Merrill Edge Premarket Trading: A Comprehensive Guide to Maximizing Your Investment Potential

Are you a savvy investor looking to gain an edge in the stock market? If so, you've come to the right place. In this blog article, we will delve into the world of Merrill Edge premarket trading and explore how it can help you make more informed investment decisions. Whether you're a seasoned trader or just starting out, understanding the intricacies of premarket trading can give you a significant advantage in the fast-paced world of finance. So, let's dive in and uncover the secrets to maximizing your investment potential.

Before we delve into the specifics of Merrill Edge premarket trading, let's first understand what exactly premarket trading entails. Simply put, premarket trading refers to the buying and selling of stocks that takes place before the official opening of the stock market. This period, which typically lasts from 4:00 a.m. to 9:30 a.m. Eastern Time, allows investors to react to news and events that may have occurred outside regular trading hours, such as overnight earnings announcements or geopolitical developments.

The Advantages of Premarket Trading

During the premarket session, market participants have the opportunity to react and position themselves ahead of the regular trading hours. This early access to the market can be advantageous for several reasons. Firstly, it allows traders to respond to breaking news and events, enabling them to potentially profit from price movements that occur as a result of the news. For example, if a company releases positive earnings results before the market opens, investors who engage in premarket trading can take advantage of the anticipated increase in the stock price. Additionally, premarket trading can provide valuable insights into the overall market sentiment, helping investors gauge the potential direction of stocks and indices when the market officially opens.

Another advantage of premarket trading is the ability to take advantage of international market developments. While the U.S. stock market is closed during certain hours, markets in other parts of the world may be open and experiencing significant movements. By participating in premarket trading, investors can react to these international market developments and adjust their positions accordingly. This can be particularly useful for investors who have exposure to international stocks or who are interested in global market trends.

Furthermore, premarket trading can offer increased liquidity compared to after-hours trading. While after-hours trading can be illiquid and result in wider bid-ask spreads, premarket trading often sees higher trading volumes and tighter spreads. This can make it easier for investors to execute trades at their desired price points and reduce the impact of transaction costs on their overall returns.

Summary:

Premarket trading offers several advantages, including the ability to respond to breaking news, profit from price movements resulting from news events, gain insight into market sentiment, take advantage of international market developments, and benefit from increased liquidity.

Understanding the Risks

While premarket trading can be a lucrative opportunity, it's important to understand the associated risks. During this session, trading volumes are typically lower than during regular market hours, which can result in wider bid-ask spreads and increased volatility. The lower liquidity can make it more challenging to execute trades at desired prices, as there may be fewer buyers or sellers in the market. It's crucial to exercise caution and use limit orders to mitigate these risks and ensure that you enter trades at your desired price point.

Another risk to consider is the potential for larger price gaps between the closing price of the previous trading day and the opening price of the premarket session. This can occur due to news events or market developments that took place outside regular trading hours. These price gaps can lead to significant differences between the expected and actual opening prices, potentially resulting in losses for traders who are not prepared for these price movements.

Additionally, the increased volatility during premarket trading can make it more challenging to accurately predict price movements. Market participants should be aware that prices can fluctuate rapidly during this session, and sudden price swings can occur without warning. Traders should have a well-defined risk management strategy in place to protect themselves from significant losses and avoid making impulsive trading decisions based on short-term price fluctuations.

Summary:

Premarket trading involves risks such as wider bid-ask spreads, increased volatility, lower liquidity, larger price gaps between closing and opening prices, and the challenge of accurately predicting price movements. Traders should exercise caution, use limit orders, have a risk management strategy, and avoid making impulsive decisions based on short-term fluctuations.

How to Access Merrill Edge Premarket Trading

Now that you understand the advantages and risks of premarket trading, let's explore how you can access this feature through Merrill Edge. Merrill Edge offers its clients the ability to trade during the premarket session, providing an additional tool to enhance their investment strategies. To access premarket trading, you will need to have an account with Merrill Edge and ensure that you have the necessary permissions enabled. Once you have met these requirements, you can take advantage of this valuable feature and start trading before the market officially opens.

Before engaging in premarket trading, it's important to familiarize yourself with Merrill Edge's premarket trading policies and procedures. These may include specific order types, time restrictions, and any additional fees or requirements. By understanding and adhering to these guidelines, you can ensure a smooth and seamless premarket trading experience.

Summary:

To access Merrill Edge premarket trading, you need to have an account with the platform and the necessary permissions enabled. Familiarize yourself with Merrill Edge's premarket trading policies and procedures to ensure a smooth experience.

