Personal Trading Compliance Software: Ensuring Regulatory Compliance Made Easy

With the increasing complexity of financial regulations and the need for transparency, personal trading compliance has become a critical aspect for financial institutions. To navigate through the intricate web of compliance requirements, many organizations are turning to personal trading compliance software. This innovative technology offers a comprehensive solution that helps firms monitor and manage employee trading activities, ensuring compliance with regulatory standards.

In this blog article, we will delve into the world of personal trading compliance software, exploring its features, benefits, and importance in maintaining regulatory compliance. From understanding the basics to exploring advanced functionalities, this comprehensive guide will equip you with the knowledge you need to make informed decisions regarding personal trading compliance software for your organization.

What is Personal Trading Compliance Software?

In today's highly regulated financial landscape, personal trading compliance software has emerged as a necessary tool for organizations to ensure regulatory compliance. This software is designed to help financial institutions monitor and manage the personal trading activities of their employees, ensuring adherence to regulatory requirements and ethical standards.

Personal trading compliance software enables organizations to track and analyze employee trades, monitor potential conflicts of interest, and prevent insider trading. It automates compliance processes, streamlines reporting, and provides real-time alerts to ensure swift action can be taken when necessary.

By leveraging advanced algorithms and data analytics, personal trading compliance software offers an efficient and accurate way to monitor employee trading activities. It enables organizations to maintain a comprehensive and auditable record of all personal trades, simplifying the compliance management process and facilitating regulatory reporting.

The Purpose of Personal Trading Compliance Software

The primary purpose of personal trading compliance software is to help organizations fulfill their regulatory obligations by monitoring and managing employee trading activities. It serves as a robust tool for maintaining transparency, preventing conflicts of interest, and ensuring fair and ethical practices within financial institutions.

By implementing personal trading compliance software, organizations can establish a system to monitor and enforce compliance with regulations such as the Securities and Exchange Commission's (SEC) Rule 17j-1 and the Investment Advisers Act of 1940. These regulations require financial firms to monitor employees' personal trading activities, disclose potential conflicts of interest, and periodically report trading activities to regulatory authorities.

Moreover, personal trading compliance software helps organizations protect their reputation and mitigate the risk of non-compliance. By enabling proactive monitoring and automated alerts, the software allows organizations to identify and address potential compliance breaches promptly, minimizing reputational damage and regulatory penalties.

How Personal Trading Compliance Software Works

Personal trading compliance software operates through a combination of data integration, monitoring algorithms, and reporting capabilities. It typically integrates with various data sources, including trading platforms, brokerage accounts, and employee personal trading disclosures.

Once integrated, the software continuously monitors employee trading activities in real-time, comparing them against predefined compliance rules and regulatory requirements. These rules can be customized based on the organization's specific regulatory obligations, internal policies, and risk appetite.

The software analyzes trade data, including transaction details, securities traded, and trade frequency, to identify potential violations or conflicts of interest. It applies advanced analytics to detect patterns, anomalies, and suspicious activities that may indicate insider trading or other unethical practices.

When the software detects a potential compliance breach or conflict of interest, it triggers alerts and notifications for compliance officers to review and take appropriate action. The software also generates comprehensive reports, facilitating regulatory reporting and internal audit processes.

The Benefits of Personal Trading Compliance Software

The implementation of personal trading compliance software offers numerous benefits for financial institutions. From improving operational efficiency to mitigating regulatory risks, let's explore the tangible advantages that organizations can gain from adopting such software.

Streamlined Compliance Processes

Personal trading compliance software simplifies and automates compliance processes, reducing the manual effort and time required for monitoring and managing employee trading activities. It eliminates the need for manual data entry, reduces the risk of human errors, and ensures accurate and up-to-date compliance monitoring.

The software automatically captures and consolidates trade data from various sources, eliminating the need for manual data gathering and reconciliation. It applies predefined compliance rules to identify potential violations, saving compliance officers significant time and effort in reviewing and assessing trading activities.

By streamlining compliance processes, organizations can allocate resources more effectively, allowing compliance officers to focus on higher-value tasks such as conducting in-depth investigations and implementing robust compliance policies.

Enhanced Risk Mitigation

Personal trading compliance software plays a crucial role in mitigating regulatory risks for financial institutions. By continuously monitoring employee trading activities, the software helps organizations identify and address potential compliance breaches promptly, reducing the risk of regulatory penalties, reputational damage, and legal liabilities.

The software's real-time alerting capabilities enable compliance officers to take immediate action when a potential violation or conflict of interest is detected. They can investigate the issue, communicate with the concerned employee, and implement appropriate remedial measures before any regulatory consequences occur.

