When Will Klaviyo Start Trading? All You Need to Know

Are you eagerly awaiting the moment when Klaviyo, the popular email marketing platform, will start trading? Well, you're not alone! As Klaviyo continues to grow in popularity among businesses of all sizes, many investors are wondering when they will have the opportunity to invest in this promising company. In this comprehensive blog article, we will delve into the details of Klaviyo's trading plans, exploring the potential timeline and factors that may influence its decision. So, let's dive in and discover when Klaviyo will start trading!

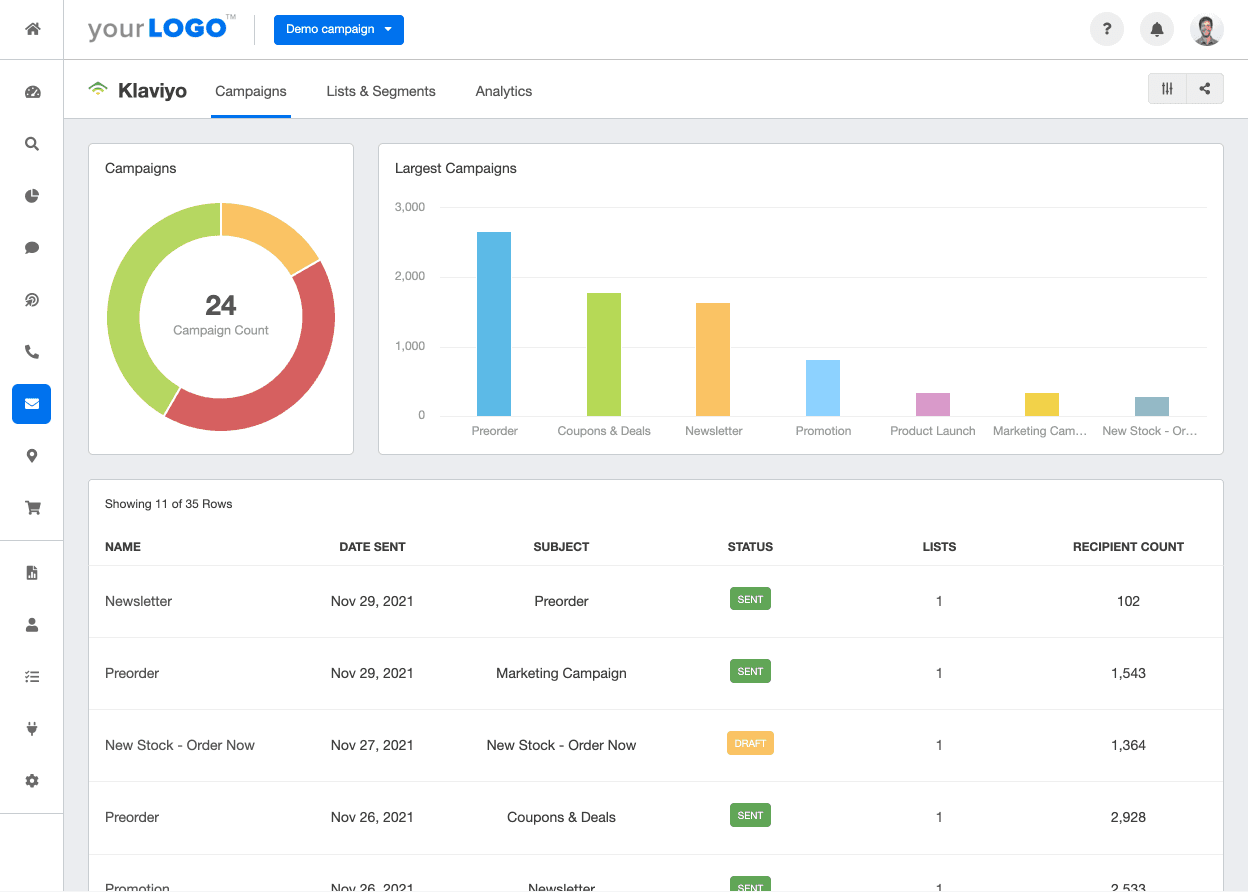

Before we dive into the specifics, let's understand a bit about Klaviyo. Founded in 2012 by Andrew Bialecki and Ed Hallen, Klaviyo has revolutionized the way businesses interact with their customers through personalized email marketing campaigns. With its powerful segmentation and automation features, Klaviyo has become a go-to platform for e-commerce businesses looking to drive sales and build customer relationships. As the company continues to experience rapid growth and expand its customer base, it's natural that investors are curious about its potential for trading on the stock market.

