Merrill Edge Stock Trading Fees: A Comprehensive Guide

Are you considering trading stocks with Merrill Edge but unsure about their fees? Look no further! In this blog article, we will provide you with a detailed and comprehensive guide to understanding Merrill Edge stock trading fees. Whether you are a beginner investor or an experienced trader, this article will help you make informed decisions about your investments.

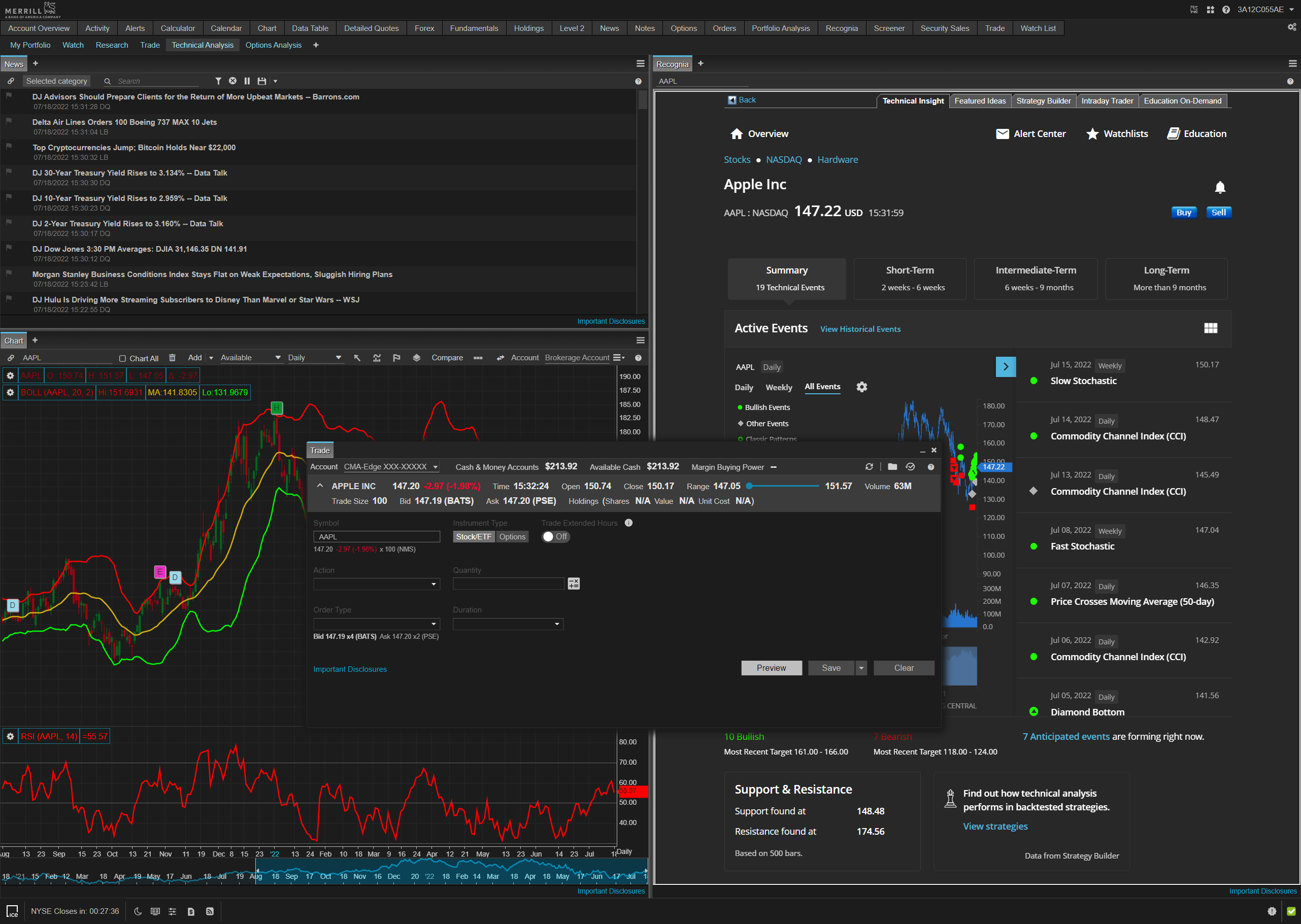

Before diving into the specific fees, let's first understand what Merrill Edge is. It is an online brokerage platform offered by Bank of America that allows investors to trade stocks, bonds, and other securities. With Merrill Edge, you can access a wide range of investment options and tools to help you manage your portfolio. However, like any brokerage platform, Merrill Edge charges fees for its services.

