market conditions. With a free futures trading demo, traders can access all the features and functionalities of a live trading account, including real-time market data, charting tools, order types, and more, without the need to invest actual capital.

A free futures trading demo serves as an excellent learning tool, enabling traders to familiarize themselves with the trading platform's interface, test different trading strategies, and gain confidence in their trading abilities. It provides an opportunity to make mistakes and learn from them without incurring any financial losses. Additionally, a free futures trading demo allows traders to explore the range of available futures contracts, understand their specifications, and evaluate the potential risks and rewards associated with each contract.

The Significance of a Free Futures Trading Demo

A free futures trading demo holds significant value for traders, especially those who are new to futures trading. It provides a risk-free environment for traders to gain hands-on experience and develop their skills. By utilizing a demo account, traders can learn how to navigate the trading platform, execute trades, and manage positions without the fear of losing real money. This experience is invaluable in building confidence and competence before venturing into actual trading.

Furthermore, a free futures trading demo allows traders to test and refine their trading strategies. It provides a platform for traders to experiment with different approaches and techniques, understand the impact of market conditions on their strategies, and make adjustments accordingly. This iterative process of trial and error helps traders identify what works best for them and develop a personalized trading plan.

Lastly, a free futures trading demo enables traders to familiarize themselves with the specific features and tools offered by the trading platform. Each platform may have its own unique set of functionalities, and exploring them through a demo account ensures traders can fully utilize these resources when trading with real money. It also aids in understanding order types, risk management tools, and other essential components of successful futures trading.

Benefits of Using a Free Futures Trading Demo

In this section, we will outline the numerous benefits that come with utilizing a free futures trading demo. Firstly, a free futures trading demo allows traders to gain valuable experience in a risk-free environment. It provides an opportunity to practice executing trades, managing positions, and analyzing market trends without the fear of losing real money. This hands-on experience can significantly enhance traders' understanding of the futures market and improve their trading skills.

Secondly, a free futures trading demo enables traders to test different trading strategies and refine their approach. By experimenting with various techniques and indicators, traders can identify what works best for them and develop a personalized trading plan. This process of trial and error can help traders build confidence and establish a solid foundation for their futures trading journey.

Furthermore, a free futures trading demo allows traders to familiarize themselves with the specific features and tools offered by the trading platform. Each platform may have its own unique set of functionalities, and exploring them through a demo account ensures traders can fully utilize these resources when trading with real money. It also aids in understanding order types, risk management tools, and other essential components of successful futures trading.

Gaining Valuable Experience without Financial Risk

One of the primary benefits of using a free futures trading demo is the ability to gain valuable experience without any financial risk. Trading in the futures market involves real money, and mistakes can lead to significant financial losses. However, with a demo account, traders can practice trading strategies, learn how to manage risk, and familiarize themselves with the trading platform, all without the fear of losing their hard-earned money.

By using virtual funds provided by the demo account, traders can execute trades, monitor market movements, and assess the outcomes of their decisions. This allows them to gain a better understanding of how the futures market operates, the impact of different market conditions, and the effectiveness of their chosen trading strategies. It is an opportunity to learn from both successful trades and those that may not have yielded the desired results.

Moreover, a free futures trading demo provides traders with the chance to experience the psychological aspects of trading without the emotional pressure of real money. Emotions, such as fear and greed, can significantly impact trading decisions and lead to irrational actions. By practicing in a risk-free environment, traders can learn to control their emotions, make rational decisions, and develop discipline in their trading approach.

Testing and Refining Trading Strategies

Another significant benefit of utilizing a free futures trading demo is the ability to test and refine trading strategies. Every trader has their own unique approach to trading, and what may work for one trader may not necessarily work for another. The demo account provides a platform for traders to experiment with different strategies, indicators, and timeframes to determine which approach aligns best with their trading goals and risk tolerance.

Traders can use the demo account to test various technical analysis tools, such as moving averages, trendlines, and oscillators. They can observe how these tools perform under different market conditions and evaluate their effectiveness in identifying potential entry and exit points. Additionally, traders can test different risk management techniques, such as setting stop-loss orders and trailing stops, to protect their positions from excessive losses.

