Choosing the Best Futures Trading Online Broker

Are you looking to dive into the exciting world of futures trading? Finding a reliable and efficient online broker is essential to your success in this fast-paced market. With numerous options available, it can be overwhelming to determine which one is the best fit for your needs. In this blog post, we will provide you with a comprehensive guide to help you choose the best futures trading online broker that suits your trading style and goals.

When selecting a futures trading online broker, several factors should be considered, such as trading platform features, commission structure, customer support, and available markets. This article aims to walk you through each aspect, providing detailed insights and comparisons to empower you to make an informed decision.

Trading Platform Features

Exploring the key features and functionalities of different trading platforms is crucial. The trading platform serves as your gateway to the futures market, so it's important to choose one that meets your requirements and preferences. Look for a platform that offers a user-friendly interface, intuitive navigation, and customizable options. This allows you to tailor the platform to your trading style and preferences, making your trading experience more efficient and effective.

User-Friendly Interface

Having a user-friendly interface is essential, especially if you are new to futures trading. Look for a platform that provides a clean and intuitive layout, with clearly labeled buttons and menus. This ensures that you can easily navigate through the platform and execute trades without any confusion or delays.

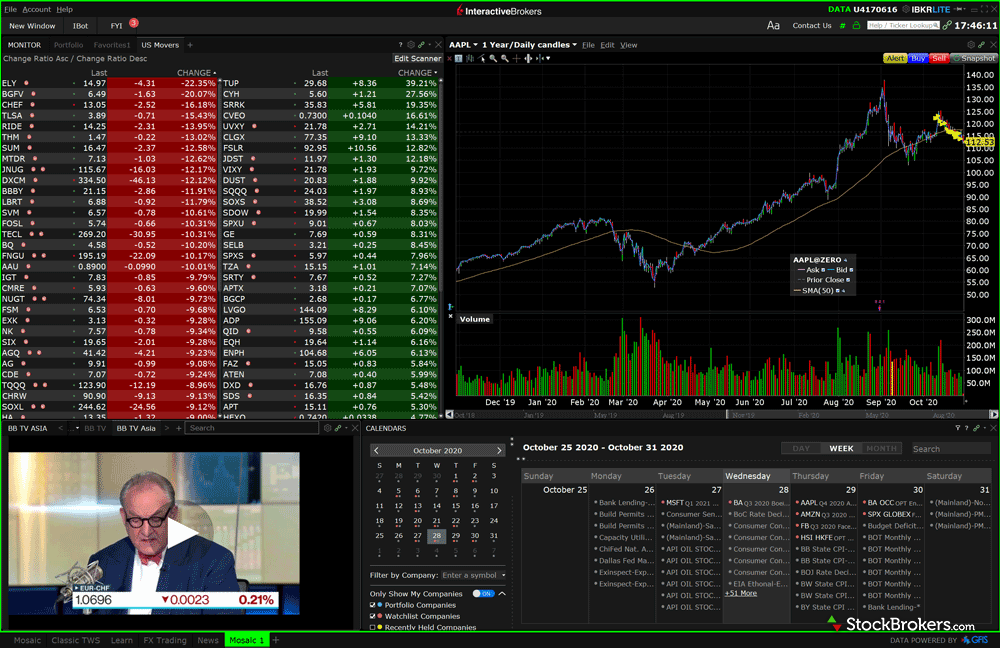

Advanced Charting Capabilities

Advanced charting capabilities are crucial for technical analysis, which plays a significant role in futures trading. Look for a platform that offers a wide range of charting tools, indicators, and drawing tools. This allows you to analyze price movements, identify trends, and make informed trading decisions.

Order Execution Speed

In the fast-paced world of futures trading, order execution speed is of utmost importance. Look for a platform that provides fast and reliable order execution, minimizing slippage and ensuring that your trades are executed at the desired price. A slow execution speed can result in missed trading opportunities and potential losses.

Commission Structure

Comparing commission structures is essential to identify the most cost-effective option. Different brokers may have varying commission fees, account types, and additional charges. It's important to understand these costs and how they can impact your trading profitability.

Commission Fees

Commission fees are the charges you incur for each futures trade you execute. Some brokers may charge a fixed fee per contract, while others may offer a tiered structure based on your trading volume. Carefully analyze the commission fees of different brokers and consider your trading frequency to determine which structure is more cost-effective for you.

Account Types

Brokers may offer different types of accounts with varying commission structures. Some brokers may have a standard account with a fixed commission fee, while others may offer a premium account with lower commission fees but require a higher minimum deposit. Assess the commission structure associated with each account type and choose the one that aligns with your trading volume and budget.

Additional Charges

In addition to commission fees, brokers may have other charges that can affect your trading costs. These charges can include platform fees, data fees, and inactivity fees. Take into account any additional charges when comparing the commission structure of different brokers to get a clear picture of the overall costs.