Furthermore, personal trading compliance software provides organizations with comprehensive and auditable records of employee trading activities. These records serve as evidence of compliance efforts and can be presented during regulatory audits or investigations, demonstrating the organization's commitment to maintaining regulatory compliance.

Efficient Conflict of Interest Management

Personal trading compliance software helps organizations effectively manage conflicts of interest that may arise from employee personal trading activities. The software allows organizations to define and enforce policies that address potential conflicts, ensuring fair treatment of clients and preventing any undue advantages gained by employees.

By monitoring employee trading activities, the software helps identify situations where an employee's personal trade may conflict with the interests of the organization or its clients. For example, if an employee trades in a security that the organization is planning to recommend to clients, it may raise concerns about insider trading or unfair market advantages.

The software enables organizations to set up automated alerts and notifications to promptly identify and address potential conflicts of interest. Compliance officers can review the flagged trades, communicate with the employees involved, and implement necessary measures to mitigate the conflict and maintain the integrity of client relationships.

Improved Reporting and Audit Capabilities

Personal trading compliance software simplifies regulatory reporting and enhances audit capabilities for financial institutions. The software generates comprehensive reports that consolidate employee trading activities, compliance violations, and conflict of interest incidents, providing a complete audit trail for regulatory authorities.

These reports can be customized to meet specific regulatory requirements, enabling organizations to efficiently fulfill their reporting obligations. By automating report generation, the software reduces the time and effort required for manual data compilation and ensures accuracy and consistency in reporting.

Furthermore, personal trading compliance software facilitates internal audits by providing compliance officers with a centralized platform to review and analyze trading activities. It enables them to conduct in-depth investigations, identify trends or patterns, and identify areas for process improvement or policy enhancements.

Enhanced Employee Accountability

Implementing personal trading compliance software establishes a culture of accountability among employees regarding their personal trading activities. The software serves as a clear reminder to employees that their trades are subject to monitoring and compliance scrutiny, encouraging them to adhere to regulatory requirements and ethical standards.

By promoting transparency and accountability, the software helps organizations foster a culture of integrity and responsible behavior. Employees become more conscious of potential conflicts of interest and are more likely to adhere to compliance policies, ensuring fair treatment of clients and maintaining the organization's reputation.

Moreover, personal trading compliance software provides employees with a platform to disclose their personal trading activities. It simplifies the process of submitting trade requests for pre-clearance and facilitates the review and approval process by compliance officers, ensuring transparency and consistency in the compliance workflow.

Key Features to Look for in Personal Trading Compliance Software

When selecting personal trading compliance software for your organization, it is essential to consider the key features that will effectively meet your compliance management needs. Let's explore the crucial features to look for in personal trading compliance software:

Real-Time Monitoring

Effective personal trading compliance software should offer real-time monitoring capabilities to ensure prompt detection of potential compliance breaches or conflicts of interest. The software should continuously analyze trade data and alert compliance officers immediately when a violation is detected, enabling swift action.

Real-time monitoring enables organizations to respond quickly to compliance issues, reducing the risk of regulatory penalties and reputational damage. It allows compliance officers to investigate and address potential violations or conflicts before they escalate, ensuring regulatory compliance and ethical behavior.

