The Best Brokers for Futures Trading

In the fast-paced world of futures trading, having the right broker can make all the difference. Whether you are a seasoned trader or just starting out, finding a broker that offers the right tools, competitive pricing, and excellent customer service is crucial. In this comprehensive guide, we will explore the best brokers for futures trading, helping you make an informed decision and maximize your trading potential.

When it comes to futures trading, there are several factors to consider when choosing a broker. These include the trading platform, commission and fees, range of products offered, educational resources, and customer support. Our guide will delve into each of these aspects, providing you with detailed insights and recommendations to help you find the best broker for your needs.

User-Friendly Trading Platforms

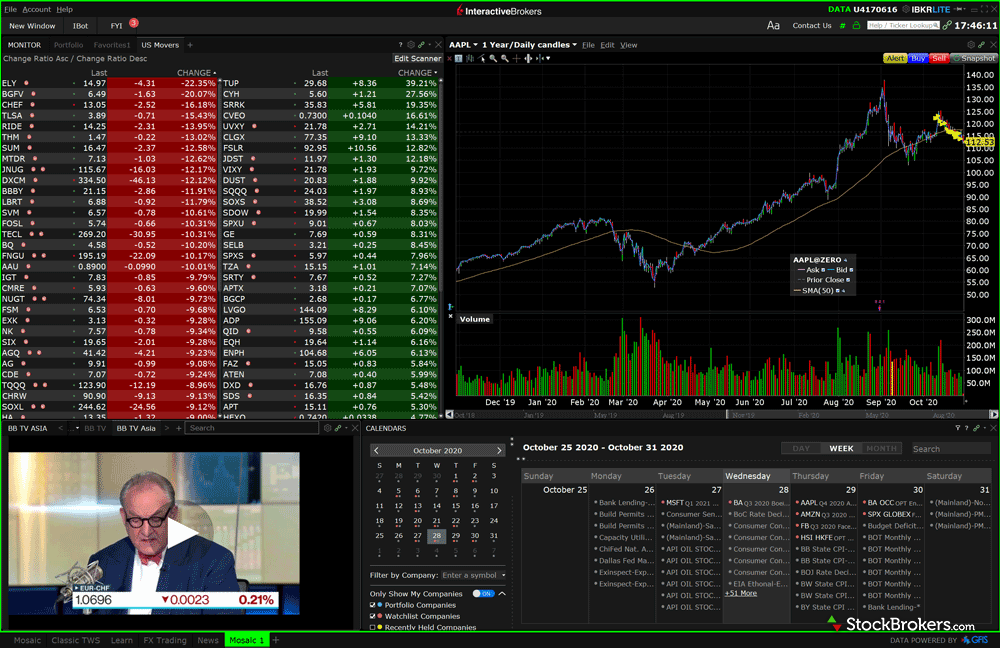

A user-friendly trading platform is essential for seamless and efficient futures trading. A well-designed platform should provide intuitive navigation, advanced charting tools, real-time market data, and customizable interfaces to cater to traders of all levels. It should also offer order execution capabilities with minimal latency, ensuring your trades are executed quickly and accurately.

Brokers that excel in this area often provide platforms that are not only easy to use but also offer a wide range of features. Look for platforms that offer customizable watchlists, advanced order types, and the ability to set up alerts and notifications. Additionally, some brokers may offer mobile trading platforms that allow you to trade on the go.

Summary: This section will provide an overview of the best brokers known for their user-friendly trading platforms, highlighting their key features and benefits.

Intuitive Navigation

A user-friendly trading platform should have intuitive navigation that allows you to quickly find the information and tools you need. Look for platforms that have a well-organized interface with easy-to-understand menus and buttons. The platform should also provide a seamless user experience, allowing you to switch between different sections and features effortlessly.

Advanced Charting Tools

Advanced charting tools are essential for technical analysis in futures trading. Look for brokers that offer robust charting capabilities, including a variety of chart types, timeframes, and drawing tools. The platform should also allow you to overlay technical indicators and perform in-depth analysis of price movements.

Real-Time Market Data

Accurate and up-to-date market data is crucial for successful futures trading. Ensure that the broker's trading platform provides real-time streaming quotes, news feeds, and market depth information. This will enable you to make informed trading decisions based on the latest market conditions.