Through the process of testing and refining trading strategies, traders can gain confidence in their chosen approach and fine-tune their decision-making process. They can identify the strengths and weaknesses of their strategies, make adjustments based on the data and insights gained from the demo account, and ultimately develop a robust trading plan.

Familiarizing with the Trading Platform

Each trading platform has its own unique set of features, tools, and functionalities. Familiarizing oneself with the trading platform is crucial for efficient and effective trading. The demo account provides an opportunity to explore and understand the various elements of the platform without the pressure of real money.

Traders can navigate through the different sections of the platform, such as the order entry screen, charting tools, and market data. They can learn how to place different order types, set profit targets and stop-loss levels, and utilize advanced order functionalities such as bracket orders. By doing so, traders can become comfortable and proficient in using the trading platform, allowing them to execute trades more seamlessly and efficiently when transitioning to real trading.

Additionally, traders can familiarize themselves with the available technical analysis tools and charting capabilities of the platform. They can explore the different chart types, timeframes, and indicators offered by the platform to identify patterns, trends, and potential trading opportunities. This knowledge and experience gained from the demo account can significantly enhance traders' ability to make informed trading decisions when trading with real money.

How to Get Started with a Free Futures Trading Demo

This section will guide you through the process of getting started with a free futures trading demo. The first step is to choose a reputable brokerage firm or trading software provider that offers a demo account. Ensure that the demo account provides access to the futures market you are interested in trading and offers a realistic trading environment. Once you have selected a platform, sign up for a free demo account by providing the necessary information.

After signing up, you will typically receive login credentials to access the demo trading platform. Take some time to familiarize yourself with the platform's interface, navigation, and available features. It is also recommended to explore the educational resources provided by the platform, such as tutorials, webinars, and articles, to deepen your understanding of futures trading concepts and strategies.

Once you feel comfortable navigating the demo platform, start practicing trades using virtual funds. Treat the demo account as if it were a real trading account, implementing the strategies and techniques you have learned. Monitor your performance, analyze your trades, and make adjustments as necessary. Remember to take advantage of the resources available within the demo account, such as market data, charting tools, and historical price data, to enhance your trading decisions.

Choosing a Reputable Brokerage Firm or Trading Software Provider

Choosing a reputable brokerage firm or trading software provider is the first crucial step in getting started with a free futures trading demo. It is essential to select a platform that meets your specific needs and provides a realistic trading environment. Conduct thorough research and consider factors such as the platform's reputation, customer reviews, available futurescontracts, fees, and the quality of customer support. Look for a platform that is well-established, regulated, and has a good track record in the industry.

Consider the range of futures contracts offered by the platform. Different platforms may offer varying selections of futures contracts, including commodities, currencies, stock indexes, and more. Choose a platform that provides access to the specific futures markets you are interested in trading.

Additionally, evaluate the platform's user interface and ease of use. A user-friendly platform with intuitive navigation and clear layout can significantly enhance your trading experience. Look for features such as customizable charts, real-time market data, and order entry screens that are easy to understand and use.

It is also important to consider the quality of customer support provided by the platform. In case you encounter any technical issues or have questions about using the demo account or the trading platform, responsive and knowledgeable customer support can be invaluable. Look for platforms that offer multiple channels of support, such as phone, email, and live chat, and ensure that their support team is available during trading hours.

Finally, take into account any additional educational resources provided by the platform. A reputable platform should offer educational materials, such as tutorials, webinars, and articles, to help you learn and improve your futures trading skills. These resources can provide valuable insights and guidance as you navigate the world of futures trading.

Signing Up for a Free Demo Account

Once you have chosen a reputable brokerage firm or trading software provider, the next step is to sign up for a free demo account. This process typically involves providing your personal information, such as your name, email address, and contact details. Some platforms may require additional information to verify your identity.

After submitting your information, you will usually receive a confirmation email with instructions on how to proceed. Follow the provided instructions to complete the registration process and create your demo account. This may involve setting up a username and password or using the login credentials provided by the platform.

It is important to note that some platforms may require you to agree to their terms and conditions before granting access to the demo account. Take the time to review and understand these terms to ensure that you are comfortable with the platform's policies and practices.

