Merrill Edge Premarket Trading: Exploring the Benefits and Strategies

Welcome to our comprehensive guide on Merrill Edge premarket trading. If you are an investor or trader looking to gain an edge in the stock market, understanding premarket trading and its potential advantages can significantly enhance your investment strategy. In this article, we will delve into the concept of premarket trading, its benefits, and explore effective strategies to navigate this exciting market.

Before we dive into the details, let's clarify what premarket trading actually means. Premarket trading, also known as extended-hours trading, refers to the trading that occurs before the official opening of the stock market. This period allows investors to react to significant news announcements, earnings reports, and other market-moving events that occur outside of regular trading hours. Now, let's explore the various aspects of Merrill Edge premarket trading in depth.

Understanding Premarket Trading

In this section, we will provide an overview of premarket trading, its participants, and the factors that influence the market during this time. We will also outline the key differences between premarket trading and regular trading hours, giving you a clear understanding of this unique trading session.

Participants in Premarket Trading

Premarket trading involves a diverse range of participants, including institutional investors, hedge funds, retail traders, and market makers. Institutional investors often take advantage of this session to adjust their positions based on overnight news or global events. Hedge funds and other professional traders also actively participate in premarket trading to capitalize on price movements before regular trading hours begin. Retail traders, armed with online trading platforms like Merrill Edge, can now access premarket trading opportunities that were once reserved for institutional players.

Factors Influencing Premarket Trading

Premarket trading is influenced by various factors that can significantly impact stock prices. Overnight news releases, earnings reports from companies, economic indicators, and geopolitical events can all trigger market movements during the premarket session. Traders closely monitor these factors to identify potential opportunities and adjust their trading strategies accordingly.

Differences between Premarket and Regular Trading Hours

While premarket trading shares similarities with regular trading hours, several key differences set them apart. Firstly, premarket trading has narrower liquidity, meaning there may be fewer buyers and sellers, leading to wider bid-ask spreads. This reduced liquidity can result in increased price volatility, making it imperative for traders to exercise caution and employ appropriate risk management strategies. Additionally, order types may be limited during premarket hours, and some stocks may not be available for trading at all. Understanding these differences will help traders make informed decisions and avoid potential pitfalls.

Benefits of Merrill Edge Premarket Trading

Here, we will delve into the specific advantages of engaging in premarket trading through Merrill Edge. From increased flexibility to access to global markets, we will explore how Merrill Edge empowers traders to capitalize on premarket opportunities and potentially enhance their investment returns.

Extended Trading Hours

Merrill Edge provides investors with extended trading hours, allowing them to trade before the market opens and after it closes. This expanded timeframe provides traders with the flexibility to react to news events and market developments that occur outside of regular trading hours. By taking advantage of premarket opportunities, investors can position themselves strategically ahead of the broader market, potentially gaining an edge.

Global Market Access

Merrill Edge premarket trading also offers access to global markets, enabling investors to respond to international news and market movements. As global events can significantly impact stock prices, having the ability to trade during premarket hours provides a unique advantage. Whether it's reacting to overnight developments in Asian markets or preparing for European market openings, Merrill Edge allows traders to stay ahead of the curve and seize opportunities in global markets.

Potential for Enhanced Returns

Premarket trading presents opportunities for potentially enhanced returns. By being among the first to react to news and events, traders can position themselves before the broader market catches up. This early access to price movements can lead to favorable entry and exit points, potentially resulting in improved trading outcomes. However, it's crucial to note that premarket trading also carries risks, including increased volatility and reduced liquidity, which we will discuss in detail in the next section.

Risks and Considerations

While premarket trading presents enticing opportunities, it is essential to be aware of the associated risks and considerations. In this section, we will discuss the potential downsides of premarket trading, including increased volatility, lower liquidity, and the importance of setting realistic expectations.

Increased Volatility

Premarket trading is known for its heightened volatility compared to regular trading hours. With fewer participants and lower trading volumes, even small orders can have a more significant impact on stock prices. This increased volatility can offer lucrative trading opportunities but also amplifies the risk of sudden price swings. Traders must employ effective risk management strategies, such as setting appropriate stop-loss orders, to protect their capital in this volatile environment.