Strategies for Successful Premarket Trading

Successful premarket trading requires a well-thought-out strategy and disciplined execution. One popular strategy is to focus on stocks that have recently reported earnings. By analyzing the earnings reports and the subsequent market reaction, traders can identify potential opportunities for profit. For example, if a company reports better-than-expected earnings, there may be a positive market reaction, leading to a potential increase in the stock price. Conversely, if a company reports disappointing earnings, there may be a negative market reaction, presenting an opportunity to short-sell the stock.

Another strategy is to monitor premarket news and events to identify sectors or industries that may experience significant price movements at the market open. By staying informed about news that may impact specific stocks or industries, traders can position themselves advantageously in the premarket session. For example, if there is positive news regarding a particular sector, such as increased demand for a certain product, traders can look for opportunities to invest in stocks within that sector.

Risk management is a crucial aspect of successful premarket trading. Traders should establish clear entry and exit points, set stop-loss orders to limit potential losses, and avoid taking on excessive risk. It's important to remember that premarket trading can be volatile, and unexpected price movements can occur. By managing risk effectively, traders can protect their capital and ensure long-term profitability.

Summary:

Successful premarket trading strategies involve focusing on earnings reports, monitoring premarket news for sector-specific opportunities, and implementing effective risk management techniques such as establishing entry and exit points and utilizing stop-loss orders.

Tips for Maximizing Profits

To maximize your profits in the premarket session, it's essential to stay disciplined and exercise patience. Avoid chasing after every price movement and instead focus on high-probability setups that align with your trading strategy. Setting realistic profit targets and adhering to them can help you avoid impulsive decision-making and prevent greed from clouding your judgment.

Additionally, continuously evaluating and refining your premarket trading strategy based on your own experiences and market conditions can contribute to long-term profitability. Keep a trading journal to track your trades, analyze what worked and what didn't, and make adjustments accordingly. By learning from your past trades and adapting your strategy, you can improve your trading performance over time.

Staying updated with market developments is also crucial for maximizing profits in premarket trading. Continuously monitor news, economic releases, and earnings reports that may impact the market. By staying informed, you can identify potential opportunities and adjust your trading strategy accordingly. Utilize resources such as financial news websites, economic calendars, and research reports to stay on top of relevant information.

Summary:

Maximizing profits in premarket trading involves staying disciplined, focusing on high-probability setups, setting realistic profit targets, continuously refining your strategy based on past trades, and staying updated with market developments.

