Demo Account Futures Trading: A Comprehensive Guide for Beginners

Are you interested in futures trading but don't know where to start? A demo account can be your gateway to understanding the ins and outs of this exciting financial market. In this article, we will take a deep dive into demo account futures trading, providing you with a comprehensive guide to help you get started.

In the first section, we will introduce you to the concept of demo accounts and explain how they work. You will learn how demo accounts simulate real trading conditions without the risk of losing real money. This section will also cover the benefits of using a demo account, such as gaining hands-on experience and testing trading strategies.

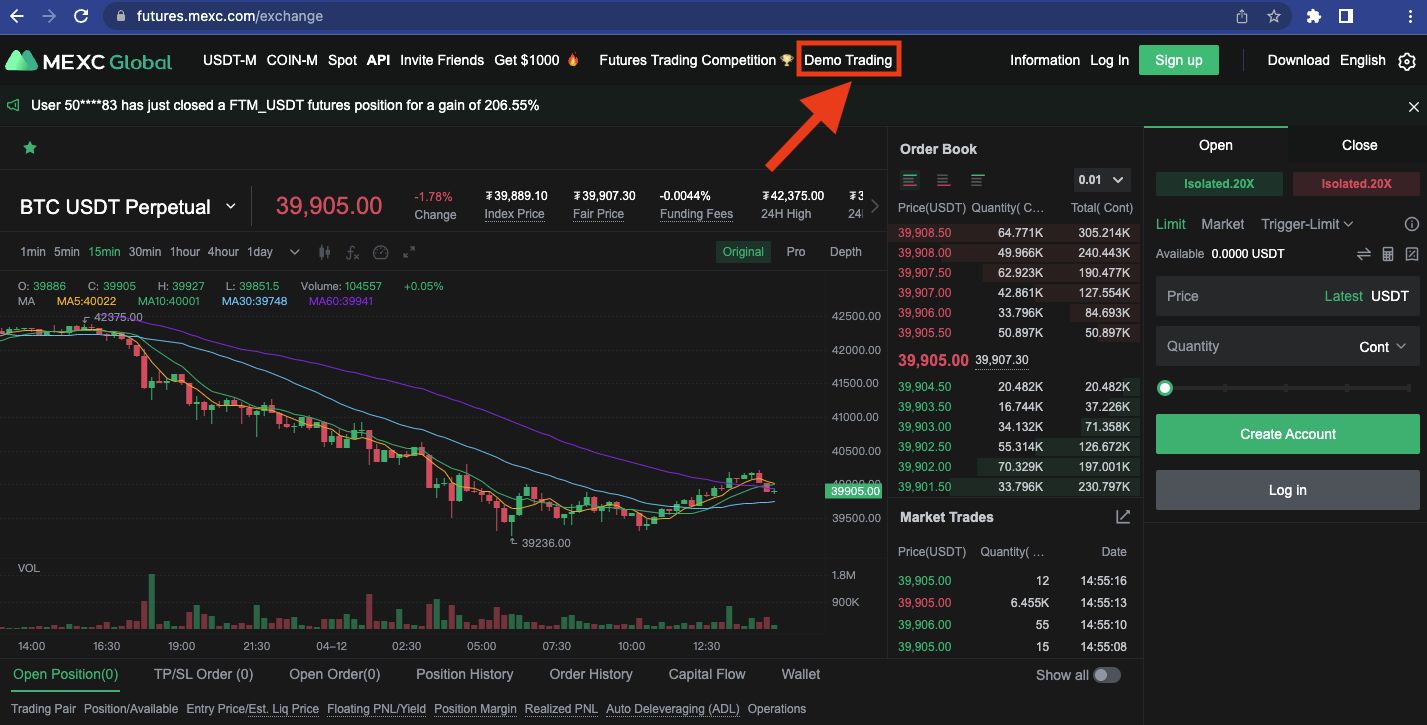

Getting Started with a Demo Account

Before you can start trading futures, it's important to set up a demo account. A demo account is a virtual trading platform that allows you to practice trading with virtual money. It replicates real trading conditions, including real-time market data and order execution, without the risk of losing your hard-earned cash.