Exploring the Demo Trading Platform

Once you have successfully registered for a free demo account, you will be granted access to the demo trading platform. Take the time to familiarize yourself with the platform's interface, navigation, and available features. This will help you feel more comfortable and confident when using the platform for practice trading.

Start by exploring the main sections of the platform, such as the order entry screen, charting tools, and account information. Familiarize yourself with the different functions and buttons within each section. Take note of any customizable features that allow you to tailor the platform to your preferences.

Next, delve into the charting capabilities of the platform. Experiment with different chart types, timeframes, and technical indicators. Learn how to apply and customize indicators on the charts to analyze price movements and identify potential trading opportunities.

It is also important to understand how to execute trades on the platform. Learn how to enter different order types, such as market orders, limit orders, and stop orders. Practice placing trades and managing open positions. Familiarize yourself with features such as profit targets and stop-loss orders to manage risk and protect your positions.

Additionally, explore the available resources within the demo account. Many platforms offer educational materials, such as tutorials, webinars, and articles, to help you learn more about futures trading concepts, strategies, and the platform's features. Take advantage of these resources to deepen your understanding and enhance your trading skills.

Practicing Trades Using Virtual Funds

Once you are comfortable navigating the demo trading platform, it's time to start practicing trades using virtual funds. Treat the demo account as if it were a real trading account, implementing the strategies and techniques you have learned.

Begin by selecting a futures contract that you are interested in trading. Analyze the price movements and market conditions for that contract using the platform's charting tools and market data. Based on your analysis, determine whether you want to enter a long or short position.

Next, decide on the appropriate order type for your trade. This could be a market order, a limit order, or a stop order, depending on your trading strategy and risk management plan. Enter the necessary details for your order, such as the quantity of contracts you wish to trade and the desired price level.

Monitor your trade as it progresses. Observe how the price moves in relation to your entry point. Use the available charting tools and indicators to identify potential exit points, such as profit targets or stop-loss levels. Make adjustments to your trade if necessary, based on your analysis and trading plan.

Continue practicing trades using different futures contracts, timeframes, and strategies. Experiment with different risk management techniques, such as setting stop-loss orders and trailing stops. Monitor your performance, analyze your trades, and make adjustments to your strategies as needed.

Remember to take advantage of the resources available within the demo account. Utilize the real-time market data, charting tools, and educational materials to enhance your trading decisions. Learn from both successful trades and those that may not have yielded the desired results.

Common Mistakes to Avoid when Using a Free Futures Trading Demo

In this section, we will highlight some common mistakes that traders should avoid when using a free futures trading demo. One crucial mistake is not taking the demo account seriously. While it may not involve real money, treating the demo account as a practice ground rather than a learning opportunity can hinder traders' progress. It is essential to approach the demo account with the same discipline and dedication as a real trading account.

Another mistake is not setting realistic expectations. It is crucial to understand that success in the demo account does not guarantee similar results in real trading. The absence of emotional and psychological factors, such as fear and greed, in demo trading can significantly impact a trader's decision-making process. Therefore, it is essential to transition from the demo account to real trading gradually, starting with small positions and gradually increasing exposure.

Lastly, a common mistake is overtrading in the demo account. Since the demo account offers unlimited virtual funds, traders may be tempted to take excessive risks and engage in frequent trading. It is important to remember that trading should be approached with a well-thought-out strategy, and overtrading can lead to impulsive decisions and poor risk management. It is advisable to maintain the same level of discipline and risk management in the demo account as in real trading.

Approaching the Demo Account Seriously

One of the most significant mistakes traders can make when using a free futures trading demo is not taking it seriously. Some traders may view the demo account as a mere practice ground, neglecting the valuable learning opportunities it offers. To make the most of the demo account, it is crucial to approach it with the same discipline, dedication, and commitment as a real trading account.

When using the demo account, treat it as if you were trading with real money. Set specific trading goals, develop a trading plan, and adhere to proper risk management practices. Avoid taking unnecessary risks or making impulsive decisions that you would not make in a real trading scenario.

Keeping a serious mindset when using the demo account allows you to develop the necessary skills, experience, and confidence to transition to real trading successfully. It also provides a realistic simulation of the emotional and psychological aspects involved in trading, helping you better prepare for the challenges that may arise when trading with real money.