Customizable Interfaces

Every trader has different preferences and trading styles. Look for brokers that offer customizable interfaces, allowing you to personalize the platform to suit your needs. This may include the ability to rearrange windows, create custom layouts, and save preferred settings.

Competitive Commission and Fees

Trading costs can significantly impact your profitability, so it's important to choose a broker that offers competitive commission rates and low fees. When comparing commission structures, consider both the per-trade commission and any additional fees that may be charged, such as exchange fees, clearing fees, or data fees.

While low fees are important, it's also essential to consider the value you receive for the cost. Some brokers may offer additional features or services that justify a slightly higher commission. Consider your trading volume and frequency to determine which commission structure is most cost-effective for your trading style.

Summary: In this section, we will compare the commission rates and fees of various brokers, enabling you to make an informed decision based on your trading style and budget.

Per-trade Commission

The per-trade commission is the fee charged by the broker for each futures contract you trade. Some brokers offer a flat rate per contract, while others may have a tiered structure where the commission decreases as your trading volume increases. Consider your average trade size and frequency to determine which commission structure is most cost-effective for you.

Additional Fees

In addition to the per-trade commission, brokers may charge additional fees that can impact your overall trading costs. These fees can include exchange fees, which are charged by the futures exchange for executing your trades, as well as clearing fees, which are charged by the clearinghouse for processing and settling your trades. Some brokers may also charge data fees for accessing real-time market data.

It's important to carefully review the fee schedule of each broker to understand the total cost of trading. Consider your trading volume and the markets you plan to trade to determine which broker offers the most competitive fee structure for your needs.

Diverse Range of Products

A diverse range of futures products allows traders to explore different markets and diversify their portfolios. Look for brokers that offer a wide selection of futures contracts, including indices, commodities, currencies, and more. This will allow you to trade in multiple markets and take advantage of various trading opportunities.

Summary: This section will highlight the brokers that provide the most extensive range of futures products, allowing you to access multiple markets and capitalize on various trading opportunities.

Indices

Indices futures contracts allow traders to speculate on the performance of a specific stock market index, such as the S&P 500 or the Dow Jones Industrial Average. These contracts provide exposure to the overall market and can be used for hedging or speculative purposes.

Look for brokers that offer a wide range of indices futures contracts from different global markets. This will allow you to diversify your trading and take advantage of opportunities in various regions.

Commodities

Commodities futures contracts allow traders to speculate on the price movements of various commodities, such as gold, oil, natural gas, or agricultural products. These contracts provide exposure to the underlying commodity without the need for physical delivery.

Consider brokers that offer a diverse range of commodity futures contracts, allowing you to trade in different sectors and take advantage of price movements in various commodities.

Currencies

Currency futures contracts allow traders to speculate on the exchange rate between two currencies. These contracts provide exposure to the foreign exchange market and can be used for hedging or speculative purposes.

Look for brokers that offer a wide range of currency futures contracts, including major currency pairs as well as exotic pairs. This will allow you to trade in different currency markets and take advantage of currency fluctuations.

Educational Resources for Traders

Education is key to becoming a successful futures trader. Look for brokers that offer comprehensive educational resources to help you enhance your trading skills and knowledge. These resources may include webinars, tutorials, market analysis, trading guides, and educational platforms.

Summary: Here, we will outline the brokers that prioritize trader education and provide valuable resources to help you improve your trading knowledge and strategies.

Webinars and Tutorials

Webinars and tutorials are a valuable resource for both beginner and experienced traders. Look for brokers that offer regular webinars on various trading topics, such as technical analysis, risk management, and trading strategies. These webinars should be presented by experienced traders or industry experts and provide practical insights and actionable tips.

In addition to webinars, brokers may also offer tutorial videos or written guides that cover the basics of futures trading, platform walkthroughs, and advanced trading concepts. These resources can help you build a solid foundation of knowledge and improve your trading skills.

Market Analysis and Research

Access to quality market analysis and research can significantly enhance your trading decisions. Look for brokers that provide daily or weekly market analysis reports, including technical analysis, fundamental analysis, and market commentary. These reports should cover a wide range of markets and provide insights into potential trading opportunities.