Customer Support

Reliable customer support is crucial in the world of futures trading. The futures market operates 24 hours a day, and you need a broker that can provide prompt assistance whenever you encounter issues or have questions. Look for brokers that offer multiple channels of communication, such as phone, email, and live chat.

Availability

Check the availability of customer support. Ideally, your broker should have customer support representatives available around the clock, especially during market hours. This ensures that you can get timely assistance whenever you need it, regardless of your time zone.

Responsiveness

It's important to assess the responsiveness of customer support. Look for brokers that are known for their quick response times and efficient resolution of issues. Prompt and effective customer support can save you valuable time and prevent potential trading losses.

Quality of Support

Consider the quality of customer support provided by different brokers. Look for brokers that have knowledgeable and helpful support representatives who can address your trading-related concerns. A broker with excellent customer support can provide valuable guidance and help you navigate through any challenges you may encounter.

Available Markets

Examining the range of futures markets offered by online brokers is vital. The availability of diverse markets allows you to diversify your trading portfolio and take advantage of different trading opportunities. Look for brokers that offer a wide range of futures markets, including commodities, currencies, indices, and more.

Commodity Futures

Commodity futures involve trading contracts for physical goods such as gold, oil, natural gas, and agricultural products. Having access to a variety of commodity futures allows you to take advantage of price movements in different sectors, diversifying your trading strategy.

Currency Futures

Currency futures involve trading contracts based on the exchange rates between different currencies. Having access to currency futures allows you to speculate on the direction of currency pairs, taking advantage of fluctuations in global currency markets.

Index Futures

Index futures involve trading contracts based on the performance of a specific stock market index, such as the S&P 500 or the Nasdaq 100. Having access to index futures allows you to trade the overall direction of the stock market without having to buy individual stocks.

Interest Rate Futures

Interest rate futures involve trading contracts based on the future value of interest rates. These futures contracts allow you to speculate on changes in interest rates, which can have a significant impact on various financial markets.

Other Futures Markets

Some brokers may offer access to additional futures markets, such as energy futures, metal futures, bond futures, or agricultural futures. Consider your trading strategy and interests when choosing a broker and ensure they provide the markets you wish to trade.

Account Types and Minimum Deposits

Understanding the different account types and minimum deposit requirements is essential to find a broker that aligns with your budget and trading goals. Brokers may offer various account types, each with different features and requirements.

Standard Accounts

Standard accounts are the most common type of trading account offered by brokers. These accounts typically have lower minimum deposit requirements and provide access to a wide range of futures markets. Standard accounts are suitable for most traders, especially those who are starting with a smaller capital.

Premium Accounts

Premium accounts, also known as VIP or Pro accounts, are often designed for experienced traders or those who trade with larger volumes. These accounts may have higher minimum deposit requirements but offer lower commission fees and additional benefits such as personalized support and access to advanced trading tools.

Micro Accounts

Micro accounts are a type of account that allows traders to start with a very small initial deposit. These accounts are suitable for beginners who want to get a feel for futures trading without risking a significant amount of capital. Micro accounts often have limited features and higher commission fees.

Minimum Deposit Requirements

Each broker has its own minimum deposit requirement for different account types. It's important to consider your financial capabilities and trading goals when choosing an account type. Ensure that the minimum deposit requirement is within your budget and allows you to trade comfortably.

Educational Resources

Having access to educational resources can significantly benefit both beginner and experienced traders. Look for brokers that offer a comprehensive range of educational materials to enhance your trading knowledge and skills.

Tutorials and Webinars

Brokers may provide tutorials and webinars on various aspects of futures trading, including basic concepts, trading strategies, technical analysis, and risk management. These educational resources can help you develop a solid foundation and improve your trading expertise.

Market Analysis Tools

Some brokers offer market analysis tools that provide insights into market trends and potential trading opportunities. These tools may include daily market reports, research articles, and expert analysis. Utilizing these resources can help you make more informed trading decisions.

Demo Accounts

Many brokers offer demo accounts, which allow you to practice trading without risking real money. Demo accounts simulate real market conditions, providing a risk-free environment to test your trading strategies and familiarize yourself with the broker's trading platform.

Community Forums

Some brokers have community forums where traders can interact, share ideas, and discuss trading strategies. Participating in these forums can provide valuable insights and allow you to learn from experienced traders.

Risk Management Tools

Effective risk management is crucial in futures trading to protect your capital and minimize potential losses. Look for brokers that offer a range of risk management tools to help you manage your trades and control your risk exposure.

Stop-Loss Orders

Stop-loss orders allow you to set a specific price at which your position will be automatically closed to limit your potential losses. This toolhelps you manage risk by ensuring that you exit a trade if it moves against you beyond a predetermined level. Look for brokers that offer flexible stop-loss order options, such as trailing stops or guaranteed stops, to provide additional protection.

