Is Webull Free Trading? A Comprehensive Guide to Webull's Pricing Structure

In today's digital age, online trading platforms have revolutionized the way individuals invest in the stock market. Webull is one such platform that has gained popularity for its user-friendly interface and advanced trading features. However, before diving into the world of online trading, many potential users wonder, "Is Webull free trading?" In this comprehensive guide, we will explore the pricing structure of Webull and shed light on the various fees and charges associated with the platform.

Webull offers a range of services and features that cater to both beginner and experienced traders. Understanding the costs involved is crucial for making informed decisions and maximizing your investment potential. So, let's delve into the details and unravel the truth behind Webull's pricing model.

Account Opening and Maintenance

When it comes to account opening and maintenance, Webull offers a truly fee-free experience. Unlike some traditional brokerage firms, Webull does not charge any fees for creating or maintaining an account. This makes it an attractive option for those looking to start their investment journey without incurring unnecessary costs.

Webull's account opening process is straightforward and can be completed entirely online. Users need to provide personal information, including their name, email address, and phone number. Additionally, Webull requires users to verify their identity by providing a valid form of identification, such as a driver's license or passport. Once the account is opened, users can access a wide range of trading features and tools.

Managing and maintaining a Webull account is also hassle-free. Users can conveniently monitor their investments, track portfolio performance, and access account statements through the Webull mobile app or website. The platform is designed to provide a seamless user experience, allowing investors to focus on their trading strategies without worrying about account maintenance fees.

Summary:

Webull does not charge any fees for account opening or maintenance. The process is straightforward, and users can manage their accounts effortlessly through the mobile app or website.

Commission Fees

One of the significant advantages of Webull is its commission-free trading policy. This means that users can buy and sell stocks, ETFs, and options without incurring any commission charges. This is a valuable feature for investors who engage in frequent trading activities, as it helps minimize costs and maximize potential returns.

Commission fees can significantly impact an investor's profitability, especially for those who trade frequently or execute large orders. Traditional brokerage firms often charge a fixed commission fee or a percentage of the trade value. However, Webull has disrupted this industry norm by eliminating commission fees entirely, making it an attractive option for cost-conscious traders.

Webull's commission-free trading applies to both market and limit orders. Market orders are executed at the prevailing market price, while limit orders allow users to set a specific price at which they are willing to buy or sell a security. By offering commission-free trading for both order types, Webull empowers users to execute trades without worrying about the impact of fees on their investment returns.

It's important to note that while Webull does not charge commissions, other fees such as regulatory and exchange fees may still apply. These fees are imposed by regulatory bodies and stock exchanges and are separate from Webull's pricing structure. We will discuss these fees in more detail in later sections.

Summary:

Webull offers commission-free trading, allowing investors to save on transaction costs. This applies to both market and limit orders, providing flexibility for executing trades at the desired prices.

Margin Trading

Webull also provides margin trading services for qualified users. Margin trading allows investors to borrow funds from the broker to amplify their trading power. This can potentially enhance both profit opportunities and risks. However, it is important to note that margin trading is not entirely free on Webull. The platform charges interest on borrowed funds, which is calculated based on the amount borrowed and the prevailing interest rate.

Margin trading can be a useful tool for experienced traders looking to leverage their capital and potentially magnify their returns. Webull offers two types of margin accounts: the Gold account and the Cash account. The Gold account requires a minimum account balance of $2,000 and provides access to higher borrowing limits and additional trading features. On the other hand, the Cash account does not require a minimum balance but has more limited borrowing capabilities.

It's crucial for margin traders to understand the risks involved, as borrowing funds to trade can lead to significant losses if not managed properly. Webull provides educational resources and risk management tools to help users make informed decisions when engaging in margin trading. Traders should carefully assess their risk tolerance, financial situation, and market conditions before utilizing margin trading on Webull.

Summary:

Margin trading on Webull incurs interest charges on borrowed funds. It is available to qualified users and can amplify both profit opportunities and risks. Traders should carefully assess their risk tolerance and market conditions before engaging in margin trading.

