Sofi Extended Hours Trading: A Comprehensive Guide

Are you looking to make the most out of your investments with Sofi? If so, you may be interested in exploring extended hours trading. In this blog article, we will provide you with a detailed and comprehensive guide to Sofi extended hours trading, including what it is, how it works, its benefits, and potential risks. By the end of this article, you will have a solid understanding of how you can take advantage of extended hours trading with Sofi.

What is Sofi Extended Hours Trading?

Sofi extended hours trading refers to the ability for Sofi users to buy and sell stocks outside of the standard trading hours of the stock market. While regular trading hours typically run from 9:30 am to 4:00 pm Eastern Time, extended hours trading allows investors to trade before the market opens and after it closes. This means you can make trades as early as 4:00 am and as late as 8:00 pm Eastern Time.

How Does Sofi Extended Hours Trading Work?

The extended hours trading feature offered by Sofi allows users to participate in pre-market and after-hours trading. Pre-market trading takes place before the regular market opens, while after-hours trading occurs after it closes. During these extended hours, you can place orders to buy or sell stocks, just like in regular trading hours. However, it's important to note that not all stocks are available for extended hours trading, and liquidity may be lower during these times.

Pre-Market Trading

Pre-market trading refers to the buying and selling of stocks before the regular market opens. It starts as early as 4:00 am Eastern Time and lasts until the market opens at 9:30 am. This period allows investors to react to news and events that occur overnight or early in the morning, which can potentially impact stock prices. However, it's important to note that pre-market trading typically has lower trading volumes and higher bid-ask spreads, which can result in increased price volatility.

After-Hours Trading

After-hours trading, on the other hand, takes place after the regular market closes at 4:00 pm Eastern Time. It extends until 8:00 pm, providing investors with additional opportunities to trade stocks outside of regular market hours. Similar to pre-market trading, after-hours trading can be affected by news and events that occur after the market closes. However, it's crucial to be aware that after-hours trading also tends to have lower liquidity and higher bid-ask spreads, making it potentially more volatile.

Benefits of Sofi Extended Hours Trading

There are several benefits to engaging in extended hours trading with Sofi. Firstly, it provides you with the opportunity to react to news and events that occur outside of regular trading hours. This can be particularly advantageous if there is breaking news that may impact the stock market. By being able to trade during extended hours, you can take immediate action and potentially capitalize on market movements before regular market hours begin.

Secondly, extended hours trading allows for flexibility, especially for individuals who are unable to trade during regular market hours due to work or other commitments. By being able to trade before the market opens or after it closes, you have the freedom to manage your investments on your own schedule. This flexibility can be particularly valuable for active traders who want to take advantage of market opportunities as they arise.

Risks and Considerations

While Sofi extended hours trading can be beneficial, it's essential to be aware of the potential risks and considerations. One key risk is that the liquidity of stocks may be lower during extended hours, meaning there may be fewer buyers and sellers. This can result in wider bid-ask spreads and increased price volatility. It's crucial to understand that lower liquidity can make it more challenging to execute trades at desired prices, and there may be a potential for increased slippage.

Higher Volatility

Another risk to consider is higher volatility during extended hours trading. With fewer participants in the market, price swings can be more pronounced. This increased volatility can work in your favor if you correctly anticipate market movements, but it can also lead to larger losses if your trades go against you. It's important to approach extended hours trading with caution and be prepared for potential fluctuations in stock prices.

Limited Availability of Stocks

Not all stocks are available for extended hours trading, and it's crucial to check if the stocks you wish to trade are eligible. While many popular stocks are included in extended hours trading, some smaller or less actively traded stocks may not be available during these times. It's advisable to research and confirm the availability of specific stocks before attempting to trade them during extended hours.

How to Access Sofi Extended Hours Trading

Accessing Sofi extended hours trading is simple and straightforward. To participate in extended hours trading, you need to have a Sofi Invest account. If you don't already have one, you can sign up for a Sofi Invest account on the Sofi website or through the Sofi app. Once you have an account, you can log in during extended hours and place your trades through the Sofi platform.

Signing Up for a Sofi Invest Account

If you're new to Sofi, signing up for a Sofi Invest account is the first step to accessing extended hours trading. To create an account, you'll need to provide some personal information, including your name, email address, and social security number. Sofi may also require you to verify your identity by providing additional documentation.