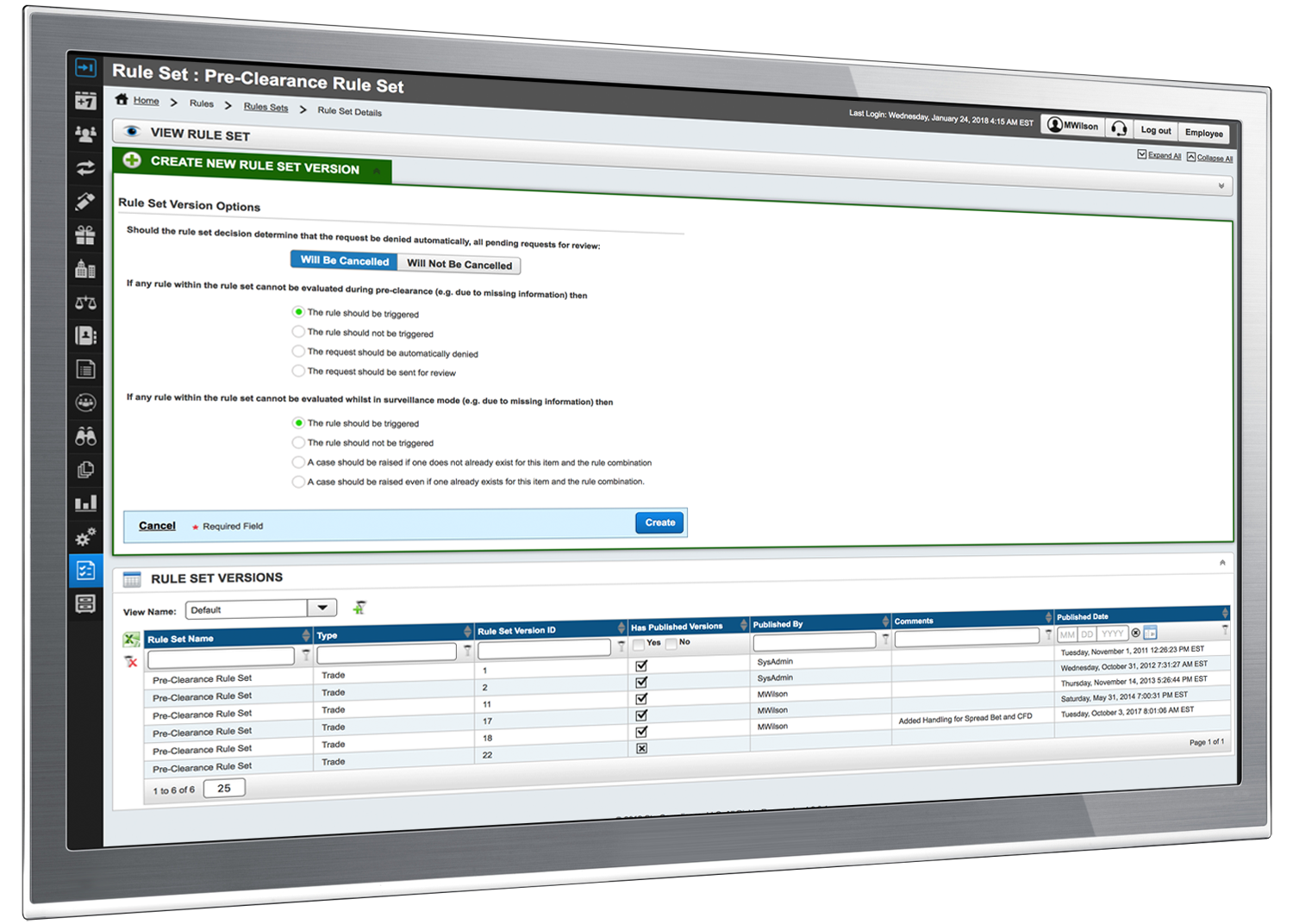

Customizable Compliance Rules

Personal trading compliance software should provide the flexibility to customize compliance rules based on your organization's specific requirements. The software should enable you to define and enforce rules that align with regulatory obligations, internal policies, and risk appetite.

Customizable compliance rules allow organizations to adapt the software to their unique business needs, ensuring accurate monitoring and enforcement of compliance requirements. This flexibility ensures that the software remains relevant and effective as regulatory frameworks evolve or organizational policies change.

Automated Alerts and Notifications

Automated alerts and notifications are crucial features of personal trading compliance software. The software should generate timely alerts to compliance officers when potential violations or conflicts of interest are detected, ensuring swift action can be taken.

These alerts should be customizable, allowing organizations to define the severity levels and escalation paths based on their internal processes. By receiving automated alerts, compliance officers can promptly investigate flagged trades, communicate with employees, and implement appropriate remedial measures, minimizing the impact of compliance breaches.

Comprehensive Reporting Capabilities

Personal trading compliancesoftware should offer comprehensive reporting capabilities to facilitate regulatory reporting and internal audits. The software should generate detailed reports that consolidate employee trading activities, compliance violations, and conflict of interest incidents, providing a complete audit trail for regulatory authorities.

The reporting capabilities should be customizable to meet specific regulatory requirements, enabling organizations to efficiently fulfill their reporting obligations. The software should allow for the generation of standardized reports as well as the ability to create ad-hoc reports based on specific criteria or analytics.

Moreover, the software should provide visualizations and analytics tools to help compliance officers analyze trading data and identify trends or patterns. This enables them to gain insights into employee trading behaviors, identify potential risks, and make data-driven decisions to strengthen compliance policies and processes.

User-Friendly Interface

A user-friendly interface is essential for personal trading compliance software, as it ensures ease of use and adoption within the organization. The software should have an intuitive interface that allows compliance officers to navigate and access the necessary information efficiently.The interface should provide clear and concise dashboards that present key compliance metrics, alerts, and reports in a visually appealing manner. It should enable compliance officers to drill down into specific trades or employees for detailed analysis and investigation.

Additionally, the software should offer a user-friendly workflow for employees to disclose their personal trading activities and request pre-clearance. The workflow should guide employees through the process and provide clear instructions to ensure accurate and complete disclosures.

Data Integration and Security

Personal trading compliance software should seamlessly integrate with various data sources, including trading platforms, brokerage accounts, and employee personal trading disclosures. The software should have robust data integration capabilities to capture trade data in real-time and ensure data accuracy and consistency.Data security is of utmost importance in personal trading compliance software. The software should adhere to industry standards and best practices for data encryption, access controls, and data privacy. It should have role-based access controls to restrict sensitive information to authorized personnel only.