Brokers may also offer research tools and resources, such as economic calendars, earnings calendars, and company-specific research reports. These resources can help you stay informed about upcoming events that may impact the markets and make more informed trading decisions.

Educational Platforms

Some brokers offer dedicated educational platforms that provide a comprehensive learning experience for traders. These platforms may include interactive courses, quizzes, and trading simulations that allow you to practice your trading skills without risking real money.

Look for brokers that offer educational platforms with structured learning paths, covering topics from beginner to advanced levels. These platforms should provide a combination of theory and practical exercises to help you apply your knowledge in real trading situations.

Reliable Customer Support

Having reliable customer support is essential when trading futures, as timely assistance can make a significant difference during volatile market conditions. Look for brokers that offer multiple channels of customer support, such as phone, email, and live chat. The support team should be responsive, knowledgeable, and able to provide prompt assistance when needed.

Summary: In this section, we will highlight brokers that prioritize customer support, ensuring you have access to responsive assistance whenever you need it.

Responsive Communication Channels

Brokers that prioritize customer support will offer multiple channels of communication, making it easy for you to reach out for assistance. Look for brokers that provide phone support with dedicated customer service representatives who can address your queries or concerns promptly.

In addition to phone support, brokers may also offer email support or live chat options. Live chat can be particularly beneficial as it allows for instant communication and quick resolution of issues.

Knowledgeable Support TeamKnowledgeable Support Team

A knowledgeable support team is crucial when seeking assistance from your broker. Look for brokers that have support representatives who are well-trained and experienced in futures trading. They should have a deep understanding of the platform, market dynamics, and trading concepts to provide accurate and helpful guidance.

When reaching out to customer support, evaluate their responsiveness and the quality of their answers. A reliable broker will have a support team that can efficiently address your concerns and provide clear solutions or explanations.

24/7 Support Availability

Since futures markets operate around the clock, it's important to choose a broker that offers 24/7 customer support. This ensures that you can get assistance whenever you need it, even during non-traditional trading hours or in case of emergencies. Look for brokers that provide round-the-clock support via phone or live chat.

Having access to 24/7 support can be especially valuable during periods of high market volatility or when unexpected events occur that may impact your trading positions.

Advanced Trading Tools and Features

Advanced trading tools and features can give traders a competitive edge. Look for brokers that offer innovative tools and features designed to enhance your trading experience and improve your trading strategies.

Summary: This section will outline the brokers that provide advanced trading tools and features, enabling you to optimize your trading strategies and stay ahead of the curve.

Algorithmic Trading

Algorithmic trading, also known as automated trading, involves using computer algorithms to execute trades based on predefined criteria. Look for brokers that offer algorithmic trading capabilities, allowing you to automate your trading strategies and take advantage of market opportunities without constant manual intervention.

Consider brokers that provide a user-friendly interface for creating and backtesting algorithms. The platform should also offer access to historical and real-time data to facilitate algorithm development and optimization.

Customizable Indicators and Technical Analysis Tools

Technical analysis is a key component of futures trading. Look for brokers that offer a wide range of customizable indicators and technical analysis tools. These tools should allow you to perform in-depth analysis of price movements, identify trends, and generate trading signals.

Consider brokers that provide popular technical analysis tools such as moving averages, oscillators, trend lines, and Fibonacci retracement levels. The platform should also allow you to create and save custom indicators to suit your specific trading strategies.

Direct Market Access (DMA)

Direct Market Access (DMA) allows traders to bypass intermediaries and trade directly with liquidity providers or exchanges. Look for brokers that offer DMA, as it can provide faster order execution and potentially lower trading costs.

Brokers that provide DMA often offer access to multiple liquidity sources, allowing you to access the best available prices and depth of market. This can be particularly important for high-frequency traders or those executing large orders.

Regulation and Security

Regulation and security are crucial factors to consider when choosing a futures broker. Look for brokers that are regulated by reputable financial authorities, as this ensures they adhere to strict standards and provide a safe trading environment.

Summary: Here, we will provide an overview of the regulatory frameworks and security measures implemented by the top brokers, ensuring you can trade with peace of mind.