Setting Realistic Expectations

Another common mistake traders make when using a free futures trading demo is setting unrealistic expectations. It is essential to understand that trading in the demo account does not guarantee similar results when trading with real money. The absence of emotional and psychological factors, such as fear and greed, can significantly impact a trader's decision-making process and execution in the demo account.

Therefore, it is crucial to approach the demo account as a learning experience rather than a reflection of potential profits in real trading. Use the demo account to refine your strategies, test different approaches, and gain familiarity with the trading platform. Set realistic expectations for your performance in the demo account and understand that it is a stepping stone towards real trading.

When transitioning to real trading, start with small positions and gradually increase your exposure as you gain more confidence and experience. This gradual approach allows you to adjust to the emotional and psychological aspects of trading with real money, reducing the chances of making impulsive decisions based on unrealistic expectations.

Avoiding Overtrading in the Demo Account

Overtrading is a common mistake that traders can fall into when using a free futures trading demo. Since the demo account provides traders with unlimited virtual funds, there is a temptation to take excessive risks and engage in frequent trading. However, overtrading can lead to impulsive decisions, poor risk management, and unrealistic performance expectations.

It is important to remember that trading should always be approached with a well-thought-out strategy and proper risk management. This principle applies to both the demo account and real trading. Avoid the temptation to take trades that do not align with your strategy or risk management plan, even if the demo account allows for unlimited virtual funds.

Maintain discipline and stick to your trading plan in the demo account. Focus on quality trades that meet your criteria rather than quantity. This approach will help you develop good trading habitsand improve your decision-making skills. Treat each trade in the demo account as if it were a real trade, carefully analyzing the market conditions, setting appropriate stop-loss and take-profit levels, and managing your positions accordingly.

By avoiding overtrading in the demo account, you will develop a more realistic understanding of your trading abilities and improve your ability to manage risk effectively. This disciplined approach will serve you well when you transition to real trading, as you will be more likely to make well-informed decisions based on a solid trading plan rather than impulsive actions driven by the availability of unlimited virtual funds.

Transitioning from a Free Futures Trading Demo to Real Trading

This section will provide guidance on transitioning from a free futures trading demo to real trading. Once you have gained sufficient experience and confidence in your trading abilities through the demo account, it may be time to consider trading with real money. However, it is crucial to approach this transition with caution and proper planning.

Before transitioning to real trading, thoroughly evaluate your performance in the demo account. Assess your profitability, risk management skills, and emotional control. It is recommended to maintain a consistent level of success over an extended period before making the switch. Additionally, ensure that you have a well-defined trading plan, including risk tolerance, profit targets, and a clear understanding of the futures contracts you wish to trade.

When transitioning to real trading, start with a small amount of capital that you are willing to risk. This will help you acclimate to the emotional and psychological aspects of real trading without jeopardizing your financial well-being. Monitor your performance closely, learn from your mistakes, and continuously refine your trading strategies. Remember, the transition from a demo account to real trading is a learning process, and it may take time to adapt to the dynamics of real markets.

Evaluating Performance in the Demo Account

Before transitioning from a free futures trading demo to real trading, it is essential to evaluate your performance in the demo account. Assessing your performance will help you gauge your readiness for real trading and identify areas for improvement.

Start by reviewing your profitability in the demo account. Measure your success by looking at your overall returns, the consistency of your profits, and your ability to manage losses. Evaluate the effectiveness of your trading strategies, risk management techniques, and decision-making process. Identify any patterns or recurring issues that may need attention.

Additionally, consider your emotional control and discipline in the demo account. Analyze how well you managed your emotions, such as fear and greed, and whether they influenced your trading decisions. Emotional control is crucial in real trading, as it can greatly impact your ability to stick to your trading plan and make rational decisions.

Lastly, assess your understanding of the futures market and the specific contracts you traded in the demo account. Ensure that you have a comprehensive knowledge of the market dynamics, contract specifications, and any factors that may affect prices. This understanding is essential for making informed trading decisions in real trading.