Extended Trading Hours

Webull stands out for offering extended trading hours, allowing users to trade before and after the regular market hours. This can be advantageous for investors who want to react to news or events that occur outside of standard trading hours. However, it's important to note that trading during extended hours may involve additional risks, such as higher volatility and lower liquidity.

Webull's extended trading hours are available from 4:00 am to 8:00 pm Eastern Time, providing users with an extended window of opportunity to execute trades. This feature can be particularly beneficial for active traders and individuals with busy schedules who cannot trade during regular market hours.

During extended hours, users can place market and limit orders, similar to regular trading hours. However, it's important to be aware that not all securities are available for trading during extended hours. Webull provides a list of eligible stocks and ETFs on its platform, ensuring transparency and helping users make informed trading decisions.

While extended trading hours can offer advantages, it's crucial to exercise caution and consider the risks involved. During non-regular hours, the market may experience wider bid-ask spreads, lower liquidity, and increased price volatility. This can potentially impact trade execution and result in unexpected outcomes. Traders should carefully evaluate their strategies and risk tolerance before participating in extended-hour trading on Webull.

Summary:

Webull provides extended trading hours, enabling users to trade outside regular market hours. This feature can be beneficial for investors who want to capitalize on news or events occurring outside of standard trading hours, but it also entails additional risks such as higher volatility and lower liquidity.

Deposits and Withdrawals

Webull allows users to deposit and withdraw funds from their accounts without any fees. You can link your bank account to your Webull account and transfer funds seamlessly. Deposits are typically processed within one to five business days, depending on your bank's processing time. The funds become available for trading once they are settled in your Webull account.

Webull supports Automated Clearing House (ACH) transfers, which are electronic transfers between financial institutions. ACH transfers are a secure and convenient way to deposit funds into your Webull account. Users can initiate deposits through the Webull app or website by providing their bank account details. It's important to ensure that you have sufficient funds in your bank account to cover the transfer.

Withdrawals from Webull can be made at any time, and there are no fees associated with withdrawing funds. The withdrawal process is straightforward, and users can initiate withdrawals through the Webull app or website. It's important to note that withdrawals may take several business days to reach your bank account, depending on your bank's processing time.

While Webull does not charge fees for deposits and withdrawals, it's essential to consider that your bank may impose its own fees or restrictions on transfers. It's advisable to check with your bank beforehand to understand any potential fees or limitations that may apply.

Summary:

Webull does not charge any fees for deposits and withdrawals. Users can link their bank accounts to their Webull accounts and transfer funds seamlessly. It's important to be aware of any potential fees or restrictions that your bank may impose.

Inactivity and Account Closure

Webull does not impose any inactivity fees for users who have dormant accounts. This means that if you don't trade or make any transactions for an extended period, you will not be charged any fees. This flexibility allows users to use the platform at their own pace without worrying about unnecessary costs.

Account closure on Webull is also fee-free. If you decide to close your account, you can do so without incurring any charges. The account closure process is straightforward and can be initiated through the Webull app or website. It's important to note that once an account is closed, all account data and trading history will be permanently deleted and cannot be recovered.

Webull's fee-free inactivity policy and account closure process provide users with flexibility and control over their trading activities. Whether you are an active trader or prefer a more long-term investment approach, Webull allows you to manage your account according to your own preferences.

Summary:

Webull does not charge inactivity or account closure fees. Users can maintain their accounts without worrying about unnecessary costs, and closing an account can be done without incurring any charges.

Regulatory and Exchange Fees

Regulatory and Exchange Fees

While Webull offers commission-free trading, it is important to be aware of regulatory and exchange fees that may apply. Regulatory fees are imposed by the Securities and Exchange Commission (SEC) and other regulatory bodies. These fees are typically charged on each trade and are non-negotiable. They are designed to fund the oversight and regulation of the financial markets, ensuring fair and transparent trading practices.

The SEC fee is based on the total dollar amount of securities sold and is currently set at $22.10 per million dollars. This fee is automatically calculated and deducted from your Webull account after each eligible trade. It is important to note that the SEC fee may vary over time, so it's essential to stay updated with the latest fee rates.