Account Opening and Maintenance Fees

When it comes to opening and maintaining an account with Merrill Edge, you'll be happy to know that they do not charge any fees. That's right – there are no account opening or maintenance fees to worry about. This is a significant advantage, especially for investors who are looking to minimize their costs. Some other brokerage platforms may charge hefty fees just to open an account, but with Merrill Edge, you can get started without any financial barriers.

No Account Opening Fees

Unlike many other brokerage platforms, Merrill Edge does not charge a fee for opening an account. This means that you can create an account with ease and without having to worry about any upfront costs. Whether you are a seasoned investor or a beginner looking to get started, this fee-free account opening process makes it accessible for everyone.

No Account Maintenance Fees

Not only does Merrill Edge waive the account opening fee, but they also do not charge any account maintenance fees. This means that you won't have to worry about paying a monthly or annual fee to keep your account active. Whether you trade frequently or prefer a more passive investment approach, Merrill Edge allows you to maintain your account without incurring any additional costs.

Commission Fees

Now, let's move on to the commission fees charged by Merrill Edge. These fees are an essential aspect to consider, as they can significantly impact the overall profitability of your trades. Merrill Edge charges a flat commission fee per trade, but the exact amount can vary depending on various factors such as your account status, trade frequency, and investment amount. It's crucial to understand these fees to make informed decisions about your trading strategy.

Flat Commission Structure

Merrill Edge follows a flat commission structure, meaning that they charge a fixed fee for each trade you make. This fee is the same regardless of the size or value of the trade. The advantage of a flat commission structure is that it provides transparency and simplicity, allowing you to calculate your costs accurately. However, it's important to note that the specific commission fee may vary depending on other factors, as we will explore in the following sections.

Account Status and Commission Discounts

Your account status and relationship with Merrill Edge can have an impact on the commission fees you are charged. Merrill Edge offers different tiers of account status, such as Preferred Rewards, which can provide you with discounted commission rates. Preferred Rewards is a loyalty program offered by Bank of America that offers various benefits to customers, including reduced fees. Depending on your account balance and relationship with Merrill Edge, you may be eligible for lower commission fees, ultimately saving you money on your trades.

Trade Frequency and Tiered Pricing

If you are a frequent trader, Merrill Edge offers a tiered pricing structure that can help reduce your overall commission costs. The more trades you make within a specific time period, the lower your commission fee per trade may be. This tiered pricing system rewards active traders and can be a significant advantage if you engage in frequent buying and selling activities. However, if you are a less active trader, it's essential to assess whether the potential savings from tiered pricing outweigh the costs of more frequent trading.

Investment Amount and Fee Caps

Another factor that can affect your commission fees with Merrill Edge is the size of your investment. Merrill Edge has a fee cap on certain types of trades, meaning that once your investment reaches a specific threshold, the commission fee no longer increases. This can be advantageous for larger investors who make substantial trades, as it puts a limit on the commission costs. However, it's important to note that fee caps may vary depending on the type of trade, so it's crucial to understand the specific thresholds and potential savings based on your investment amount.

Stock and ETF Trades

If you are interested in trading stocks or exchange-traded funds (ETFs), Merrill Edge offers a variety of options. However, it's necessary to understand the specific fees associated with these trades to make informed decisions about your investment strategy.

Standard Commission Fee

For stock and ETF trades, Merrill Edge charges a standard commission fee. The exact amount of this fee can depend on various factors such as your account status, trade frequency, and investment amount. It's crucial to review the specific commission fee applicable to your account to accurately calculate your trading costs. The standard commission fee provides you with access to Merrill Edge's wide range of stocks and ETFs, allowing you to build a diversified portfolio tailored to your investment goals.

Preferred Rewards Discount

If you are a Preferred Rewards member, you may be eligible for a commission fee discount on stock and ETF trades. Preferred Rewards offers three tiers – Gold, Platinum, and Platinum Honors – based on your combined Bank of America account balances. Depending on your tier, you can receive a discount ranging from 0.05% to 0.30% on the standard commission fee. This discount can add up significantly, especially if you are an active trader or have a substantial investment portfolio.