Trailing Stops

Trailing stops are a type of stop-loss order that automatically adjusts as the market price moves in your favor. This allows you to lock in profits while still giving your trades room to breathe. Trailing stops can be an effective tool for protecting your gains and maximizing your profit potential.

Margin Requirements

Margin requirements determine the amount of funds you need to have in your trading account to open and maintain a futures position. Brokers may have different margin requirements for different futures contracts and account types. It's important to understand the margin requirements of your chosen broker to ensure that you have sufficient funds to cover your positions and avoid margin calls.

Risk Assessment Tools

Some brokers provide risk assessment tools that help you evaluate the potential risk and reward of a trade before entering it. These tools may include calculators that allow you to estimate your potential profit or loss based on different scenarios and position sizes. Utilizing these tools can help you make more informed and risk-conscious trading decisions.

Mobile Trading Capabilities

In today's fast-paced world, having access to mobile trading platforms is essential. Look for brokers that offer mobile trading capabilities that allow you to monitor and manage your trades on the go, ensuring flexibility and convenience.

Mobile App Features

When evaluating mobile trading platforms, consider the features available on the broker's mobile app. Look for apps that provide a user-friendly interface, real-time market data, advanced charting tools, and order execution capabilities. The app should be compatible with both iOS and Android devices to cater to a wide range of users.

Ease of Use

An intuitive and easy-to-use mobile app is crucial, especially if you are frequently trading on the move. Look for apps that offer a seamless and efficient trading experience, with simple navigation, clear order placement, and quick access to account information.

Notifications and Alerts

Mobile trading platforms should provide notifications and alerts to keep you updated on market movements and important events. Look for apps that allow you to set price alerts, news alerts, and order execution notifications. These features ensure that you stay informed and can take action promptly, even when you are away from your computer.

Security Measures

Security is paramount when it comes to mobile trading. Look for brokers that prioritize the security of their mobile apps, implementing measures such as encryption and two-factor authentication to protect your account and personal information. Additionally, ensure that the app has a secure login process and offers the option to remotely wipe data in case of loss or theft.

Research and Analysis Tools

Access to comprehensive research and analysis tools can greatly enhance your trading decisions. Look for brokers that offer a wide range of research and analysis tools to help you stay informed and make more accurate predictions.

Real-Time Market Data

Real-time market data is essential for making informed trading decisions. Look for brokers that provide access to real-time price quotes, order book data, and market depth. Having up-to-date information ensures that you can react quickly to market movements and execute trades at the desired prices.

Technical Analysis Indicators

Technical analysis is a common approach to futures trading. Look for brokers that offer a wide range of technical analysis indicators, such as moving averages, oscillators, and trend lines. These tools can help you identify patterns and trends in price movements, improving your entry and exit timing.

News Feeds and Market Analysis

Staying updated on market news and analysis is crucial for understanding the factors that can impact futures prices. Look for brokers that provide access to real-time news feeds, market commentary, and research reports. These resources can help you gain insights into market trends and make more informed trading decisions.

Economic Calendar

An economic calendar is a tool that provides a schedule of upcoming economic events and indicators. Look for brokers that offer an economic calendar within their platform. This allows you to stay informed about important economic releases that can have a significant impact on futures prices, helping you plan your trades accordingly.

Regulation and Security

Ensuring the safety of your funds and personal information is paramount. Look for brokers that are regulated by reputable financial authorities and implement robust security measures to protect your assets and maintain your privacy.

Regulatory Compliance

Regulation is important as it ensures that brokers operate within a set of rules and standards designed to protect traders. Look for brokers that are regulated by recognized financial authorities, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Regulatory compliance provides an added layer of protection for your funds and ensures that the broker follows industry best practices.

Segregated Accounts

Segregated accounts are bank accounts where brokers keep client funds separate from their own operating funds. Look for brokers that offer segregated accounts, as this provides an additional level of protection in the event of the broker's insolvency. Segregated accounts ensure that your funds are kept separate from the broker's assets and can be easily returned to you in case of any financial issues.

Data Encryption

Data encryption is a security measure that ensures that your personal information and trading data are protected from unauthorized access. Look for brokers that use advanced encryption protocols, such as Secure Socket Layer (SSL) or Transport Layer Security (TLS), to secure your data during transmission. This encryption technology makes it extremely difficult for hackers to intercept and decipher your information.

Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your trading account. Look for brokers that offer 2FA, which requires you to provide a second form of verification, such as a unique code generated by a mobile app, in addition to your username and password. This ensures that even if someone gains access to your login credentials, they would still need the second factor to access your account.

In conclusion, selecting the best futures trading online broker requires careful consideration of multiple factors. By thoroughly analyzing trading platform features, commission structures, customer support, available markets, account types, educational resources, risk management tools, mobile trading capabilities, research and analysis tools, as well as regulation and security, you can make an informed decision that aligns with your trading goals and preferences. Remember, finding the right broker is a crucial step towards achieving success in the exciting world of futures trading.