To get started, you need to choose a reputable broker that offers demo accounts. Look for brokers that are regulated and have a good track record in the industry. Once you've selected a broker, you'll need to complete the registration process, which typically involves providing some personal information and agreeing to the terms and conditions.

After completing the registration, you'll gain access to the demo trading platform. This platform will provide you with a virtual balance that you can use to execute trades and explore the features of the platform. Take your time to familiarize yourself with the platform and its functionalities before diving into actual trading.

Choosing a Reputable Broker

When choosing a broker for your demo account futures trading, there are several factors to consider. First and foremost, ensure that the broker is regulated by a recognized financial authority. Regulation provides a level of security and ensures that the broker operates in a fair and transparent manner.

Additionally, consider the trading platform offered by the broker. Look for a platform that is user-friendly, intuitive, and provides the necessary tools and features for futures trading. The platform should offer real-time market data, charting tools, and order execution capabilities.

Another important aspect to consider is the customer support provided by the broker. You may encounter technical issues or have questions about the trading platform, so it's crucial to have access to responsive and knowledgeable customer support. Look for brokers that offer various channels of communication, such as phone, email, and live chat.

Completing the Registration Process

When registering for a demo account, you will typically be required to provide some personal information. This information may include your name, email address, phone number, and country of residence. The broker may also ask you to verify your identity by providing scanned copies of your identification documents.

It's important to note that reputable brokers have stringent security measures in place to protect your personal information. They adhere to strict privacy policies and use encryption technology to ensure the safety and confidentiality of your data.

Once you've provided the necessary information, you will need to agree to the terms and conditions of the broker. Take the time to read through these terms and understand the obligations and responsibilities of both parties. If you have any questions or concerns, don't hesitate to reach out to the broker's customer support for clarification.

Exploring the Demo Trading Platform

After completing the registration process, you will gain access to the demo trading platform. This platform is designed to replicate real trading conditions and provides you with a virtual balance that you can use to place trades and experiment with different trading strategies.

Take the time to explore the various features and functionalities of the trading platform. Familiarize yourself with the layout and navigation, and understand how to execute trades, analyze charts, and monitor your positions. Most demo trading platforms offer a range of order types, such as market orders, limit orders, and stop orders, so make sure you understand how to use them effectively.

Additionally, take advantage of the educational resources provided by the broker. Many brokers offer tutorials, webinars, and guides that can help you understand how to use the platform and improve your trading skills. Don't be afraid to experiment and practice different trading strategies to see what works best for you.

Understanding Futures Contracts

Before you start trading futures, it's crucial to have a solid understanding of what futures contracts are. A futures contract is a legally binding agreement to buy or sell a specific asset at a predetermined price and date in the future.

One of the key features of futures contracts is that they are standardized. This means that each contract represents a specific quantity of the underlying asset and has predefined contract specifications, such as delivery months and tick sizes. Standardization allows for liquidity and ease of trading.

When trading futures, you can choose to take a long or short position. A long position involves buying a futures contract with the expectation that the price of the underlying asset will increase. On the other hand, a short position involves selling a futures contract with the anticipation that the price will decrease.

Structure of Futures Contracts

Futures contracts have a specific structure that is important to understand. Each contract specifies the underlying asset, contract size, expiration date, and delivery months. For example, a futures contract on crude oil may have a contract size of 1,000 barrels and expire in the month of December.

It's important to note that most futures contracts are not physically settled. This means that the actual delivery of the underlying asset rarely occurs. Instead, most traders close out their positions before the expiration date by offsetting their contracts with opposite positions.

When trading futures, you need to be aware of the margin requirements. Margin is a deposit that you need to maintain in your trading account to cover potential losses. The margin requirements vary depending on the broker and the specific futures contract you are trading.

Long and Short Positions in Futures Trading

In futures trading, you have the flexibility to take both long and short positions. A long position involves buying a futures contract with the expectation that the price of the underlying asset will increase. If the price does increase, you can sell the contract at a higher price and profit from the price difference.

On the other hand, a short position involves selling a futures contract with the anticipation that the price will decrease. If the price does decrease, you can buy back the contract at a lower price and profit from the price difference.

Both long and short positions come with their own risks and rewards. When taking a long position, your potential profit is unlimited, but your potential loss is limited to the amount you invested. Conversely, when taking a short position, your potential profit is limited to the amount you received when selling the contract, but your potential loss is unlimited if the price goes against you.