Klaviyo's Growth Trajectory

Summary: In this section, we will explore Klaviyo's growth trajectory, highlighting its key milestones and achievements that make it an attractive prospect for investors.

1. Early Beginnings and Foundational Growth

Summary: Klaviyo's journey started in 2012 when Andrew Bialecki and Ed Hallen founded the company with a vision to transform email marketing. From its humble beginnings, Klaviyo quickly gained traction by providing businesses with a user-friendly platform to create personalized email campaigns. With innovative features and robust analytics, Klaviyo established itself as a trusted solution in the market.

2. Rapid Expansion and Market Dominance

Summary: Over the years, Klaviyo experienced rapid growth and achieved market dominance in the email marketing space. By 2016, Klaviyo had surpassed 5,000 customers, and its revenue continued to soar. The company's ability to adapt to evolving customer needs and introduce new features positioned it as a leader in the industry, attracting businesses of all sizes. Klaviyo's success story became a testament to its potential for future growth and profitability.

3. Investment and Strategic Partnerships

Summary: To fuel its expansion, Klaviyo secured significant investments from venture capital firms. These investments not only provided the financial resources needed for growth but also signaled confidence in Klaviyo's potential. Additionally, Klaviyo strategically partnered with leading e-commerce platforms, enabling seamless integration and expanding its reach to a broader customer base. These partnerships further solidified Klaviyo's position as an industry frontrunner.

The Potential Benefits of Going Public

Summary: Going public can bring several advantages to a company like Klaviyo. In this section, we will discuss the potential benefits that Klaviyo might reap by entering the stock market.

1. Access to Capital for Expansion

Summary: One significant advantage of going public is the ability to raise substantial capital through the sale of shares. Klaviyo can utilize these funds to fuel its expansion plans, invest in research and development, and explore new markets. The infusion of capital can provide the necessary resources for Klaviyo to scale its operations and continue innovating its product offerings.

2. Enhanced Visibility and Brand Recognition

Summary: Going public can significantly enhance a company's visibility and brand recognition. As Klaviyo becomes a publicly traded company, it attracts more attention from investors, analysts, and the media. This heightened exposure not only helps to increase brand awareness but also establishes Klaviyo as a reputable player in the industry. The increased visibility can lead to new partnerships, customers, and growth opportunities.

3. Increased Valuation and Potential for Acquisitions

Summary: Going public often results in an increase in a company's valuation. As Klaviyo's shares become publicly traded, the market determines its value, which can be higher than previous private valuations. This increased valuation can provide Klaviyo with additional leverage for potential acquisitions. By acquiring complementary businesses, Klaviyo can expand its product offerings, enter new markets, and accelerate its growth trajectory.

Factors Influencing Klaviyo's Decision

Summary: Klaviyo's decision to go public is influenced by various factors. In this section, we will examine the key considerations that may impact their decision-making process.

1. Market Conditions and Investor Demand

Summary: One crucial factor that influences Klaviyo's decision to go public is the overall market conditions and investor demand for technology stocks. Klaviyo's leadership team will closely monitor market trends and evaluate the appetite for tech IPOs. If the market is favorable and there is strong investor demand, Klaviyo may be more inclined to proceed with its IPO plans.

2. Financial Performance and Growth Prospects

Summary: Klaviyo's financial performance and growth prospects play a vital role in the decision-making process. The company will assess its revenue trends, profitability, and projected future earnings. Klaviyo's ability to consistently deliver impressive financial results can instill confidence in potential investors and increase the likelihood of a successful IPO.

3. Competitive Landscape and Differentiation

Summary: Klaviyo operates in a competitive landscape with several other email marketing platforms vying for market share. The company will evaluate its competitive positioning and differentiation strategy. Klaviyo's unique features, customer-centric approach, and ability to stay ahead of industry trends can strengthen its case for going public and attract investor interest.

The IPO Process

Summary: Going public involves a series of steps known as the Initial Public Offering (IPO) process. This section will provide an overview of the IPO process and its significance for Klaviyo's trading plans.

1. Selecting Investment Banks and Underwriters

Summary: As Klaviyo prepares for its IPO, it will engage investment banks and underwriters to manage the process. These financial institutions play a crucial role in advising Klaviyo on various aspects of the IPO, including valuation, pricing, and regulatory compliance. The selection of reputable investment banks is essential to ensure a smooth and successful IPO.