Furthermore, the software should have robust data backup and disaster recovery mechanisms to ensure data integrity and availability in case of any unforeseen events. Regular backups, secure storage, and redundancy measures should be in place to protect the organization's trading data.

Scalability and Flexibility

Personal trading compliance software should be scalable and able to accommodate the growing needs of the organization. The software should be able to handle increasing trade volumes and support a growing number of users without compromising performance.Additionally, the software should be flexible enough to adapt to changes in regulatory requirements and organizational policies. It should allow for easy configuration and customization of compliance rules, reporting templates, and workflows to ensure ongoing compliance and alignment with evolving needs.

Scalability and flexibility are crucial to ensure that the personal trading compliance software remains effective and valuable as the organization grows and regulatory landscapes evolve.

Integration with Existing Systems

Personal trading compliance software should seamlessly integrate with existing systems within the organization, such as human resource management systems, trading platforms, and risk management systems. Integration capabilities ensure smooth data flow between different systems, eliminating manual data entry and reducing the risk of errors.Integration with HR systems allows for automatic updates of employee information, ensuring accurate monitoring of employee trading activities. Integration with trading platforms and brokerage accounts enables real-time retrieval of trade data, providing up-to-date information for compliance monitoring and reporting.

Furthermore, integration with risk management systems allows for a holistic view of compliance risks, enabling organizations to identify potential areas of improvement and strengthen risk mitigation strategies.

How Personal Trading Compliance Software Helps with Employee Trading Ethics

Personal trading compliance software plays a crucial role in promoting and enforcing ethical behavior among employees. By establishing robust monitoring and compliance processes, the software helps organizations prevent insider trading, ensure fair market practices, and maintain a culture of integrity.

Prevention of Insider Trading

Insider trading is a significant concern for financial institutions, as it can result in unfair advantages for employees and undermine market integrity. Personal trading compliance software helps prevent insider trading by monitoring employee trading activities and detecting any suspicious or unauthorized trades.The software analyzes trade data in real-time and compares it against predefined compliance rules to identify potential insider trading activities. It looks for patterns, anomalies, or abnormal trading behavior that may indicate the use of non-public information for personal gain.

When the software detects a potential insider trading activity, it triggers alerts for compliance officers to investigate further. This allows organizations to take swift action, including communicating with the concerned employee, conducting a thorough investigation, and reporting any suspicious activities to regulatory authorities if necessary.

Promotion of Fair Market Practices

Personal trading compliance software also helps organizations ensure fair market practices by monitoring employee trades and identifying potential market manipulation or front-running activities. Market manipulation and front-running can distort market prices, disadvantage other market participants, and erode investor confidence.The software analyzes trade data to identify any suspicious trading patterns or unusually timed trades that may indicate market manipulation or front-running. By detecting such activities, organizations can take proactive measures to prevent unfair market practices and maintain a level playing field for all market participants.

In addition, personal trading compliance software enables organizations to set trading restrictions or blackout periods to prevent employees from trading certain securities during critical events or sensitive periods. This helps prevent conflicts of interest and ensures fair treatment of clients and investors.

Culture of Integrity and Compliance

Implementing personal trading compliance software helps foster a culture of integrity and compliance within financial institutions. The software serves as a clear reminder to employees that their personal trades are subject to monitoring and compliance scrutiny, encouraging them to adhere to regulatory requirements and ethical standards.By promoting transparency and accountability, the software helps organizations establish a strong ethical foundation. Employees become more conscious of potential conflicts of interest and are more likely to comply with compliance policies and regulations, ensuring fair treatment of clients and maintaining the organization's reputation.

Furthermore, personal trading compliance software provides employees with a platform to disclose their personal trading activities. It simplifies the process of submitting trade requests for pre-clearance and facilitates the review and approval process by compliance officers, ensuring transparency and consistency in the compliance workflow.

Integrating Personal Trading Compliance Software with Existing Systems

Integrating personal trading compliance software with existing systems within an organization is crucial for seamless data flow and efficient compliance management. By integrating with HR systems, trading platforms, and risk management systems, organizations can ensure accurate and up-to-date monitoring of employee trading activities.

Integration with HR Systems

Integrating personal trading compliance software with HR systems allows organizations to automatically update employee information and ensure accurate monitoring and compliance management. When an employee joins or leaves the organization, their personal trading compliance profile is automatically updated, reflecting the changes in the software.This integration enables compliance officers to have real-time access to employee information, ensuring accurate monitoring of personal trading activities. It eliminates the need for manual data entry and reduces the risk of errors or delays in updating employee profiles.