Margin Requirements and Leverage

One of the advantages of futures trading is the ability to leverage your capital. Leverage allows you to control a larger position with a smaller amount of capital. However, leverage also increases the potential risk and can lead to significant losses if not managed properly.

Margin requirements are set by the exchange and the broker and represent the minimum amount of capital you need to maintain in your trading account to cover potential losses. The margin requirements vary depending on the futures contract, the volatility of the underlying asset, and the broker's risk management policies.

When trading futures, it's important to understand the concept of initial margin and maintenance margin. Initial margin is the amount of capital you need to deposit when opening a position, while maintenance margin is the minimum amount of capital you need to maintain in your account to keep the position open.

Managing Risk in Futures Trading

Risk management is crucial in futures trading to protect your capital and ensure long-term success. By implementing effective risk management strategies, you can minimize potential losses and maximize your chances of profitability.

One of the key risk management techniques is setting stop-loss orders. A stop-loss order is an order that automatically closes your position when the price reaches a predetermined level. By setting a stop-loss order, you can limit your losses and protect your capital if the market moves against your position.

Another important aspect of risk management is managing leverage. While leverage can amplify your profits, it can also magnify your losses. It's important to use leverage responsibly and ensure that you have sufficient margin to cover potential losses.

Setting Stop-Loss Orders

Setting stop-loss orders is a crucial risk management tool in futures trading. A stop-loss order allows you to specify the maximum amount of loss you are willing to tolerate on a trade. When the price reaches the stop-loss level, the order is triggered, and your position is automatically closed.

When setting a stop-loss order, it's important to consider the volatility of the underlying asset and set the stop-loss level accordingly. Setting the stop-loss too tight may result in premature exits, while setting it too wide may expose you to larger losses.

It's also important to reassess and adjust your stop-loss orders as the market conditions change. As the price moves in your favor, you can consider raising the stop-loss level to lock in profits and protect your capital.

Managing Leverage and Margin

Leverage is a powerful tool in futures trading, but it should be used with caution. It's important to understand the risks associated with leverageand manage it effectively to protect your capital. Here are some key considerations when managing leverage and margin in futures trading:

1. Understand the concept of leverage: Leverage allows you to control a larger position with a smaller amount of capital. For example, if the leverage is 1:10, it means that for every $1 of capital, you can control $10 worth of the underlying asset. While leverage can amplify your profits, it can also increase your losses if the market moves against your position.

2. Determine your risk tolerance: Before using leverage, it's important to assess your risk tolerance. Consider how much capital you are willing to risk on a single trade and set a maximum leverage level accordingly. Remember, higher leverage increases the potential for larger losses, so it's crucial to find a balance that aligns with your risk tolerance.

3. Calculate your position size: When using leverage, it's essential to calculate your position size based on your risk tolerance and the margin requirements. Position sizing refers to the number of contracts or lots you trade in relation to your account size. By determining an appropriate position size, you can limit the impact of potential losses and protect your capital.

4. Monitor your margin requirements: Margin requirements can change depending on market conditions and the specific futures contract you are trading. It's important to monitor your margin requirements regularly and ensure that you have sufficient margin to cover potential losses. If your margin falls below the maintenance margin level, you may be required to deposit additional funds or close out positions to meet the margin requirements.

5. Use risk management tools: In addition to setting stop-loss orders, there are other risk management tools you can utilize in futures trading. For example, you can consider using trailing stop-loss orders, which automatically adjust as the price moves in your favor. This allows you to lock in profits while still giving your position room to grow.

6. Diversify your portfolio: Diversification is a key risk management strategy in any investment market, including futures trading. By spreading your capital across different futures contracts or asset classes, you can reduce the impact of potential losses on your overall portfolio. Diversification allows you to take advantage of different market opportunities while mitigating the risk associated with individual positions.

7. Stick to your trading plan: A well-defined trading plan is crucial for managing risk in futures trading. Your trading plan should outline your risk management strategies, including the use of leverage, position sizing, and stop-loss orders. By sticking to your plan and not deviating based on emotions or market fluctuations, you can maintain discipline and protect your capital.