Tiered Pricing for Active Traders

Merrill Edge's tiered pricing structure can also apply to stock and ETF trades. If you engage in frequent trading activities, you may be eligible for reduced commission fees. The more trades you make within a specific time period, the lower your commission fee per trade may be. This can be advantageous for active traders who regularly buy and sell stocks or ETFs. However, it's important to consider whether the potential savings from tiered pricing outweigh the costs associated with more frequent trading.

Investment Amount and Fee Caps

For larger investors, Merrill Edge offers fee caps on stock and ETF trades. Once your investment reaches a specific threshold, the commission fee no longer increases. This fee cap can be advantageous for those who make substantial trades, as it puts a limit on the commission costs. However, it's essential to understand the specific fee caps applicable to your account and investment amount to accurately evaluate the potential savings.

Options Trades

If you are interested in trading options, Merrill Edge offers a range of options contracts. However, it's necessary to understand the specific fees associated with options trades to make informed decisions about your investment strategy.

Options Contract Fee

When it comes to options trading, Merrill Edge charges an additional fee per contract. The exact amount of this fee can vary depending on your account status, trade frequency, and investment amount. It's crucial to review the specific options contract fee applicable to your account to accurately calculate your trading costs. Understanding these fees will help you assess the viability of options trading within your investment strategy.

Preferred Rewards Discount

Similar to stock and ETF trades, Preferred Rewards members may be eligible for a commission fee discount on options trades. Depending on your Preferred Rewards tier, you can receive a discount ranging from 0.05% to 0.30% on options contract fees. This discount can be particularly beneficial for options traders who engage in frequent trading activities or have substantial options portfolios.

Tiered Pricing for Active Traders

Merrill Edge's tiered pricing structure can also apply to options trades. If you are an active options trader, you may be eligible for reduced commission fees based on your trade frequency. The more options contracts you trade within a specific time period, the lower your commission fee per contract may be. This tiered pricing system encourages active options trading and can lead to significant cost savings for frequent traders.

Investment Amount and Fee Caps

Options traders with larger investments can benefit from Merrill Edge's fee caps. Once your options investment reaches a specific threshold, the commission fee no longer increases. This fee cap can be advantageous for those who trade large volumes of options contracts, as it puts a limit on the commission costs. However, it's essential to understand the specific fee caps applicable to your account and investment amount to accurately evaluate the potential savings.

Mutual Fund Trades

Merrill Edge offers a wide selection of mutual funds, allowing investors to diversify their portfolios and potentially achieve their financial goals. However, it's important to be aware of the fees associated with buying or selling mutual funds through Merrill Edge.

Mutual Fund Transaction Fee

Merrill Edge charges a transaction fee for buying or selling mutual funds. The exact amount of this fee can vary depending on the specific mutual fund and its load structure. It's crucial to review the mutual fund transaction fees applicable to your desired funds to accurately calculate your trading costs. As mutual fund fees can impact your overall investment returns, it's essential to assess the potential costs and compare them with the fund's performance andexpense ratio to ensure you are making informed investment decisions.

No-Load Mutual Funds

In addition to mutual funds with transaction fees, Merrill Edge also offers a selection of no-load mutual funds. No-load mutual funds do not charge transaction fees when buying or selling shares. This can be advantageous for investors looking to minimize their trading costs. However, it's important to note that even though there are no transaction fees, these funds may still have an expense ratio, which represents the ongoing management fees and other operating expenses.

Preferred Rewards Discount

Similar to stock and options trades, Preferred Rewards members may be eligible for a commission fee discount on mutual fund transactions. Depending on your Preferred Rewards tier, you can receive a discount ranging from 0.05% to 0.30% on the transaction fees associated with mutual fund trades. This discount can be particularly beneficial for investors who regularly buy or sell mutual funds or have a substantial mutual fund portfolio.

Fee Waivers and Load Discounts

Merrill Edge may also offer fee waivers or load discounts on certain mutual funds. These waivers or discounts can vary depending on the specific fund and any promotional offers available. It's essential to review the details of each fund to determine if any fee waivers or load discounts apply, as they can provide cost savings when investing in specific mutual funds.