Furthermore, integration with HR systems enables the software to enforce compliance rules based on employee roles and responsibilities. Different rules can be applied to different employee categories, ensuring relevant and tailored monitoring of personal trading activities.

Integration with Trading Platforms and Brokerage Accounts

Integrating personal trading compliance software with trading platforms and brokerage accounts enables organizations to retrieve trade data in real-time, ensuring accurate monitoring and compliance management. The software can automatically fetch trade data from these systems, eliminating the need for manual data entry or reconciliation.Real-time integration with trading platforms and brokerage accounts provides up-to-date information on employee trades, allowing compliance officers to monitor trading activities in real-time. It ensures that any potential compliance violations or conflicts of interest are promptly detected and addressed.

Additionally, integration with trading platforms allows for the automatic capture of trade details, including transaction dates, securities traded, and trade volumes. This ensures that the compliance monitoring is accurate and comprehensive, providing a complete view of employee trading activities.

Integration with Risk Management Systems

Integrating personal trading compliance software with risk management systems provides a holistic view of compliance risks within the organization. The software can leverage risk management data to assess the potential impact of employee trading activities on overall risk exposure.By integrating with risk management systems, personal trading compliance software can identify potential compliance risks associated with specific securities or trading strategies. It allows compliance officers to evaluate the risk implications of employee trades and take appropriate actions to mitigate any potential risks.

Furthermore, integration with risk management systems enables compliance officers to assess the effectiveness of compliance policies and controls in mitigating compliance risks. They can analyze the correlation between employee trading activities and overall risk exposure, identifying areas for improvement and strengthening risk mitigation strategies.

Personal Trading Compliance Software: Implementation Best Practices

Implementing personal trading compliance software requires careful planning and execution to ensure successful adoption and effective compliance management. By following best practices, organizations can maximize the benefits of the software and achieve seamless integration within their operations.

Establish Clear Policies and Procedures

Before implementing personal trading compliance software, it is essential to establish clear policies and procedures regarding employee personal trading activities. These policies should outline the rules, restrictions, and disclosure requirements for employees engaging in personal trades.The policies should be aligned with regulatory requirements and the organization's risk appetite. They should be communicated to all employees, ensuring they are aware of their obligations and responsibilities regarding personal trading compliance.

Furthermore, organizations should establish a clear escalation process for potential compliance breaches and conflicts of interest. This ensures that employees know how to report any concerns or violations, allowing for prompt investigation and resolution.

Comprehensive Training and Education

To ensure successful implementation and adoption of personal trading compliance software, organizations should provide comprehensive training and education to employees and compliance officers. Training programs should focus on the software's features, functionalities, and compliance policies.Employees should be educated on their obligations regarding personal trading compliance, including the process for submitting trade requests for pre-clearance and disclosing personal trades. They should understand the potential consequences of non-compliance and the importance of maintainingintegrity and ethics in their personal trading activities.

Compliance officers should receive in-depth training on the personal trading compliance software, including how to configure compliance rules, review alerts and reports, and conduct investigations. They should be equipped with the necessary knowledge and skills to effectively monitor and manage employee trading activities.

Regular training sessions and refresher courses should be conducted to keep employees and compliance officers up to date with any changes in regulatory requirements or software updates. This ensures ongoing compliance and maximizes the effectiveness of the personal trading compliance software.

Collaboration and Communication

Successful implementation of personal trading compliance software requires collaboration and communication across different departments within the organization. Compliance officers should work closely with HR, legal, and IT departments to ensure seamless integration and data flow.Collaboration with HR is crucial for integrating employee information and ensuring accurate monitoring and compliance management. Compliance officers should establish a strong working relationship with HR personnel to address any issues or updates related to employee profiles.

Legal departments play a vital role in reviewing and aligning compliance policies with regulatory requirements. Compliance officers should collaborate with legal experts to ensure that the personal trading compliance policies and procedures are robust, effective, and legally compliant.

IT departments are responsible for the technical aspects of implementing and integrating the personal trading compliance software. Compliance officers should work closely with IT professionals to ensure a seamless integration process, address any technical challenges, and ensure data security and privacy.

Effective communication is key to successful implementation and adoption of personal trading compliance software. Compliance officers should provide clear instructions and guidelines to employees regarding the use of the software, including how to submit trade requests and disclose personal trades.

Regular communication channels should be established to address any questions or concerns from employees regarding the personal trading compliance software. Compliance officers should be accessible and responsive to ensure a smooth transition and ongoing support for employees using the software.

Continuous Monitoring and Evaluation

The implementation of personal trading compliance software is not a one-time event; it requires continuous monitoring and evaluation to ensure its effectiveness and alignment with changing regulatory requirements.Compliance officers should regularly review and analyze the software's alerts, reports, and data to identify any potential compliance issues or areas for improvement. They should conduct periodic audits to assess the software's accuracy, efficiency, and overall impact on compliance management.