Utilizing Technical Analysis in Premarket Trading

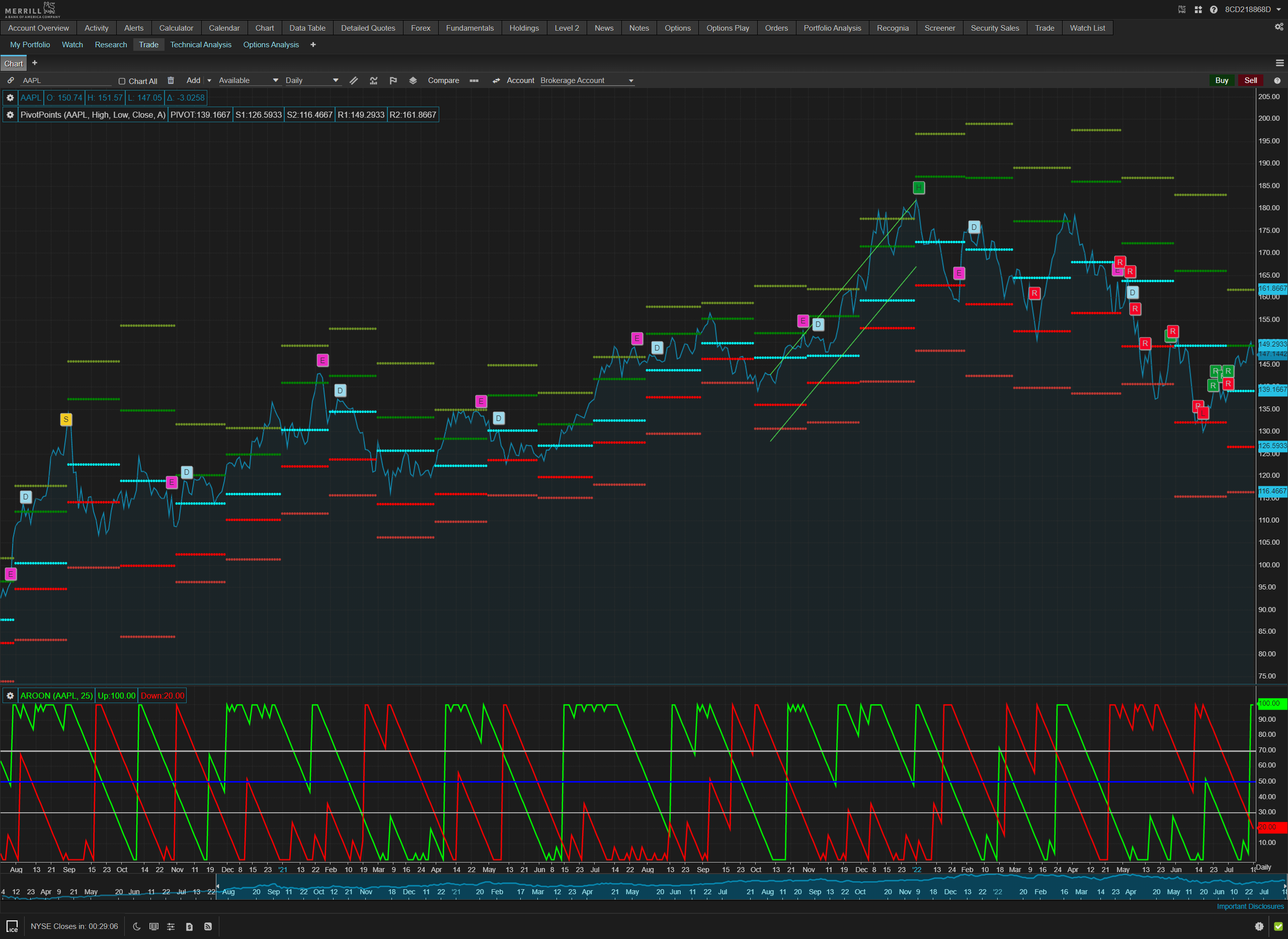

Technical analysis plays a crucial role in premarket trading, helping traders identify potential entry and exit points based on historical price patterns and indicators. By analyzing charts and applying technical tools such as trendlines, support and resistance levels, and moving averages, traders can make more informed trading decisions.

However, it's important to note that premarket trading can be characterized by lower liquidity compared to regular trading hours, which can impact the effectiveness of certain technical analysis techniques. The lower liquidity can lead to increased volatility and wider bid-ask spreads, making it more challenging to accurately interpret chart patterns and indicators. Traders should be aware of these limitations and adjust their technical analysis approach accordingly.

One effective technical analysis technique in premarket trading is to identify key support and resistance levels. These levels represent price areas where the stock has historically had difficulty breaking through or has found support. By identifying these levels, traders can set entry and exit points based on potential price reactions at these levelsand potentially increase the probability of successful trades. Additionally, trend analysis can be useful in premarket trading. Traders can identify the overall direction of the stock's price movement by analyzing the trend using tools such as moving averages. This can help traders determine whether to take a bullish or bearish stance on a particular stock.

It's important to keep in mind that technical analysis is just one tool in a trader's arsenal and should be used in conjunction with other forms of analysis. Fundamental analysis, which involves evaluating a company's financial health, industry trends, and market conditions, can provide valuable insights that complement technical analysis. By combining both approaches, traders can make more well-rounded and informed trading decisions.

Another important consideration when utilizing technical analysis in premarket trading is the timeframe of the charts being analyzed. Due to the shorter trading hours and potentially lower liquidity, shorter timeframes such as 1-minute or 5-minute charts may provide more relevant and timely information. Traders should adjust their charting preferences to reflect the premarket trading session and adapt their analysis accordingly.

Summary:

Technical analysis can be a valuable tool in premarket trading for identifying potential entry and exit points based on historical price patterns and indicators. Key techniques include identifying support and resistance levels and analyzing trends using moving averages. However, traders should consider the limitations of technical analysis in premarket trading, such as lower liquidity and adjust their approach accordingly. It's also important to combine technical analysis with other forms of analysis, such as fundamental analysis, to make well-informed trading decisions.

The Impact of Pre-Market News and Events

Premarket news and events can significantly impact stock prices and market sentiment. Traders should closely monitor economic releases, earnings reports, and geopolitical developments that occur outside regular trading hours. By staying informed about these events and understanding their potential implications, traders can position themselves advantageously in the premarket session.

Earnings reports, in particular, can have a substantial impact on stock prices. Positive earnings surprises, where a company reports better-than-expected earnings, can lead to increased investor confidence and potentially drive up stock prices. On the other hand, negative earnings surprises can result in selling pressure and cause stock prices to decline. By analyzing earnings reports and anticipating market reactions, traders can make informed decisions on whether to buy, sell, or hold a particular stock.

Geopolitical developments and macroeconomic news can also have a significant effect on premarket trading. Events such as political elections, trade negotiations, or economic data releases can create volatility and uncertainty in the market. Traders should stay updated on these events and assess their potential impact on specific stocks or sectors. By understanding how these events may influence market sentiment, traders can adjust their strategies accordingly.