Developing a Well-Defined Trading Plan

Before transitioning to real trading, it is crucial to have a well-defined trading plan. A trading plan outlines your trading goals, risk tolerance, profit targets, and the strategies you will use to achieve them. It serves as a roadmap for your trading journey and helps you make consistent and informed decisions.

Start by defining your trading goals. What do you aim to achieve through futures trading? Are you looking for short-term profits or long-term growth? Clarify your goals, both financial and personal, to guide your trading decisions.

Next, determine your risk tolerance. Assess how much capital you are willing to risk on each trade and set appropriate stop-loss levels to protect your positions. Consider your financial situation, risk appetite, and the potential impact of losses on your overall portfolio.

Identify your profit targets and define the criteria for exiting trades. Determine the specific conditions or price levels at which you will take profits or cut losses. Having predefined exit points helps remove emotions from the decision-making process and ensures disciplined trading.

Lastly, outline the strategies and techniques you will use in your trading plan. Based on your experience in the demo account, determine which strategies have been most effective for you. Consider factors such as technical analysis tools, timeframes, and market conditions that align with your trading style.

Starting with a Small Amount of Capital

When transitioning from a free futures trading demo to real trading, it is advisable to start with a small amount of capital that you are willing to risk. This approach allows you to acclimate to the emotional and psychological aspects of real trading without putting your financial well-being at significant risk.

By starting with a small amount of capital, you can focus on refining your trading strategies, managing risk effectively, and gaining experience in real market conditions. It also helps you become comfortable with the potential losses that may occur in real trading and learn how to handle them without excessive emotional reactions.

As you gain confidence and experience, you can gradually increase your trading capital. This progression allows you to assess your performance and make adjustments to your trading plan along the way. It also helps you build a track record of success and develop a solid foundation for future trading endeavors.

Choosing the Right Futures Trading Platform

In this section, we will discuss the factors to consider when choosing the right futures trading platform. The trading platform plays a crucial role in your trading experience, so it is essential to select one that meets your specific needs and preferences. Firstly, consider the platform's user interface and ease of navigation. A user-friendly platform with intuitive functionalities can enhance your trading efficiency and overall experience.

Additionally, assess the platform's range of available futures contracts. Ensure that the platform offers the contracts you are interested in trading and provides access to a diverse range of markets and asset classes. Furthermore, consider the platform's order types, risk management tools, and charting capabilities. These features can significantly impact your ability to execute trades effectively and make informed trading decisions.

Lastly, take into account the platform's customer support and educational resources. A responsive and knowledgeable customer support team can be invaluable, especially for beginners who may encounter technical or trading-related issues. Educational resources, such as tutorials, webinars, and market analysis, can provide valuable insights and help you stay informed about market trends and developments.

User Interface and Navigation

The user interface and navigation of a futures trading platform are critical factors to consider when choosing the right platform. A user-friendly interface with intuitive navigation can greatly enhance your trading experience and efficiency.

Look for a platform that offers a clean and organized layout, with easy-to-understand menus and buttons. The platform should provide clear and concise information, allowing you to quickly access important features and tools.

Consider the platform's customization options. A good trading platform allows you to personalize your workspace, arrange windows, and customize settings to suit your preferences. This flexibility can enhance your trading workflow and make it easier to access the features and tools you use most frequently.

Range of Available Futures Contracts

When choosing a futures trading platform, it is crucial to consider the range of available futures contracts. Different platforms may offer varying selections of futures contracts, including commodities, currencies, stock indexes, and more.

Ensure that the platform provides access to the specific futures markets you are interested in trading. Consider the diversity of asset classes and markets available, as this can allow for greater trading opportunities and portfolio diversification.

Additionally, evaluate the platform's coverage of different contract expirations. Some platforms may offer a broad range of contract expirations, allowing you to trade both short-term and long-term futures contracts. This flexibility can be beneficial for implementing different trading strategies based on your market outlook and timeframe preferences.

Order Types and Risk Management Tools

The order types and risk management tools offered by a futures trading platform are essential considerations for successful trading. Look for a platform that provides a variety of order types to accommodate different trading strategies and preferences.