Feedback from employees should be actively sought and considered to identify any usability issues or suggestions for enhancements. This feedback can help improve the user experience and ensure that the personal trading compliance software meets the needs and expectations of the users.

Additionally, compliance officers should stay informed about regulatory changes and updates that may impact personal trading compliance requirements. They should continuously update the compliance rules within the software to reflect these changes and ensure ongoing compliance.

Challenges of Personal Trading Compliance Software Implementation

Implementing personal trading compliance software can come with its own set of challenges. Understanding and addressing these challenges is crucial for successful implementation and utilization of the software within the organization.

Data Migration and Integration

One of the primary challenges of implementing personal trading compliance software is the migration and integration of data from existing systems. Integrating the software with HR systems, trading platforms, and brokerage accounts requires careful planning and coordination with IT teams.Data migration can be complex, particularly when dealing with large volumes of historical trade data. It is essential to ensure that the data is accurately transferred to the new system and that any inconsistencies or errors are identified and resolved.

Integration with existing systems may also require technical expertise and resources to establish the necessary data connections and ensure seamless data flow. IT teams may need to work closely with software vendors and internal stakeholders to address any compatibility issues and ensure a smooth integration process.

User Adoption and Training

The successful adoption of personal trading compliance software relies on user acceptance and engagement. Employees and compliance officers may initially resist change or struggle with the new software's features and functionalities.To overcome this challenge, organizations should invest in comprehensive training programs to educate employees and compliance officers about the software's benefits and how to effectively use it. Training should be tailored to different user groups and should provide hands-on experience to build confidence and familiarity with the software.

Clear communication and ongoing support are also essential to address any concerns or questions from users. Organizations should establish dedicated channels for user support and provide timely responses to ensure a smooth transition and encourage user adoption.

Complexity of Compliance Rules

Compliance rules can be complex and vary based on regulatory requirements, internal policies, and risk appetite. Configuring and managing these rules within the personal trading compliance software can be challenging, particularly for organizations with unique compliance needs.To address this challenge, organizations should work closely with compliance officers and software vendors to define and configure compliance rules accurately within the software. Collaboration and communication between compliance officers and software vendors are crucial to ensure that the software effectively addresses the organization's specific compliance requirements.

Additionally, organizations should regularly review and update compliance rules to reflect changes in regulatory requirements. This ensures ongoing compliance and prevents the software from becoming outdated or ineffective in identifying potential compliance breaches.

Resistance to Change

Resistance to change is a common challenge when implementing any new technology or system within an organization. Employees may resist the adoption of personal trading compliance software due to concerns about privacy, increased monitoring, or changes in existing processes.To overcome resistance to change, organizations should proactively communicate the benefits of the personal trading compliance software to employees. Clear messages about the software's purpose, its role in maintaining regulatory compliance, and the organization's commitment to ethical behavior can help alleviate concerns and gain employee buy-in.

Involving employees in the implementation process, such as seeking their feedback and input, can also help increase their engagement and acceptance of the software. Providing training and ongoing support to address any usability issues or challenges can further encourage user adoption and overcome resistance to change.

Cost and Resource Allocation

Implementing personal trading compliance software can involve significant costs, including software licensing fees, implementation costs, and ongoing maintenance expenses. Organizations need to allocate the necessary financial resources to ensure a successful implementation and long-term utilization of the software.Additionally, organizations should allocate appropriate human resources, particularly in the compliance department, to manage the software effectively. Compliance officers should be trained and dedicated to monitoring and managing employee trading activities using the software.

It is essential to consider the long-term costs and resource requirements associated with the software. This includes budgeting for software updates, technical support, and any additional training or integration needs that may arise.

Case Studies: Real-Life Examples of Successful Personal Trading Compliance Software Implementation

Real-life case studies can provide valuable insights into how organizations have successfully implemented personal trading compliance software and the benefits they have gained. Let's examine a few examples:

Case Study 1: XYZ Bank

XYZ Bank, a global financial institution, implemented personal trading compliance software to streamline their compliance processes and ensure adherence to regulatory requirements. The software integrated with their existing HR systems, trading platforms, and risk management systems, providing real-time monitoring and comprehensive reporting capabilities.By implementing the software, XYZ Bank experienced significant improvements in operational efficiency and risk mitigation. The automated monitoring and alerting features enabled compliance officers to identify potential compliance breaches promptly, allowing for swift action and resolution.

The software's comprehensive reporting capabilities simplified regulatory reporting and enhanced internal audits. Compliance officers were able to generate standardized reports and conduct in-depth analysis of employee trading activities, identifying areas for process improvement and policy enhancements.