Remember, risk management is an ongoing process in futures trading. As market conditions change, it's important to reassess your risk management strategies and adjust them accordingly. By effectively managing risk, you can protect your capital and increase your chances of long-term success in futures trading.

Analyzing Futures Market Trends

To make informed trading decisions in futures trading, it's essential to analyze market trends and identify potential trading opportunities. There are several approaches to market analysis, and combining multiple methods can provide a more comprehensive view of the market. Here are some key techniques for analyzing futures market trends:

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends in the market. Traders who use technical analysis believe that historical price movements can provide insights into future price movements. Some common technical analysis tools include trend lines, support and resistance levels, moving averages, and oscillators.

When conducting technical analysis, it's important to consider different timeframes. Short-term traders may focus on intraday charts and use indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Long-term traders, on the other hand, may analyze daily or weekly charts to identify broader market trends.

Fundamental Analysis

Fundamental analysis involves studying the underlying factors that influence the price of the futures contract. This can include economic data, company earnings reports, geopolitical events, and supply and demand factors. Fundamental analysis aims to determine the intrinsic value of the underlying asset and identify whether the current price is overvalued or undervalued.

When conducting fundamental analysis, it's important to stay updated on relevant news and events that may impact the market. Economic indicators such as GDP growth, interest rates, and inflation can have a significant impact on futures prices. Additionally, keeping an eye on industry-specific news and developments can provide insights into supply and demand dynamics.

Sentiment Analysis

Sentiment analysis involves gauging market sentiment and investor psychology to anticipate future price movements. It focuses on understanding the emotions and behavior of market participants, as these factors can influence buying and selling decisions. Sentiment analysis can be done through various methods, including analyzing social media sentiment, surveying market participants, or monitoring options and futures market activity.

Contrarian traders often use sentiment analysis to identify potential market reversals. For example, if the majority of market participants are excessively bullish, it may indicate that the market is overbought and due for a correction. Conversely, extreme pessimism may signal a market bottom and a potential buying opportunity.

Combining Different Analysis Methods

While technical, fundamental, and sentiment analysis are often used individually, combining different analysis methods can provide a more holistic view of the market. For example, a trader may use technical analysis to identify potential entry and exit points based on chart patterns, while also considering fundamental factors that may impact the overall trend.

Additionally, it's important to adapt your analysis approach to the specific futures contract you are trading. Different contracts have unique characteristics and are influenced by different factors. For example, agricultural futures may be more influenced by weather conditions and crop reports, while energy futures may be more affected by geopolitical events and supply-demand dynamics.

Developing a Trading Strategy

Developing a well-defined trading strategy is essential for success in futures trading. A trading strategy outlines your approach to the market, including entry and exit criteria, risk management guidelines, and position sizing rules. Here are some key steps to develop a trading strategy:

Identify Your Trading Goals

Before developing a trading strategy, it's important to identify your trading goals. What are you looking to achieve in futures trading? Are you aiming for short-term gains or long-term capital growth? Understanding your goals will help shape your trading strategy and determine the appropriate approach to the market.

For example, if your goal is to generate consistent income from futures trading, you may focus on strategies that involve selling options or utilizing spreads. On the other hand, if you're looking for larger capital appreciation, you may focus on directional strategies that aim to profit from market trends.

Choose Your Trading Style

There are different trading styles in futures trading, and each has its own advantages and considerations. Some common trading styles include day trading, swing trading, and position trading. Consider your personality, time availability, and risk tolerance when choosing a trading style.

Day trading involves opening and closing positions within the same trading day, aiming to profit from short-term price fluctuations. Swing trading involves holding positions for a few days to a few weeks to capture larger market moves. Position trading, on the other hand, involves holding positions for weeks to months, aiming to capture long-term trends.

Define Your Entry and Exit Criteria

Your trading strategy should clearly define your entry and exit criteria. This includes identifying specific technical or fundamental indicators that signal a potential entry or exit point. For example, you may decide to enter a long position when a certain moving average crosses above another moving average, indicating a bullish trend.

Similarly, you should establish criteria for exiting a position to protect yourself from potential losses or to secure profits. This may involve setting stop-loss orders based on a percentage of your account balance or using trailing stop-loss orders to lock in profits as the market moves in your favor.