Using the Sofi Platform for Extended Hours Trading

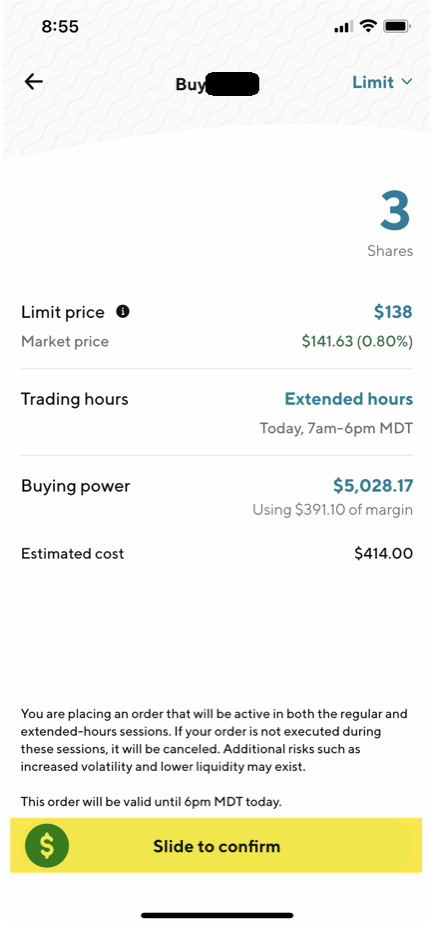

Once you have a Sofi Invest account, you can access extended hours trading through the Sofi platform. Whether you prefer using the Sofi app on your mobile device or the Sofi website on your computer, the process for placing extended hours trades is similar. Simply log in to your Sofi account during the designated extended hours and navigate to the trading section of the platform. From there, you can enter the stock symbol, specify the quantity you wish to buy or sell, and choose the order type.

Tips for Successful Sofi Extended Hours Trading

If you're interested in engaging in successful extended hours trading with Sofi, here are some tips to keep in mind:

Stay Informed

Stay informed about important news and events that may impact the stock market. News can have a significant impact on stock prices, and being aware of potential market-moving events can help you make informed decisions during extended hours trading. Utilize news sources, financial websites, and research tools to stay up to date with the latest information.

Set Clear Goals and Stick to Your Trading Strategy

Before engaging in extended hours trading, it's essential to set clear goals and develop a trading strategy. Define your objectives, such as profit targets and risk tolerance, and stick to your plan. Having a well-defined strategy can help guide your decision-making process and prevent impulsive trades based on emotions or short-term market fluctuations.

Be Cautious of Increased Volatility

Extended hours trading tends to have higher volatility compared to regular market hours. Be cautious of sudden price swings and increased market uncertainty. Consider adjusting your position sizes and risk management techniques to account for the potentially larger price fluctuations during extended hours.

Consider Using Limit Orders

Consider using limit orders when placing trades during extended hours. A limit order allows you to specify the maximum price you are willing to pay when buying or the minimum price you are willing to accept when selling. By using limit orders, you have more control over the price at which your trades are executed, potentially avoiding unfavorable fills or price slippage.

Practice Risk Management

Risk management is crucial in any trading activity, including extended hours trading. Set stop-loss orders to limit potential losses and protect your capital. Determine your risk-reward ratio for each trade and only take trades that offer favorable risk-reward profiles. Remember that risk management is an ongoing process, and it's important to regularly review and adjust your risk management strategies as needed.

Alternatives to Sofi Extended Hours Trading

If Sofi extended hours trading doesn't meet your needs or preferences, there are alternative platforms and brokers that offer similar services. Some popular alternatives include Robinhood, TD Ameritrade, and E-Trade. It's important to research and compare different platforms to find the one that aligns with your specific requirements.

Robinhood

Robinhood is a popular commission-free trading platform that allows investors to trade stocks, ETFs, options, and cryptocurrencies. Robinhood offers extended hours trading, providing users with access to pre-market and after-hours trading. It's known for its user-friendly interface and simplicity, making it an attractive option for beginner traders.

TD Ameritrade

TD Ameritrade is a well-established brokerage firm that offers a comprehensive range of investment products and services. It provides extended hours trading, allowing users to trade stocks, options, ETFs, and mutual funds before the market opens and after it closes. TD Ameritrade is known for its powerful trading platform and educational resources, making it a popular choice for both beginner and advanced traders.

E-Trade

E-Trade is another reputable online brokerage that offers extended hours trading. Itprovides users with the ability to trade stocks, options, ETFs, and mutual funds during pre-market and after-hours sessions. E-Trade offers a robust trading platform, research tools, and educational resources to help investors make informed trading decisions. It is a trusted and widely used platform in the investment community.