Overall, the implementation of personal trading compliance software helped XYZ Bank strengthen their compliance management, minimize regulatory risks, and foster a culture of integrity and compliance among employees.

Case Study 2: ABC Investment Firm

ABC Investment Firm, a leading asset management company, implemented personal trading compliance software to address their growing compliance needs and ensure fair and ethical practices among their employees. The software integrated with their trading platforms, brokerage accounts, and risk management systems, providing real-time monitoring and automated compliance rule enforcement.The software's real-time monitoring capabilities allowed compliance officers at ABC Investment Firm to detect potential conflicts of interest and prevent insider trading effectively. Alerts and notifications were sent when potential violations were detected, enabling prompt investigation and resolution.

The software's integration with risk management systems enabled compliance officers to assess the impact of employee trading activities on overall risk exposure. This helped ABC Investment Firm strengthen their risk mitigation strategies and ensure compliance with regulatory requirements.

By implementing personal trading compliance software, ABC Investment Firm achieved enhanced operational efficiency, improved risk management, and a heightened culture of compliance among their employees.

The Future of Personal Trading Compliance Software

The future of personal trading compliance software holds exciting possibilities for further enhancing compliance management processes and leveraging emerging technologies. Let's explore some of the trends that may shape the future of personal trading compliance software:

Integration of Artificial Intelligence (AI)

Artificial intelligence (AI) has the potential to revolutionize personal trading compliance software by automating compliance monitoring and enhancing detection capabilities. AI algorithms can analyze vast amounts of trade data, detect complex patterns, and identify potential compliance breaches with greater accuracy and efficiency.AI-powered personal trading compliance software can continuously learn from historical data and adapt to changing regulatory requirements. It can proactively identify emerging risks and provide real-time insights to compliance officers, enabling them to take proactive measures to prevent non-compliance.

Furthermore, AI can enable natural language processing capabilities, allowing the software to interpret and analyze textual data, such as news articles or social media posts, to identify potential market-moving information that may impact employee trading activities.

Enhanced Data Analytics and Visualization

Data analytics and visualization capabilities will continue to evolve in personal trading compliance software, enabling compliance officers to gain deeper insights into employee trading activities and compliance risks. Advanced analytics tools can provide predictive analytics, anomaly detection, and risk scoring, enabling proactive compliance management.Visualization techniques, such as interactive dashboards and data visualizations, will make it easier for compliance officers to understand and interpret complex trade data. This will facilitate data-driven decision-making and enable compliance officers to identifytrends, patterns, and potential compliance risks more effectively.

The enhanced data analytics and visualization capabilities will also enable compliance officers to generate more insightful and comprehensive reports. These reports can provide a holistic view of employee trading activities, compliance breaches, and trends, empowering organizations to make informed decisions and strengthen their compliance strategies.

Integration with Blockchain Technology

Blockchain technology has the potential to revolutionize personal trading compliance by providing a secure and transparent platform for recording and verifying trade data. By leveraging blockchain, personal trading compliance software can ensure the immutability and integrity of trade records, making it even more robust and resistant to manipulation.Blockchain technology can also facilitate secure and efficient data sharing between different stakeholders, such as regulatory authorities, trading platforms, and brokerage firms. This can streamline the regulatory reporting process and enhance collaboration and transparency in compliance management.

Furthermore, blockchain technology can enable the implementation of smart contracts, which can automatically enforce compliance rules and facilitate the pre-clearance process for employee trades. This can reduce manual intervention and enhance the efficiency of compliance workflows.

Integration with RegTech Solutions

Regulatory technology, or RegTech, solutions are emerging as powerful tools to support compliance management across various industries. Personal trading compliance software can integrate with RegTech solutions to leverage advanced regulatory intelligence, automated compliance checks, and real-time regulatory updates.By integrating with RegTech solutions, personal trading compliance software can ensure that compliance rules and processes are consistently aligned with the latest regulatory requirements. It can automate the monitoring and enforcement of complex regulations, reducing the risk of non-compliance and ensuring regulatory adherence.

RegTech solutions can also provide compliance officers with access to comprehensive regulatory databases, enabling them to stay up to date with new regulations, guidelines, and best practices. This can enhance compliance officers' ability to interpret and apply regulatory requirements effectively.

Enhanced Mobile and Remote Access

The future of personal trading compliance software will likely involve enhanced mobile and remote access capabilities. With the increasing trend of remote work and the need for flexible access to compliance systems, software vendors will likely focus on developing mobile-friendly applications and cloud-based solutions.Mobile access to personal trading compliance software will enable compliance officers to monitor and manage employee trading activities on the go, providing real-time insights and alerts. This will enhance the efficiency and responsiveness of compliance management, even when compliance officers are not physically present in the office.