2. Conducting Due Diligence and Financial Audits

Summary: Before going public, Klaviyo will undergo a thorough due diligence process. This involves conducting financial audits, reviewing legal and regulatory compliance, and ensuring accurate and transparent financial reporting. The due diligence process is critical for building investor confidence and complying with regulatory requirements.

3. Drafting the Prospectus

Summary: The prospectus is a comprehensive document that provides detailed information about Klaviyo's business, financials, risks, and future prospects. Klaviyo will work with its legal and financial teams to draft a compelling prospectus that effectively communicates its value proposition to potential investors.

4. Roadshow and Investor Presentations

Summary: The roadshow is a crucial phase of the IPO process. Klaviyo's leadership team, along with investment bankers, will embark on a series of investor presentations and meetings to generate interest in the IPO. These presentations allow Klaviyo to showcase its business model, growth potential, and competitive advantages to potential investors.

5. Pricing and Allocation of Shares

Summary: Determining the share price and allocation of shares is a pivotal step in the IPO process. Klaviyo and its underwriters will carefully consider market conditions, investor demand, and valuation models to set an appropriate IPO price. The allocation of shares to institutional and retail investors is also carefully managed to ensure a fair and balanced distribution.

6. Listing on Stock Exchanges

Summary: Once the IPO is successfully completed, Klaviyo's shares will be listed on one or more stock exchanges. The company will work with the relevant stock exchanges, such as the New York Stock Exchange or NASDAQ, to fulfill listing requirements and ensure seamless trading of its shares.

Speculations and Rumors

Summary: Speculation and rumors are inevitable when it comes to a highly anticipated event like Klaviyo's IPO. In this section, we will explore some of the speculations and rumors surrounding Klaviyo's trading plans.

1. Valuation Expectations

Summary: One common speculation revolves around Klaviyo's potential valuation at the time of its IPO. Analysts and industry experts may offer their predictions, taking into account Klaviyo's financial performance, growth prospects, and market conditions. However, it's important to note that valuations can vary, and the final determination will be based on investor demand and market dynamics.

2. Potential Underwriters and Lead Bookrunners

Summary: Another area of speculation is the selection of investment banks and underwriters for Klaviyo's IPO. Various financial institutions with expertise in technology IPOs may be considered for this role. The choice of underwriters can influence the success of the IPO and generate further interest among investors.

3. Impact on Competitors and Market Dynamics

Summary: Klaviyo's IPO can potentially impact itscompetitors and the overall market dynamics. Speculations may arise regarding how Klaviyo's entry into the stock market will affect its competitors' market share and whether it will create a ripple effect in the industry. Analysts and industry observers might offer insights on how Klaviyo's IPO could influence the competitive landscape and potentially reshape the market dynamics in the email marketing space.

Competitors in the Market

Summary: Klaviyo operates in a competitive market with several other email marketing platforms. This section will shed light on Klaviyo's competitors and how they might factor into their decision to start trading.

1. Established Players in Email Marketing

Summary: Klaviyo faces competition from well-established players in the email marketing industry. Companies like Mailchimp and Constant Contact have been around for years and have built a strong customer base. Klaviyo will need to navigate the competitive landscape and differentiate itself to attract investors and gain a competitive edge.

2. Emerging Players and Niche Solutions

Summary: In addition to the established players, there are also emerging email marketing platforms and niche solutions targeting specific industries or customer segments. These players bring unique offerings and cater to specific customer needs. Klaviyo's ability to position itself as a comprehensive solution while also catering to niche requirements can be a key differentiating factor in the eyes of investors.

3. Technological Advancements and Innovation

Summary: The email marketing industry is constantly evolving, with new technological advancements and innovative features being introduced regularly. Klaviyo's competitors are likely to invest in research and development to stay competitive and meet evolving customer demands. Klaviyo's ability to stay ahead of the curve, innovate, and deliver cutting-edge solutions will be crucial in attracting investor interest.

Analysts' Insights and Predictions

Summary: Analysts often provide valuable insights and predictions about the future of a company. In this section, we will explore what industry experts and analysts have to say about Klaviyo's potential entry into the stock market.

1. Growth Potential and Market Opportunity

Summary: Analysts may highlight the growth potential and market opportunity for Klaviyo in their assessments. They might consider factors such as the expanding e-commerce market, the increasing importance of email marketing, and Klaviyo's unique value proposition. These insights can provide investors with a clearer picture of the potential returns they can expect from investing in Klaviyo.