Margin Trading Fees

If you are interested in margin trading, it's crucial to understand the fees associated with borrowing funds to invest. Margin trading allows you to amplify your buying power by borrowing funds from Merrill Edge. However, this service comes with additional costs.

Interest on Margin Loans

When you borrow funds through margin trading, Merrill Edge charges interest on the loan amount. The interest rate can vary depending on various factors such as the size of the loan and prevailing market conditions. It's important to review the specific interest rates applicable to margin loans to understand the cost implications. Margin trading can be a useful strategy for experienced investors, but it's essential to carefully assess the potential interest costs against the potential returns.

Margin Maintenance Fees

In addition to interest charges, Merrill Edge may also charge margin maintenance fees. These fees are typically applied to ensure that your account meets certain equity requirements. The exact amount of these fees can vary depending on your account status and the size of your margin loan. It's important to review the specific margin maintenance fees applicable to your account to accurately calculate your trading costs. Margin maintenance fees can impact your overall profitability, so it's crucial to factor them into your investment strategy.

Account Transfer and Closing Fees

If you decide to transfer your account from Merrill Edge to another brokerage platform or close your account altogether, there may be fees involved. It's essential to understand these fees to plan your investment moves effectively.

Account Transfer Fees

When transferring your account from Merrill Edge to another brokerage platform, there may be fees associated with the process. These fees can vary depending on the specific circumstances and the receiving brokerage platform's policies. It's important to review the account transfer fees before initiating the transfer to understand the potential costs involved. Transferring your account can be a strategic move, but it's essential to evaluate whether the potential benefits outweigh the transfer fees.

Account Closing Fees

If you decide to close your Merrill Edge account, there may be fees associated with the closure process. These fees can vary depending on the specific circumstances and Merrill Edge's policies. It's important to review the account closing fees to understand the potential costs involved. Before closing your account, consider whether the reasons for closure outweigh the associated fees. It's also worth noting that some brokerage platforms may offer incentives or reimbursements for account transfer or closure fees, so it's beneficial to explore these options.

Hidden Fees and Miscellaneous Charges

In addition to the fees mentioned above, it's important to be aware of any potential hidden fees or miscellaneous charges that may apply when trading with Merrill Edge. While Merrill Edge strives to be transparent with its fee structure, there may be additional costs that you should factor into your investment strategy.

Inactivity Fees

Merrill Edge does not charge inactivity fees. However, it's important to note that some brokerage platforms may impose fees if your account remains inactive for an extended period. Inactivity fees can be an additional cost to consider, particularly if you are a less active trader. With Merrill Edge, you can avoid inactivity fees, providing flexibility in managing your investments.

Wire Transfer Fees

If you need to transfer funds via wire transfer, Merrill Edge may charge a fee for this service. Wire transfer fees can vary depending on the specific circumstances and the amount being transferred. It's important to review the wire transfer fees to understand the potential costs involved. If possible, consider alternative transfer methods that may incur lower fees, such as electronic funds transfers or Automated Clearing House (ACH) transfers.

Foreign Transaction Fees

If you engage in international trading or hold foreign currency in your account, Merrill Edge may charge foreign transaction fees. These fees can apply when converting currency or conducting transactions involving foreign securities. It's important to review the foreign transaction fees to understand the potential costs involved. If you frequently trade internationally, consider exploring alternative brokerage platforms that may offer lower foreign transaction fees.

Fee Comparison with Competitors

To gain a comprehensive understanding of Merrill Edge's fees, it's helpful to compare them with other popular brokerage platforms. By evaluating the fees charged by different platforms, you can assess whether Merrill Edge is the right choice for your investment needs.

Comparison of Commission Fees

One essential aspect to consider when comparing brokerage platforms is the commission fees charged for various types of trades. Evaluate how Merrill Edge's commission fees compare to those of other platforms for stock, ETF, options, and mutual fund trades. Consider the specific factors that can influence the fees, such as account status, trade frequency, and investment amount. By comparing the commission fees, you can identify potential cost savings opportunities and select the platform that aligns with your investment strategy.

Assessing Hidden Fees

In addition to comparing the visible commission fees, it's crucial to assess any potential hidden fees or miscellaneous charges imposed by different brokerage platforms. Look for any inactivity fees, wire transfer fees, foreign transaction fees, or other charges that may impact your overall trading costs. By thoroughly evaluating the fee structures of different platforms, you can make an informed decision that considers all potential costs.