In addition to regulatory fees, Webull users may also incur exchange fees. Exchange fees are charged by the stock exchanges where the trades are executed. These fees vary depending on the exchange and the specific trade. Different exchanges have different fee structures and may charge fees based on factors such as trade volume, order type, and market conditions.

Webull provides transparency regarding exchange fees, and users can view the fee schedule on the platform. It's important to review the fee schedule and understand the potential costs associated with trading on different exchanges. By being aware of regulatory and exchange fees, traders can accurately assess the overall costs of their trades and make informed decisions.

Summary:

Webull users may need to pay regulatory and exchange fees on each trade. Regulatory fees are determined by the SEC and other regulatory bodies, while exchange fees are imposed by the stock exchanges. It's important to review the fee schedule and understand the potential costs associated with trading on different exchanges.

Subscription Services

In addition to its free trading services, Webull offers subscription-based services that provide advanced features and data. These subscriptions are designed to cater to the needs of traders who require in-depth market data and real-time quotes. While the basic trading platform is free, these subscription services offer additional tools and insights to enhance the trading experience.

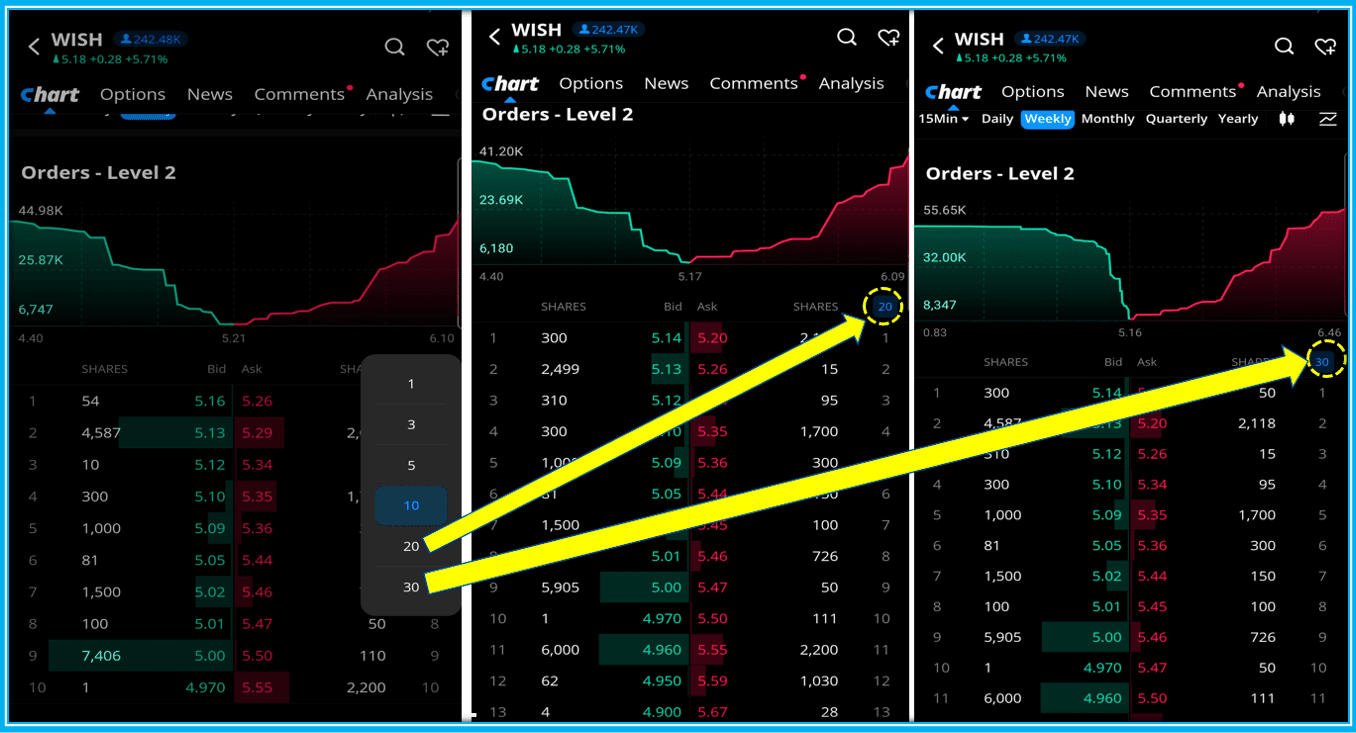

One of the subscription services offered by Webull is the "Level-2 Advance" package. This package provides users with access to Level-2 market data, which includes real-time quotes, bid and ask prices, and order book information. Level-2 data allows traders to gain deeper insights into market liquidity and the supply and demand dynamics of a particular security.

Another subscription service offered by Webull is the "Nasdaq TotalView" package. This package provides users with comprehensive market data from the Nasdaq exchange. It includes Level-2 data as well as the ability to view the complete order book for Nasdaq-listed securities. This information can be valuable for traders who require a more detailed understanding of market depth and order flow.

Webull's subscription services come with a monthly fee, and users can choose to subscribe based on their individual trading needs. It's important to evaluate the benefits and costs of the subscription services before subscribing. Traders who require advanced market data and real-time quotes may find value in these services, while others may prefer to utilize the free trading features provided by Webull.

Summary:

Webull offers subscription-based services for advanced market data and quotes. These services provide in-depth insights and tools for traders who require additional information. Users can choose to subscribe based on their individual trading needs and preferences.

IRA Account Fees

For those looking to invest in an Individual Retirement Account (IRA) through Webull, it's essential to be aware of the associated fees. Webull charges an annual fee for maintaining an IRA account. The fee is relatively low compared to traditional brokerage firms, making Webull an attractive option for retirement savings.