Reduced Liquidity

Lower liquidity is another factor to consider when trading during premarket hours. As mentioned earlier, premarket trading typically has narrower bid-ask spreads due to fewer buyers and sellers in the market. This reduced liquidity can make it challenging to execute trades at desired prices, potentially leading to slippage or difficulty in entering and exiting positions. Traders should be mindful of these liquidity limitations and adjust their trading strategies accordingly.

Realistic Expectations

Having realistic expectations is crucial when engaging in premarket trading. While the potential for enhanced returns exists, it is important to understand that not every trade will be profitable. Preparing for potential losses and accepting them as part of the trading process is essential for long-term success. Traders should focus on maintaining a disciplined approach, diligently following their strategies, and learning from both wins and losses to improve their overall trading performance.

Strategies for Successful Premarket Trading

Developing effective strategies is crucial for navigating premarket trading successfully. In this section, we will explore proven tactics, such as analyzing premarket news, setting appropriate entry and exit points, and utilizing technical analysis tools to make informed trading decisions.

Analyzing Premarket News

Staying informed about relevant news developments is key to successful premarket trading. Traders should monitor overnight news releases, global events, and earnings reports that can impact the market. By analyzing this information, traders can identify potential trading opportunities and adjust their strategies accordingly. Utilizing news aggregation services, financial websites, and real-time market data can help traders stay up to date with the latest news developments.

Setting Entry and Exit Points

Setting appropriate entry and exit points is crucial in premarket trading. Traders should identify key support and resistance levels, trendlines, and other technical indicators to guide their decision-making process. By establishing clear entry and exit points, traders can manage risk effectively and avoid impulsive trading decisions. Utilizing stop-loss orders and profit targets can further assist in maintaining discipline and protecting capital.

Utilizing Technical Analysis Tools

Technical analysis plays a vital role in premarket trading. Traders can utilize various technical analysis tools, such as moving averages, oscillators, and chart patterns, to identify potential market trends and reversals. These tools can provide valuable insights into price direction, momentum, and potential entry or exit points. By combining technical analysis with fundamental analysis and market sentiment, traders can make more informed trading decisions.

Utilizing Merrill Edge Tools and Resources

Merrill Edge offers a range of tools and resources to assist traders in their premarket endeavors. In this section, we will explore the various features Merrill Edge provides, such as real-time quotes, advanced charting tools, and customizable watchlists, enabling traders to make the most of their premarket trading activities.

Real-Time Quotes

Merrill Edge provides real-time quotes during premarket trading, allowing traders to stay updated with current prices and market movements. Real-time quotes enable traders to make quick and informed decisions based on the most up-to-date information available. By leveraging real-time quotes, traders can react promptly to changing market conditions and seize opportunities as they arise.