Common order types include market orders, limit orders, stop orders, and stop-limit orders. Market orders allow you to buy or sell a futures contract at the prevailing market price, while limit orders enable you to set a specific price at which you want to buy or sell. Stop orders are used to trigger a market order when the price reaches a specified level, and stop-limit orders combine the features of stop orders and limit orders.

In addition to order types, consider the risk management tools provided by the platform. Risk management is a crucial aspect of successful trading, and having tools to manage risk effectively is essential. Look for features such as stop-loss orders, which automatically close a position at a predetermined price level to limit potential losses, and trailing stops, which adjust the stop-loss order as the price moves in your favor.

Charting Capabilities and Technical Analysis Tools

Charting capabilities and technical analysis tools are vital components of a futures trading platform. The ability to analyze price movements, identify trends, and apply technical indicators is crucial for making informed trading decisions.

Evaluate the charting capabilities of the platform. Look for features such as multiple chart types (such as line, bar, and candlestick charts), various timeframes (such as minute, hourly, daily, and weekly), and the ability to customize charts to suit your preferences. The platform should also offer drawing tools and annotation features, allowing you to mark important levels or patterns on the charts.

Consider the availability and quality of technical analysis tools provided by the platform. Look forfeatures such as a wide range of technical indicators (e.g., moving averages, oscillators, trendlines), the ability to customize indicator settings, and the option to overlay multiple indicators on a single chart. These tools can help you analyze price movements, identify patterns, and make more informed trading decisions.

Customer Support and Educational Resources

When choosing a futures trading platform, it is important to consider the level of customer support and the availability of educational resources. A responsive and knowledgeable customer support team can be invaluable, especially for beginner traders who may encounter technical or trading-related issues.

Look for platforms that offer multiple channels of support, such as phone, email, and live chat. Ensure that the support team is available during trading hours and can assist you in a timely manner. Consider the quality of support provided, such as the promptness and accuracy of responses.

Educational resources are also crucial for expanding your knowledge and enhancing your trading skills. Look for platforms that offer a variety of educational materials, such as tutorials, webinars, articles, and video lessons. These resources can provide valuable insights into futures trading concepts, strategies, and the platform's features. They can help you deepen your understanding and stay informed about market trends and developments.

Risk Management Strategies in Futures Trading

In this section, we will delve into the importance of risk management strategies in futures trading. Risk management is a crucial aspect of successful trading, as it helps protect your capital and minimize potential losses. One widely used risk management strategy is setting stop-loss orders. A stop-loss order automatically closes a position when the price reaches a predetermined level, limiting the potential loss.

Another risk management strategy is diversifying your portfolio. By spreading your investments across different futures contracts, asset classes, and markets, you can reduce the impact of a single trade or market event on your overall portfolio. Additionally, practicing proper position sizing is essential. Allocating an appropriate amount of capital to each trade based on your risk tolerance and account size can help manage potential losses.

Furthermore, regularly evaluating and adjusting your risk management strategy is crucial. As market conditions change, it is important to reassess your risk tolerance, profit targets, and stop-loss levels. Staying disciplined and adhering to your risk management plan, even during periods of market volatility, can significantly contribute to long-term trading success.

Setting Stop-Loss Orders

Setting stop-loss orders is one of the most commonly used risk management strategies in futures trading. A stop-loss order is an order placed with your broker to automatically close a position when the price reaches a specified level, limiting your potential loss.

When setting a stop-loss order, consider factors such as your risk tolerance, the volatility of the futures contract, and the specific market conditions. Set the stop-loss level at a point where, if reached, it indicates a significant change in the market direction and invalidation of your trading thesis.

By setting stop-loss orders, you can protect your positions from excessive losses and ensure that your risk is controlled. It is important to regularly review and adjust your stop-loss levels as market conditions change. Avoid the temptation to move your stop-loss orders further away from your entry point in the hope of a market reversal. Stick to your predetermined risk tolerance and trading plan.

Diversifying Your Portfolio

Diversifying your portfolio is another essential risk management strategy in futures trading. By spreading your investments across different futures contracts, asset classes, and markets, you can reduce the impact of a single trade or market event on your overall portfolio.