Considering Additional Services

While fees are an essential factor to consider, it's also important to evaluate the additional services and features offered by different brokerage platforms. Consider the quality of research tools, educational resources, customer support, and other value-added services provided by Merrill Edge and its competitors. These additional services can contribute to your overall trading experience and may justify slightly higher fees if they enhance your investment decision-making process.

Tips to Minimize Trading Fees

While fees are an inevitable part of trading, there are strategies you can employ to minimize your trading costs with Merrill Edge. By following these tips, you can optimize your investment returns and reduce unnecessary expenses.

Take Advantage of Preferred Rewards

If you are eligible for Preferred Rewards, make sure to enroll and take advantage of the commission fee discounts offered. By achieving a higher tier within the program, you can enjoy greater savings on your trades. Consider consolidating your Bank of America accounts to reach the next tier and unlock even more benefits.

Assess Trade Frequency and Tiered Pricing

If you engage in frequent trading activities, evaluate whether the tiered pricing structure offered by Merrill Edge is beneficial for your investment strategy. Calculate the potential savings from reduced commission fees and compare them with the costs associated with more frequent trading. Optimize your trade frequency to strike a balance between cost savings and investment objectives.

Consider Investing in No-Load Mutual Funds

If you are interested in mutual fund investments, explore the selection of no-load mutual funds offered by Merrill Edge. By opting for no-load funds, you can avoid transaction fees associated with buying or selling mutual fund shares. However, ensure that you review the expense ratios of these funds to assess the ongoing management fees.

Evaluate Margin Trading Costs Carefully

If you plan to engage in margin trading, carefully evaluate the interest rates and margin maintenance fees charged by Merrill Edge. Consider the potential returns of your investments against the interest costs and ensure that margin trading aligns with your risk tolerance and investment strategy. Margin trading can amplify profits, but it can also increase losses, so exercise caution and only borrow funds when necessary.

Review Your Investment Portfolio Regularly

Regularly review your investment portfolio to identify any underperforming securities or funds. By actively managing your portfolio and making strategic adjustments, you can minimize the need for frequent trades and associated commission fees. Rebalance your portfolio periodically to maintain your desired asset allocation and avoid unnecessary trading costs.

Stay Informed and Educated

Continuously educate yourself about the financial markets, investment strategies, and trading techniques. By staying informed, you can make more confident and informed investment decisions. Utilize the research tools and educational resources offered by Merrill Edge to enhance your knowledge and improve your trading skills. A well-informed investor can make more strategic and cost-effective trading decisions.

In conclusion, understanding the fees associated with MerrillEdge stock trading is crucial for every investor. By following this comprehensive guide, you now have a detailed understanding of the various fees charged by Merrill Edge and how they can impact your trading costs. From account opening and maintenance fees to commission fees, options trades, mutual fund trades, margin trading fees, and account transfer and closing fees, each aspect has been thoroughly explained.

It's important to note that while fees are an important consideration, they should not be the sole determining factor when choosing a brokerage platform. Consider other factors such as the platform's features, research tools, customer support, and overall user experience. Merrill Edge offers a wide range of investment options, tools, and resources that can enhance your trading experience and potentially offset some of the associated fees.

Remember to evaluate your investment goals, trading frequency, and account balance when assessing the impact of these fees on your overall portfolio. What may be cost-effective for one investor may not necessarily be the best option for another. It's crucial to align the fee structure with your investment strategy and trading preferences.

By applying the tips provided to minimize trading fees, such as taking advantage of Preferred Rewards, assessing trade frequency and tiered pricing, considering no-load mutual funds, evaluating margin trading costs carefully, and regularly reviewing your investment portfolio, you can optimize your trading experience and mitigate unnecessary expenses.

Always stay informed and educated about the financial markets and investment strategies. The more knowledge you have, the better equipped you are to make informed decisions and potentially reduce trading costs. Utilize the resources and tools offered by Merrill Edge to enhance your understanding and stay up to date with market trends.

In conclusion, Merrill Edge offers a comprehensive online brokerage platform for stock trading. By understanding and carefully considering the fees associated with Merrill Edge, you can make informed decisions that align with your investment goals and trading preferences. Remember, trading fees are an investment in the services and opportunities provided by Merrill Edge, and by optimizing your trading approach, you can maximize your potential returns.