Implement Risk Management Strategies

Risk management is a crucial component of any trading strategy. It involves implementing measures to protect your capital and limit potential losses. Consider using techniques such as setting stop-loss orders, diversifying your portfolio, and managing leverage effectively.

It's important to determine your risk tolerance and establish guidelines for position sizing. This involves determining the maximum amount of capital you are willing to risk on a single trade and adjusting your position size accordingly. By implementing risk management strategies, you can protect your capital and ensure long-term success.

Backtest and Evaluate Your Strategy

Once you have developed your trading strategy, it's important to backtest it using historical data to evaluate its performance. Backtesting involves applying your strategy to past market data to see how it would have performed in different market conditions.

During the backtesting process, evaluate key performance metrics such as the profitability ratio, win-loss ratio, and drawdowns. This will help you assess the effectiveness of your strategy and identify any areas for improvement. Keep in mind that past performance is not indicative of future results, but backtesting can provide valuable insights into the potential profitability of your strategy.

Continuously Monitor and Adapt Your Strategy

The markets are dynamic, and what works today may not work tomorrow. It's important to continuously monitor the performance of your trading strategy and adapt it as needed. Stay updated on market conditions, evaluate the impact of changes in volatility or economic factors, and make adjustments to your strategy accordingly.

Additionally, keep a trading journal to track your trades and analyze your decision-making process. A trading journal can help you identify patterns, strengths, and weaknesses in your trading strategyand provide valuable insights for improvement. By continuously monitoring and adapting your strategy, you can stay ahead of market trends and increase your chances of success in futures trading.

Practicing Trading with a Demo Account

Once you have developed your trading strategy, it's time to put it into practice using a demo account. A demo account allows you to trade in a simulated environment with virtual funds, providing an opportunity to test your strategy and gain practical experience without risking real money. Here are some key steps to effectively practice trading with a demo account:

Execute Trades Based on Your Strategy

Start by executing trades based on the entry and exit criteria defined by your trading strategy. Use the tools and features provided by the demo trading platform to place orders and monitor your positions. Pay attention to the execution speed, accuracy, and reliability of the platform, as these factors can have a significant impact on your trading experience.

As you execute trades, closely monitor the outcome and compare it to your expectations. Did the trade generate the anticipated profit or loss? Did the market behavior align with your analysis? This feedback will help you assess the effectiveness of your strategy and make any necessary adjustments.

Analyze and Evaluate Your Trades

After executing trades, take the time to analyze and evaluate your performance. Review the trades you placed, the reasons behind your decisions, and the outcome of each trade. Use the analytical tools provided by the demo trading platform to assess the profitability and effectiveness of your strategy.

Pay attention to key performance metrics such as the win-loss ratio, average profit or loss per trade, and maximum drawdown. These metrics will provide insights into the profitability and risk management of your strategy. Additionally, analyze the reasons behind any losing trades and identify any patterns or mistakes that can be corrected in future trades.

Make Adjustments to Your Strategy

Based on your analysis and evaluation, make adjustments to your trading strategy as needed. Identify any weaknesses or areas for improvement and refine your strategy accordingly. This may involve tweaking your entry or exit criteria, adjusting position sizing, or incorporating additional indicators or analysis methods.

It's important to remember that no strategy is perfect, and the market is constantly evolving. By continuously making adjustments and adaptations, you can stay ahead of market trends and increase the effectiveness of your strategy over time.

Experiment with Different Trading Techniques

While practicing with a demo account, take the opportunity to experiment with different trading techniques and approaches. Test out different indicators, timeframes, or trading styles to see what works best for you. This experimentation phase can help you discover new strategies or refine existing ones.

Keep a trading journal to record your observations and learnings from each trading session. This will allow you to track your progress, identify patterns, and make informed decisions based on past experiences. Regularly reviewing your trading journal will help you fine-tune your strategies and develop a deeper understanding of your trading style.

Transitioning to Live Trading

Once you feel confident in your trading abilities and have consistently achieved positive results in your demo account, you may consider transitioning to live trading. Live trading involves trading with real money and exposes you to the emotions and psychological aspects of the market. Here are some important factors to consider when transitioning from a demo account to live trading:

Start with a Small Capital Allocation

When transitioning to live trading, it's advisable to start with a small capital allocation. This allows you to test your strategy in a live environment while minimizing potential losses. Gradually increase your capital allocation as you gain more experience and confidence in your trading abilities.