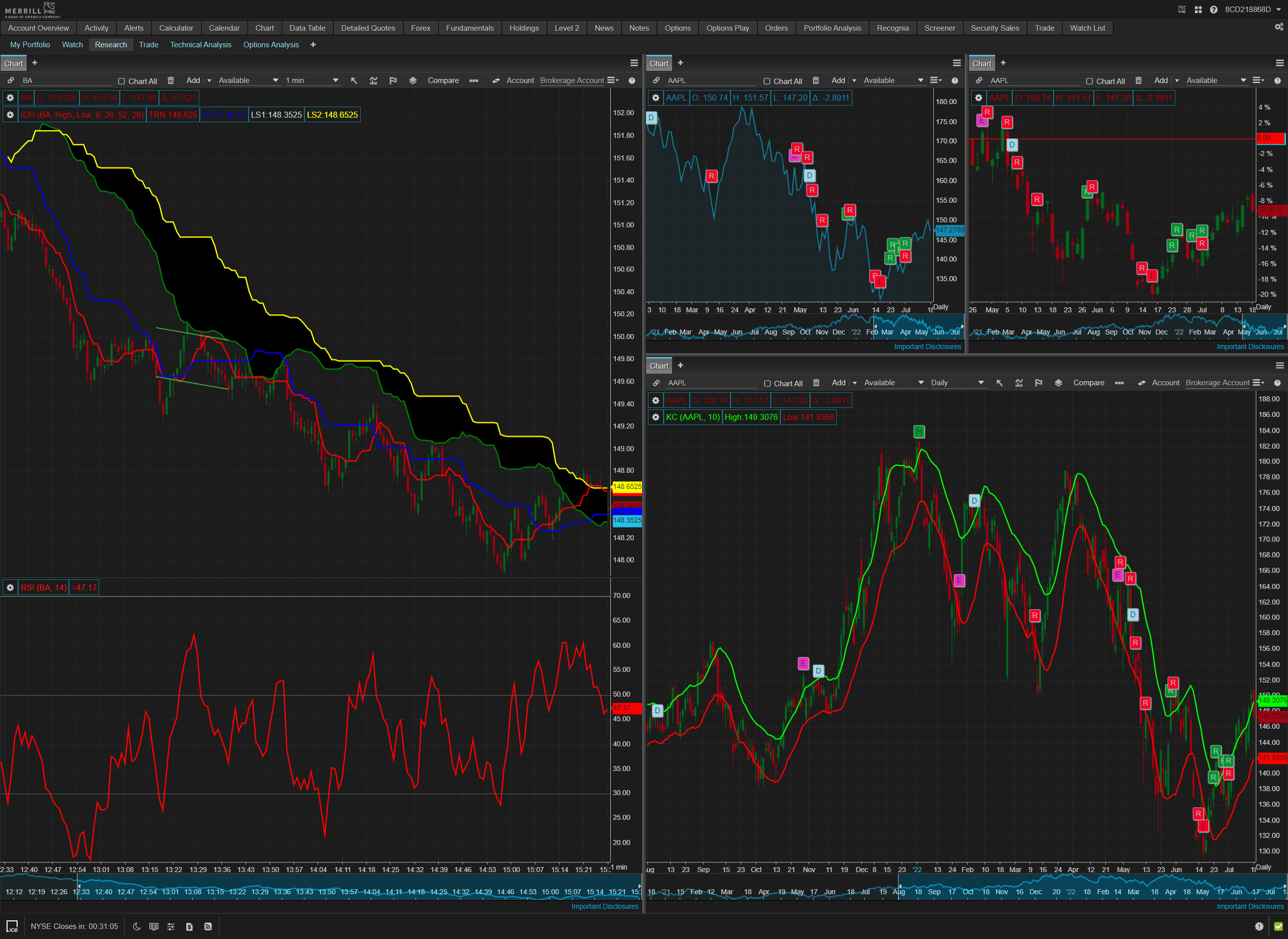

Advanced Charting Tools

Advanced charting tools offered by Merrill Edge empower traders to analyze price patterns, indicators, and overlays during premarket hours. These tools provide comprehensive technical analysis capabilities, allowing traders to identify potential trading setups and make informed decisions. By customizing charts, adding indicators, and utilizing drawing tools, traders can gain valuable insights into market trends and price movements.

Customizable Watchlists

Merrill Edge allows traders to create customizable watchlists, enabling them to monitor specific stocks or sectors during premarket trading. By curating watchlists based on individual preferences, traders can efficiently track relevant securities and stay focused on specific market segments. Customizable watchlists help traders stay organized and promptly identify potential trading opportunities.

Case Studies: Real-Life Examples

Real-life examples can provide valuable insights into premarket trading strategies and their outcomes. In this section, we will examine notable case studies of successful premarket trading, analyzing the strategies employed, the factors influencing the trades, and the resulting profitability.

Case Study 1: Capitalizing on Positive Earnings Surprise

In this case study, we will explore a scenario where a trader identifies a company that reportsstronger-than-expected earnings during premarket hours. The trader analyzes the earnings report, noting significant revenue growth and positive guidance for future quarters. Recognizing the potential for a positive market reaction, the trader decides to enter a long position before the market opens.