2. Competitive Analysis and Positioning

Summary: Analysts may conduct a comprehensive competitive analysis, comparing Klaviyo with its competitors. They might evaluate factors such as market share, customer satisfaction, and technological advancements. These analyses can shed light on Klaviyo's competitive positioning and its ability to capture a larger share of the market.

3. Financial Performance and Projections

Summary: Analysts often analyze a company's financial performance and projections to assess its investment potential. They may delve into Klaviyo's revenue growth, profitability, and projected future earnings. By examining these financial aspects, analysts can provide insights into Klaviyo's financial health and its potential for delivering returns to investors.

Potential Impacts on Klaviyo's Customers

Summary: Klaviyo's customers are an essential aspect to consider when it comes to the company's trading plans. This section will highlight the potential impacts on Klaviyo's customers if they decide to go public.

1. Continued Product Innovation and Development

Summary: Klaviyo's customers might expect the company to continue investing in product innovation and development even after going public. The influx of capital through an IPO can enable Klaviyo to enhance its offerings, introduce new features, and provide an even better customer experience. This can be beneficial for existing and potential customers, as they can expect continuous improvements and advancements in the platform.

2. Stability and Long-Term Commitment

Summary: Going public can signal stability and a long-term commitment to customers. As a publicly traded company, Klaviyo will be subject to greater scrutiny and accountability. This can provide customers with confidence that Klaviyo will continue to serve their needs and invest in the platform's success over the long term.

3. Potential Pricing and Service Changes

Summary: Some customers may have concerns about potential pricing and service changes following the IPO. As Klaviyo transitions into a publicly traded company, it may need to reassess its pricing strategy and align it with market expectations. While adjustments are possible, Klaviyo will likely strive to maintain competitive pricing and value for its customers.

Legal and Regulatory Considerations

Summary: Going public involves complying with various legal and regulatory requirements. This section will discuss the legal and regulatory considerations that Klaviyo needs to address before starting to trade.

1. Securities and Exchange Commission (SEC) Compliance

Summary: Klaviyo will need to comply with the regulations set forth by the Securities and Exchange Commission (SEC). This includes filing the necessary documents, such as the S-1 registration statement, and ensuring accurate and transparent disclosures about its business, financials, and risks. Compliance with SEC regulations is crucial to maintain trust and transparency with investors.

2. Corporate Governance and Reporting Obligations

Summary: As a publicly traded company, Klaviyo will need to adhere to corporate governance standards and reporting obligations. This includes establishing a board of directors, implementing internal controls, and ensuring proper financial reporting. Klaviyo's commitment to good corporate governance practices can enhance investor confidence and protect shareholder interests.

3. Intellectual Property Protection and Compliance

Summary: Intellectual property plays a vital role in Klaviyo's business. Before going public, Klaviyo will need to ensure that it has robust intellectual property protection in place and that it complies with any relevant intellectual property laws and regulations. Protecting its intellectual property rights is crucial to maintaining a competitive advantage and avoiding potential legal disputes.

The Future Outlook

Summary: In the final section, we will discuss the potential future outlook for Klaviyo and what it might mean for investors, customers, and the market as a whole.

1. Continued Growth and Expansion

Summary: The future looks promising for Klaviyo as it continues to experience rapid growth and expand its customer base. With the potential capital infusion from an IPO, Klaviyo can accelerate its growth trajectory, penetrate new markets, and further solidify its position as a leader in the email marketing industry.

2. Innovation and Adaptation to Market Trends

Summary: Klaviyo's success hinges on its ability to innovate and adapt to evolving market trends. The company will need to stay ahead of technological advancements, customer preferences, and industry changes. By continuing to deliver innovative solutions and addressing customer needs, Klaviyo can maintain its competitive edge and drive further growth.

3. Investor Confidence and Market Performance

Summary: Klaviyo's performance in the stock market will play a crucial role in its future outlook. The reception from investors and the market's perception of Klaviyo's growth potential will influence its ability to raise additional capital, attract top talent, and pursue strategic opportunities. A positive market performance can create a virtuous cycle of growth and further solidify Klaviyo's position in the industry.

In conclusion, the anticipation surrounding Klaviyo's trading debut is palpable. As the company continues to grow and make waves in the email marketing industry, investors eagerly await the opportunity to invest in this promising platform. While the exact timeline for Klaviyo's trading remains uncertain, exploring the company's growth trajectory, potential benefits, influencing factors, and the IPO process can provide valuable insights into when we might see Klaviyo start trading. Regardless of when it happens, Klaviyo's entry into the stock market is sure to be a significant event with far-reaching implications for investors, customers, and the industry at large.