Consider investing in futures contracts from various sectors, such as commodities, currencies, and stock indexes. Diversify your trading strategies by incorporating both long and short positions, and consider different timeframes and trading approaches. By diversifying your portfolio, you can potentially benefit from different market conditions and reduce the risk associated with relying on a single trade or market sector.

However, it is important to note that diversification does not guarantee profits or eliminate all risks. It is still essential to conduct thorough research, perform technical and fundamental analysis, and manage risk effectively for each individual trade within your diversified portfolio.

Practicing Proper Position Sizing

Practicing proper position sizing is a crucial risk management strategy in futures trading. Position sizing refers to the allocation of an appropriate amount of capital to each trade based on your risk tolerance and account size.

Before entering a trade, assess the potential risk and reward of the trade. Determine the maximum amount of capital you are willing to risk on the trade, taking into account factors such as the distance to your stop-loss level and the size of your trading account.

By practicing proper position sizing, you ensure that a single trade does not excessively impact your overall portfolio. It allows you to manage your risk and avoid overexposure to a single trade or market. Remember that risk management is about preserving capital and staying in the game for the long term.

Regular Evaluation and Adjustment of Risk Management Strategies

Risk management is not a static process but requires regular evaluation and adjustment. As market conditions change, it is important to reassess your risk tolerance, profit targets, and stop-loss levels.

Regularly review your trading performance and analyze the effectiveness of your risk management strategies. Identify any patterns or recurring issues that may need adjustment. Consider factors such as changes in market volatility, economic indicators, and geopolitical events that may impact the risk-reward dynamics of your trades.

Staying disciplined and adhering to your risk management plan, even during periods of market volatility, is crucial. Avoid making impulsive decisions based on emotions or short-term market fluctuations. Stick to your predetermined risk tolerance and trading plan, and adjust your risk management strategies as needed to adapt to changing market conditions.

Technical Analysis Tools for Futures Trading

This section will introduce various technical analysis tools that can aid in futures trading. Technical analysis involves studying historical price data, chart patterns, and indicators to identify potential trading opportunities. One commonly used technical analysis tool is moving averages. Moving averages help smooth out price fluctuations and identify trends by calculating the average price over a specific period. Traders often use the intersection of different moving averages as a signal to enter or exit trades.

Another useful tool is the Relative Strength Index (RSI), which measures the speed and change of price movements. RSI is displayed as a line graph that ranges from 0 to 100. Traders use RSI to identify overbought and oversold conditions, which can indicate potential reversals in price.

Additionally, candlestick charts are widely used in technical analysis. Candlestick charts display the open, high, low, and close prices of an asset within a specific time period. The patterns formed by candlesticks can provide insights into market sentiment and potential price movements.

Bollinger Bands are another popular technical analysis tool. They consist of a middle band, which is a moving average, and upper and lower bands that represent standard deviations from the moving average. Bollinger Bands help traders identify periods of high or low volatility, which can be useful for determining entry and exit points.

Fibonacci retracement levels are also commonly used in futures trading. Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to identify areas where price may reverse or continue its trend.

Moving Averages

Moving averages are a widely used technical analysis tool in futures trading. They help smooth out price fluctuations and identify trends by calculating the average price over a specific period.

There are different types of moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA). SMAs give equal weight to each data point in the calculation, while EMAs assign more weight to recent data. The choice between SMAs and EMAs depends on the trader's preference and trading style.

Traders often use the intersection of different moving averages as a signal to enter or exit trades. For example, when a shorter-term moving average crosses above a longer-term moving average, it may signal a bullish trend reversal or the potential for a price breakout. Conversely, when a shorter-term moving average crosses below a longer-term moving average, it may indicate a bearish trend reversal or the potential for a price breakdown.

Moving averages can also act as dynamic support or resistance levels. When the price approaches a moving average, it may find support if the moving average is acting as a floor for the price. Similarly, the moving average can act as resistance if the price is struggling to break above it.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a popular oscillator used in futures trading. It measures the speed and change of price movements and is displayed as a line graph that ranges from 0 to 100.

Traders use RSI to identify overbought and oversold conditions in the market. When the RSI is above 70, it suggests that the market is overbought, meaning that prices may have risen too quickly and a reversal or correction could occur. Conversely, when the RSI is below 30, it suggests that the market is oversold, indicating that prices may have fallen too quickly and a potential rebound or price recovery could be imminent.