As regular trading hours commence, the positive sentiment surrounding the company's earnings propels the stock price higher. The trader carefully monitors the price action, utilizing technical analysis tools to identify key resistance levels and potential profit targets. Once the stock reaches a predetermined profit target, the trader exits the position, locking in a substantial gain.

This case study highlights the importance of thorough analysis and timely decision-making in premarket trading. By leveraging premarket news and acting swiftly, traders can capture significant profit opportunities before the broader market fully reacts to positive earnings surprises.

Case Study 2: Reacting to Negative Global News

In this case study, we will examine a situation where a trader becomes aware of negative global news overnight, affecting a particular industry. The trader recognizes the potential for the news to impact stock prices and decides to take advantage of the situation during premarket trading.

As the premarket session begins, the trader observes a sharp decline in stock prices within the affected industry. Using technical analysis, the trader identifies key support levels and sets a short-selling strategy to profit from the anticipated continued downward momentum.

As regular trading hours commence, the negative sentiment intensifies, causing further selling pressure on the stocks in the industry. The trader closely monitors the price action, adjusting their position size and stop-loss orders accordingly.

By the end of the regular trading session, the trader closes their short positions, capitalizing on the significant decline in stock prices. This case study demonstrates the ability of premarket trading to provide early access to market-moving news and opportunities for profitable short-selling strategies.

Common Mistakes to Avoid

In order to maximize your chances of success, it is important to be aware of common mistakes that traders often make during premarket trading. In this section, we will highlight some of these pitfalls and provide guidance on how to steer clear of them, ensuring a more informed and disciplined approach.

Impulsive Trading Decisions

One common mistake in premarket trading is making impulsive trading decisions based on emotions or limited analysis. It is crucial to approach premarket trading with a well-defined strategy and stick to it, regardless of market fluctuations. Avoid chasing after quick profits or panicking during volatile periods. Instead, rely on your pre-established entry and exit points and trust your analysis.

Overlooking Risk Management

Risk management is paramount in premarket trading, yet it is often overlooked. Traders should set appropriate stop-loss orders to limit potential losses and protect their capital. Additionally, avoid taking on excessive leverage or position sizes that could lead to substantial losses. Prioritize risk management and always be prepared for unexpected market movements.

Ignoring Regular Trading Session Preparation

While premarket trading offers unique opportunities, it is crucial to remember that it is only a precursor to the regular trading session. Traders should use premarket trading as a means to gather information, identify trends, and prepare for the official market opening. Take the time to evaluate premarket activities, adjust positions if necessary, and set new targets in anticipation of the regular trading session.

Regulatory Considerations and Compliance

Compliance with regulatory requirements is vital for traders engaged in premarket trading. In this section, we will outline the key regulations and compliance considerations that traders should be aware of, ensuring they operate within the legal boundaries of premarket trading.

Understanding Regulatory Restrictions

Various regulatory bodies govern premarket trading, and it is important to familiarize yourself with the specific rules and regulations in your jurisdiction. These regulations may include limitations on order types, restrictions on short-selling, and requirements for disclosure of positions. By understanding and adhering to these rules, traders can engage in premarket trading while staying compliant with regulatory frameworks.

Consulting with a Financial Advisor

If you are unsure about the regulatory aspects of premarket trading or need guidance on compliance, consulting with a qualified financial advisor is advisable. Financial advisors can provide valuable insights into the legal and regulatory considerations specific to your region and help ensure that your trading activities align with the applicable laws.

Conclusion

In conclusion, Merrill Edge premarket trading offers unique advantages for investors and traders looking to gain an edge in the stock market. By understanding the intricacies of premarket trading, utilizing effective strategies, and leveraging the tools and resources offered by Merrill Edge, traders can potentially enhance their investment returns. However, it is essential to be aware of the associated risks, maintain realistic expectations, and approach premarket trading with a disciplined and informed mindset. With proper preparation, analysis, and risk management, premarket trading can be a valuable addition to your trading arsenal, allowing you to capitalize on market-moving events and potentially achieve improved trading outcomes.