When considering alternatives to Sofi extended hours trading, it's important to evaluate factors such as trading fees, account minimums, available investment products, research and analysis tools, customer support, and platform usability. Each platform has its own strengths and weaknesses, so take the time to compare and determine which one best suits your trading needs.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions related to Sofi extended hours trading:

Can I trade all stocks during extended hours with Sofi?

No, not all stocks are available for extended hours trading. Sofi provides a list of eligible stocks for extended hours trading, and it's important to check if the stocks you wish to trade are included in this list. The availability of stocks for extended hours trading can vary depending on liquidity and other factors.

What are the risks of extended hours trading?

Extended hours trading carries certain risks. Lower liquidity during these times can result in wider bid-ask spreads, making it potentially more expensive to enter or exit trades. Higher volatility can also lead to larger price swings, increasing the potential for both profits and losses. It's important to approach extended hours trading with caution, conduct thorough research, and use risk management strategies to mitigate potential risks.

Are there any fees associated with Sofi extended hours trading?

Sofi does not charge additional fees specifically for extended hours trading. However, it's important to review Sofi's fee schedule to understand any applicable fees or commissions for trading in general. Be aware that other platforms may have different fee structures for extended hours trading, so consider this when evaluating alternative trading platforms.

Can I use margin trading during extended hours with Sofi?

No, Sofi does not currently support margin trading during extended hours. Margin trading allows investors to borrow funds from their brokerage to trade larger positions. However, it's important to note that margin trading carries additional risks and requirements, and it's not available during extended hours with Sofi.

How can I learn more about extended hours trading strategies?

Learning more about extended hours trading strategies can be beneficial in enhancing your trading skills and decision-making process. There are various resources available, including books, online articles, videos, and educational courses. Consider researching and studying different trading strategies specific to extended hours trading to gain insights and develop a trading plan that aligns with your goals and risk tolerance.

Case Studies: Successful Sofi Extended Hours Trades

Explore real-life case studies of successful extended hours trades made through Sofi. These case studies will provide you with insights into the strategies and decision-making processes of experienced traders, giving you valuable lessons and inspiration for your own trading journey.

Case Study 1: Capitalizing on Earnings Reports

In this case study, we examine a trader who successfully traded a stock during extended hours based on positive earnings reports. The trader conducted thorough research, identified a company with strong financials, and anticipated a positive earnings surprise. They entered a position during after-hours trading and profited significantly as the stock price soared following the earnings release. This case study highlights the importance of staying informed and capitalizing on market-moving events during extended hours.

Case Study 2: Reacting to Breaking News

Another case study focuses on a trader who reacted swiftly to breaking news during pre-market trading. The trader monitored news sources and received an alert about a significant development in a particular industry. Recognizing the potential impact on related stocks, the trader quickly analyzed the situation, formulated a trading plan, and executed trades before the market opened. As a result, they were able to take advantage of the initial market reaction and secure profits. This case study demonstrates the importance of being proactive and nimble in extended hours trading.

Testimonials from Sofi Extended Hours Traders

Hear directly from Sofi users who have experienced extended hours trading. These testimonials will provide you with firsthand accounts of the benefits and challenges of trading during extended hours, giving you a well-rounded perspective on the topic.

Testimonial 1: Sarah, an Active Trader

"As a full-time professional, I found it challenging to trade during regular market hours. Sofi extended hours trading has been a game-changer for me. I can now place trades before I start my workday or after I finish. It allows me to actively manage my investments without compromising my job. The flexibility and convenience are fantastic."

Testimonial 2: John, a News-Driven Trader

"I've always been a news-driven trader, and Sofi extended hours trading has been invaluable for me. I often trade stocks based on breaking news, and being able to react immediately during pre-market or after-hours has given me an edge. I've capitalized on significant price movements and seized opportunities that I would have missed during regular market hours."

Conclusion

Sofi extended hours trading offers users the opportunity to trade stocks outside of regular market hours, providing flexibility and the ability to react to news. However, it's important to be aware of the risks associated with lower liquidity and increased volatility. By following the tips provided, conducting thorough research, and utilizing risk management strategies, you can make informed decisions and maximize your trading success with Sofi extended hours trading. Whether you're an active trader or someone with limited availability during regular market hours, extended hours trading can be a valuable tool in your investment journey.