An IRA is a tax-advantaged account designed to help individuals save for retirement. It offers certain tax benefits, such as tax-deductible contributions or tax-free growth, depending on the type of IRA. Webull provides a variety of IRA account types, including Traditional IRAs and Roth IRAs, allowing users to choose the one that aligns with their retirement goals and financial situation.

Webull's IRA account fees are competitive compared to other brokerage firms. The annual fee is charged to cover administrative and custodial services provided by Webull for maintaining the IRA account. It's important to consider the fee in relation to the potential benefits and tax advantages offered by an IRA. Traders should assess their retirement goals and consult with a financial advisor to determine if an IRA account on Webull is the right choice for them.

Summary:

Webull charges an annual fee for maintaining an IRA account. The fee is relatively low compared to traditional brokerage firms, making Webull an attractive option for retirement savings. Traders should consider the fee in relation to the potential benefits and tax advantages offered by an IRA.

Customer Support

Webull provides customer support through various channels, including email, live chat, and phone. While it's not directly related to fees, it's important to mention that Webull's customer support is generally responsive and helpful. Having reliable support can be beneficial, especially when dealing with account-related inquiries or technical issues.

Webull's customer support team is available during market hours to assist users with any questions or concerns they may have. Users can reach out to the support team through the Webull app or website and can expect a prompt response. Additionally, Webull provides a comprehensive knowledge base and educational resources to help users navigate the platform and understand its features.

Having access to responsive customer support can enhance the overall trading experience on Webull. Whether you need assistance with account-related matters or have technical questions, Webull's customer support team is there to help.

Summary:

Webull offers responsive customer support through multiple channels, including email, live chat, and phone. The support team is available during market hours and can assist users with account-related inquiries or technical issues.

In conclusion, Webull offers a predominantly free trading experience, making it an appealing platform for investors. While the platform does not charge any account opening or maintenance fees, it's important to consider other costs such as regulatory fees, exchange fees, and subscription services. Understanding the fees associated with Webull allows users to make informed decisions and tailor their trading strategies accordingly. By taking advantage of the commission-free trading, extended trading hours, and advanced features, investors can potentially enhance their trading experience on Webull.

Disclaimer: This article provides general information and should not be considered as financial advice. Trading involves risks, and it's important to conduct thorough research and seek professional guidance before making any investment decisions.