Summary:

Premarket news and events, including earnings reports, geopolitical developments, and macroeconomic news, can have a significant impact on stock prices and market sentiment. Traders should closely monitor these events and assess their potential implications to position themselves advantageously in the premarket session.

The Role of Market Sentiment in Premarket Trading

Market sentiment refers to the overall mood or attitude of investors towards the market or a specific stock. During the premarket session, analyzing market sentiment can provide valuable insights into the potential direction of stocks and indices when the market officially opens. Traders can gauge market sentiment through various methods, such as monitoring futures contracts, analyzing premarket price movements, and assessing the overall economic and geopolitical landscape.

Futures contracts, which allow investors to speculate on the future price movements of an underlying asset, can provide an indication of market sentiment. By monitoring futures contracts before the market opens, traders can gain insights into investor expectations and potential market trends. For example, if the futures contracts for a particular stock or index are trading higher in the premarket session, it may indicate positive market sentiment and potential upward price movement at the market open.

Premarket price movements can also be indicative of market sentiment. If a stock experiences significant price changes in the premarket session, it may suggest that investors have strong opinions or expectations about the stock. Traders can analyze these price movements and assess whether they align with their own trading strategies.

Assessing the overall economic and geopolitical landscape can also provide insights into market sentiment. Factors such as interest rate decisions, economic indicators, and geopolitical tensions can influence investor confidence and sentiment. Traders should stay informed about these factors and consider their potential impact on the market and specific stocks.

Summary:

Market sentiment analysis in premarket trading involves monitoring futures contracts, premarket price movements, and assessing the economic and geopolitical landscape to make informed decisions and adapt strategies. By understanding market sentiment, traders can gain insights into potential market trends and adjust their trading strategies accordingly.

Preparing for Regular Trading Hours

As the premarket session comes to an end and regular trading hours approach, it's important to reassess your positions and adjust your strategy if necessary. The premarket session can provide valuable insights into potential market direction and allow you to set up trades in advance. However, it's crucial to remain flexible and adapt to any new information or developments that may arise before the market officially opens.

One important consideration when preparing for regular trading hours is the potential for price gaps between the premarket closing price and the regular market opening price. These price gaps can occur due to news events or market developments that took place outside regular trading hours. It's important to be aware of these gaps and anticipate their potential impact on your positions. Traders should consider adjusting their stop-loss orders or profit targets to account for these potential gaps and manage their risk effectively.

Another aspect to consider when transitioning to regular trading hours is the potential change in market dynamics. Regular trading hours typically see higher trading volumes and increased liquidity compared to the premarket session. This can result in different price movements and trading patterns. Traders should be mindful of these changes and adjust their strategies accordingly.

Summary:

Preparing for regular trading hours involves reassessing positions, adjusting strategies if necessary, and remaining flexible to adapt to new information or developments. Traders should consider potential price gaps, adjust stop-loss orders or profit targets, and be mindful of changes in market dynamics as regular trading hours commence.

The Future of Premarket Trading

Premarket trading continues to evolve alongside advancements in technology and changes in market dynamics. As more investors recognize the potential benefits of trading during this session, we can expect increased participation and liquidity. Additionally, developments in algorithmic trading and artificial intelligence may further enhance premarket trading strategies and provide additional opportunities for investors. Staying informed about industry trends and technological advancements will be crucial for those looking to stay ahead of the curve in the world of premarket trading.

One potential area of growth in premarket trading is the integration of machine learning and artificial intelligence algorithms. These technologies can analyze vast amounts of data and identify patterns or correlations that may not be apparent to human traders. By utilizing these advanced analytical tools, traders can potentially uncover new trading opportunities and improve decision-making processes.

Furthermore, advancements in trading platforms and infrastructure may also contribute to the growth of premarket trading. Faster and more reliable trading systems can enhance execution speed and efficiency, allowing traders to take advantage of time-sensitive opportunities in the premarket session. Additionally, improved access to real-time market data and news can provide traders with more timely information, enabling them to make more informed trading decisions.

Summary:

The future of premarket trading involves increased participation and liquidity, advancements in algorithmic trading and artificial intelligence, and the need to stay informed about industry trends and technological advancements. Integration of machine learning and artificial intelligence, as well as improvements in trading platforms and infrastructure, are expected to shape the future of premarket trading.

In conclusion, Merrill Edge premarket trading offers investors a unique opportunity to gain a competitive edge in the stock market. By understanding the advantages, risks, and strategies associated with premarket trading, you can make more informed investment decisions and potentially maximize your profits. Remember to stay disciplined, continuously refine your trading strategy, and adapt to changing market conditions. With the right knowledge and preparation, you can unlock the full potential of Merrill Edge premarket trading and take your investment journey to new heights.