Traders can also look for divergences between the RSI and price movements. A bullish divergence occurs when the price makes a lower low, but the RSI makes a higher low, indicating a potential bullish reversal. Conversely, abearish divergence occurs when the price makes a higher high, but the RSI makes a lower high, indicating a potential bearish reversal.

Candlestick Charts

Candlestick charts are widely used in technical analysis and provide valuable insights into market sentiment and potential price movements. They display the open, high, low, and close prices of an asset within a specific time period, typically represented by a single candlestick.

Each candlestick has a body and wicks (also known as shadows). The body represents the price range between the open and close prices, and the wicks represent the price range between the high and low prices. Candlesticks can be bullish (green or white) or bearish (red or black), depending on whether the close price is higher or lower than the open price.

Traders analyze the patterns formed by candlesticks to identify potential reversals or continuations in price trends. For example, a bullish engulfing pattern occurs when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candlestick. This pattern suggests a potential bullish reversal.

Other candlestick patterns, such as doji, hammer, and shooting star, provide further insights into market sentiment and potential price movements. Traders often combine candlestick patterns with other technical indicators to make more informed trading decisions.

Bollinger Bands

Bollinger Bands are a popular technical analysis tool used in futures trading. They consist of a middle band, which is a moving average, and upper and lower bands that represent standard deviations from the moving average.

Bollinger Bands help traders identify periods of high or low volatility. When the price is within the bands, it suggests a period of normal volatility. However, when the price moves outside the bands, it indicates a potential increase in volatility.

Traders can use Bollinger Bands to identify potential entry and exit points. For example, when the price touches or crosses the upper band, it may suggest that the market is overbought and a reversal or price pullback could occur. Conversely, when the price touches or crosses the lower band, it may indicate that the market is oversold and a potential price rebound or reversal could be imminent.

Additionally, traders can look for squeezes in Bollinger Bands, which occur when the bands contract, indicating a period of low volatility. Squeezes are often followed by periods of high volatility and potential price breakouts or breakdowns.

Fibonacci Retracement Levels

Fibonacci retracement levels are technical analysis tools based on the Fibonacci sequence. They are horizontal lines that indicate potential support and resistance levels in the market.

Traders use Fibonacci retracement levels to identify areas where price may reverse or continue its trend. The most commonly used levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are derived from the Fibonacci sequence, a mathematical pattern in which each number is the sum of the two preceding numbers (e.g., 0, 1, 1, 2, 3, 5, 8, 13, 21, etc.).

When a market is in an uptrend, traders will draw Fibonacci retracement levels from the low to the high of the trend. The retracement levels act as potential support levels, where the price may find buying interest and resume its upward movement. Conversely, when a market is in a downtrend, Fibonacci retracement levels are drawn from the high to the low of the trend, acting as potential resistance levels where the price may encounter selling pressure and continue its downward movement.

Traders often look for confluence between Fibonacci retracement levels and other technical indicators or chart patterns to increase the likelihood of a successful trade.

Conclusion

In conclusion, a free futures trading demo is an invaluable tool for traders of all experience levels. It allows you to practice trading strategies, explore different futures contracts, and gain confidence in your trading abilities without risking real money. By utilizing a demo account, you can develop your skills, test various trading techniques, and familiarize yourself with the trading platform's features and functionalities.

However, it is crucial to approach the demo account seriously and avoid common mistakes such as overtrading and not setting realistic expectations. Additionally, transitioning from a demo account to real trading requires careful planning, evaluation of performance, and a well-defined trading plan.

By utilizing the right risk management strategies and technical analysis tools, and continuously learning and adapting to market conditions, you can navigate the challenges of futures trading and increase your chances of success. Remember to leverage the available resources, such as online educational platforms, books, webinars, and online communities, to further enhance your knowledge and skills in futures trading.

Ultimately, mastering futures trading requires a combination of theoretical knowledge, practical experience, and disciplined execution. By utilizing a free futures trading demo, you can develop and refine your trading strategies, gain confidence in your decision-making abilities, and set yourself on the path to success in the dynamic world of futures trading.