Starting with a small capital allocation also helps you manage the psychological aspect of trading. Real money trading can evoke emotions such as fear and greed, which can impact your decision-making process. By starting small, you can gradually acclimate yourself to the emotional aspects of live trading and develop the discipline necessary for long-term success.

Monitor and Manage Your Emotions

Emotions play a significant role in trading, and it's important to be aware of their impact on your decision-making process. Fear and greed can cloud your judgment and lead to impulsive or irrational trading decisions. Develop strategies to manage your emotions, such as practicing mindfulness techniques or taking breaks during volatile market conditions.

Additionally, stick to your trading plan and avoid making impulsive trades based on short-term market fluctuations. Trust in the process and the strategies you have developed through thorough testing and analysis. Remember that trading is a marathon, not a sprint, and focus on the long-term profitability of your strategy.

Evaluate Your Performance and Learn from Mistakes

As you transition to live trading, it's crucial to continuously evaluate your performance and learn from your mistakes. Keep a trading journal and record the details of each trade, including entry and exit points, the rationale behind your decisions, and the outcome of each trade. Regularly review your journal to identify patterns, strengths, and weaknesses in your trading strategy.

Learn from your mistakes and use them as opportunities for growth and improvement. Identify any behavioral or psychological patterns that may be hindering your trading performance and develop strategies to overcome them. Seek feedback from experienced traders or consider working with a trading mentor who can provide guidance and support.

Stay Educated and Adapt to Market Changes

Markets are constantly evolving, and it's important to stay educated and adapt to changes in market conditions. Continuously update your knowledge by reading books, attending webinars or seminars, and following reputable financial news sources. Stay informed about economic indicators, geopolitical events, and industry-specific news that may impact the futures market.

As you gain more experience and confidence in your trading abilities, consider expanding your trading horizons by exploring different futures contracts or asset classes. Diversifying your trading portfolio can help you manage risk and take advantage of various market opportunities.

Additional Resources and Support

As you continue your futures trading journey, there are many additional resources and support available to enhance your knowledge and connect with a supportive trading community. Here are some valuable resources to consider:

Books and Online Courses

There are numerous books and online courses available that provide in-depth knowledge and insights into futures trading. Look for reputable authors or educators who have a wealth of experience in the field. These resources can help you deepen your understanding of technical analysis, fundamental analysis, risk management techniques, and trading psychology.

Consider joining online communities or forums dedicated to futures trading. These platforms allow you to connect with like-minded individuals, share ideas, and learn from experienced traders. Engaging in discussions and asking questions can provide valuable insights and support as you continue to develop your trading skills.

Financial News and Analysis Platforms

Stay updated on the latest financial news and analysis by following reputable financial news platforms. These platforms provide insights into market trends, economic indicators, and industry-specific developments that may impact futures trading. Consider subscribing to newsletters or setting up news alerts to stay informed in real-time.

In addition to news platforms, there are also specialized analysis platforms that provide advanced charting tools, technical indicators, and in-depth market analysis. These platforms can help you refine your trading strategies and make more informed trading decisions.

Continued Education and Learning

Never stop learning in the world of futures trading. Attend webinars or seminars hosted by industry experts to gain insights into new trading strategies or emerging market trends. Consider enrolling in advanced courses or certifications that can further enhance your knowledge and credentials as a futures trader.

Lastly, network with other traders and professionals in the industry. Attend trading conferences or events where you can connect with experienced traders, industry experts, and representatives from brokerage firms. Building a strong network can provide valuable support, guidance, and potential collaboration opportunities.

In conclusion, demo account futures trading is an invaluable tool for beginners looking to enter the world of futures trading. By utilizing a demo account, you can gain hands-on experience, test trading strategies, and develop the skills necessary for successful trading. Remember, practice makes perfect, and a demo account is the perfect place to start your futures trading journey. With a solid understanding of demo account futures trading, you can confidently transition to live trading and pursue your financial goals in the exciting world of futures markets.