Regulatory Oversight

Regulation helps protect traders by ensuring brokers operate in a fair and transparent manner. Look for brokers that are regulated by well-established financial authorities, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

Regulated brokers are required to meet certain capital requirements, segregate client funds from their own, and adhere to strict operational and reporting standards. This provides an additional layer of security for your funds and helps ensure fair trading practices.

Security Measures

Security measures are essential to protect your personal and financial information. Look for brokers that implement robust security protocols, such as data encryption, two-factor authentication, and secure socket layer (SSL) technology.

Additionally, brokers may offer additional security features, such as insurance coverage for client funds or the option to set up withdrawal restrictions. These measures can provide added peace of mind when trading with a broker.

Mobile Trading Experience

With the rise of mobile trading, having a reliable and user-friendly mobile app is essential for on-the-go futures trading. Look for brokers that offer robust mobile trading platforms, allowing you to monitor the markets and execute trades from anywhere.

Summary: In this section, we will evaluate the mobile trading experience provided by different brokers, helping you choose a broker that offers a seamless and convenient mobile trading solution.

Mobile App Functionality

A good mobile trading app should provide all the essential features and functionality available on the desktop platform. Look for brokers that offer mobile apps that are easy to navigate, provide real-time market data, and allow for quick and secure order execution.

The app should also offer advanced charting capabilities, customizable watchlists, and the ability to set up alerts and notifications. Additionally, consider brokers that offer mobile apps for both iOS and Android devices to cater to a wider range of users.

Stability and Reliability

When trading on a mobile app, stability and reliability are crucial. Look for brokers that have invested in developing a stable and reliable mobile trading platform that can handle high volumes of trading activity without crashing or experiencing delays.

Read user reviews and consider the reputation of the broker's mobile app to ensure that it provides a smooth and seamless trading experience. A stable and reliable mobile app will allow you to trade with confidence, even during periods of high market volatility.

Demo Accounts and Practice Trading

For beginners or traders looking to test their strategies, having access to demo accounts and practice trading is invaluable. Look for brokers that offer demo accounts, enabling you to hone your skills and gain confidence before trading with real money.

Summary: Here, we will discuss the brokers that provide demo accounts and practice trading, allowing you to gain hands-on experience without risking your capital.

Demo Accounts

Demo accounts provide a risk-free environment for practicing and familiarizing yourself with the broker's trading platform. Look for brokers that offer demo accounts with virtual funds that mirror real market conditions.

A demo account allows you to test different trading strategies, practice order execution, and get a feel for the platform's features and functionality. It's an excellent way to gain confidence and improve your trading skills without risking your own money.

Practice Trading Tools

Some brokers may offer additional practice trading tools or simulators that allow you to simulate real market conditions and test your strategies in real-time. These tools can provide a more interactive and immersive practice trading experience.

Consider brokers that offer practice trading tools with features such as real-time market data, customizable trading conditions, and performance analytics. These tools can help you refine your trading strategies and identify areas for improvement.

Broker Reputation and Reviews

Lastly, we will consider the reputation and reviews of each broker, taking into account feedback from traders and industry experts. A broker's reputation can provide valuable insights into their reliability, customer service, and overall trading experience.

Summary: In this final section, we will summarize the reputation and reviews of the brokers, helping you make an informed decision based on the experiences of other traders.

Trader Feedback and Reviews

Research and read reviews from other traders to gauge their experiences with different brokers. Look for feedback on various aspects, such as customer service, platform stability, order execution, and overall satisfaction.

Consider both positive and negative reviews, as they can provide a balanced perspective on the strengths and weaknesses of each broker. Additionally, check reputable industry websites and forums for discussions and recommendations from experienced traders.

Industry Recognition and Awards

Industry recognition and awards can also be a good indicator of a broker's reputation and reliability. Look for brokers that have received awards or accolades from reputable financial publications or industry organizations.

These awards are often based on factors such as customer satisfaction, innovation, and overall performance. Brokers that have been consistently recognized for their excellence are likely to provide a high-quality trading experience.

In conclusion, choosing the best broker for futures trading requires careful consideration of various factors. By exploring the user-friendly platforms, competitive pricing, diverse product offerings, educational resources, customer support, advanced trading tools, regulation and security, mobile trading experience, demo accounts, and broker reputation, you can find the perfect fit for your trading needs. Make an informed decision and embark on your futures trading journey confidently with the right broker by your side.