Cloud-based solutions will also enable seamless access to personal trading compliance software from any location and any device, ensuring that compliance officers can perform their duties effectively, regardless of their physical location.

Choosing the Right Personal Trading Compliance Software: Key Considerations

When selecting personal trading compliance software for your organization, it is essential to consider the following key considerations to ensure the software meets your specific needs:

Regulatory Compliance

Ensure that the personal trading compliance software aligns with the regulatory requirements applicable to your organization. The software should support the key regulations and guidelines that govern personal trading activities in your jurisdiction, such as SEC Rule 17j-1 or the Investment Advisers Act of 1940.Verify that the software can accommodate regulatory changes and updates by providing regular software updates and ongoing support. It should have a track record of keeping up with regulatory changes and promptly implementing necessary adjustments.

Scalability and Flexibility

Consider the scalability and flexibility of the personal trading compliance software to accommodate your organization's growth and changing needs. The software should be capable of handling increasing trade volumes, supporting a growing number of users, and adapting to evolving regulatory requirements.Ensure that the software allows for customization and configuration of compliance rules, reporting templates, and workflows to meet your organization's specific requirements. It should provide the flexibility to accommodate changes in internal policies, risk appetite, and compliance processes.

User-Friendly Interface

Choose a personal trading compliance software with a user-friendly interface that is intuitive and easy to navigate. The software should provide clear and concise dashboards, alerts, and reports, enabling compliance officers to access and interpret information efficiently.Consider the ease of use and accessibility of the software for both compliance officers and employees. The software should have a clear and intuitive workflow for employees to disclose personal trades and request pre-clearance, ensuring a seamless user experience.

Data Integration and Security

Evaluate the personal trading compliance software's data integration capabilities and security measures. The software should seamlessly integrate with your existing systems, such as HR systems, trading platforms, and risk management systems, to ensure accurate and up-to-date monitoring of employee trading activities.Ensure that the software adheres to industry standards and best practices for data encryption, access controls, and data privacy. It should have robust data backup and disaster recovery mechanisms to protect the integrity and availability of trading data.

Vendor Reputation and Support

Research the reputation and track record of the software vendor. Look for vendors with experience in the personal trading compliance domain and a proven track record of successful implementations.Consider the level of support and customer service provided by the vendor. Ensure that the vendor offers ongoing technical support, software updates, and training resources to help your organization maximize the value of the software.

Cost and ROI

Evaluate the cost of implementing and maintaining the personal trading compliance software, including licensing fees, implementation costs, and ongoing maintenance expenses. Consider the potential return on investment (ROI) that the software can deliver in terms of operational efficiency, risk mitigation, and regulatory compliance.Consider the long-term costs and benefits of the software, including scalability and flexibility to accommodate your organization's growth. Evaluate the potential savings in time, resources, and potential regulatory penalties that the software can provide.

By carefully considering these key considerations, your organization can choose the right personal trading compliance software that aligns with your regulatory obligations, meets your specific needs, and enables effective compliance management.

Conclusion

Personal trading compliance software plays a crucial role in ensuring regulatory compliance, promoting ethical behavior, and managing employee trading activities within financial institutions. By automating compliance processes, streamlining reporting, and enhancing monitoring capabilities, this software enables organizations to navigate the complex regulatory landscape with ease.

In this comprehensive guide, we explored the purpose and functionality of personal trading compliance software, highlighting its benefits in improving operational efficiency, mitigating regulatory risks, and fostering a culture of integrity. We discussed the key features to look for in personal trading compliance software, such as real-time monitoring, customizable compliance rules, automated alerts, and comprehensive reporting capabilities.

We also explored how personal trading compliance software helps organizations maintain employee trading ethics by preventing insider trading, promoting fair market practices, and establishing a culture of integrity and compliance. Integrating the software with existing systems, such as HR systems, trading platforms, and risk management systems, ensures seamless data flow and efficient compliance management.

While implementing personal trading compliance software may come with challenges, such as data migration, user adoption, and complexity of compliance rules, organizations can overcome these challenges by following best practices, establishing clear policies and procedures, providing comprehensive training, promoting collaboration and communication, and continuously monitoring and evaluating the software's effectiveness.

The future of personal trading compliance software holds exciting possibilities, including the integration of artificial intelligence, enhanced data analytics and visualization, integration with blockchain technology, and improved mobile and remote access capabilities. Considering key factors such as regulatory compliance, scalability, user-friendliness, data integration and security, vendor reputation and support, and cost and ROI will help organizations choose the right personal trading compliance software for their specific needs.

By leveraging the power of personal trading compliance software, organizations can ensure regulatory adherence, maintain transparency, and uphold ethical standards in their employee trading activities, thus safeguarding their reputation and minimizing the risk of non-compliance in today's complex financial landscape.